Equifax: Why finance companies are using verification tools at record levels

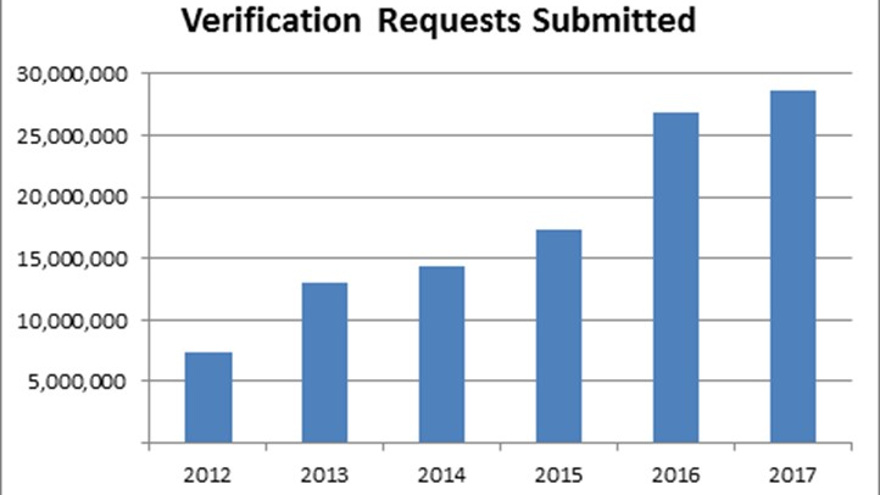

According to a recent Equifax report, auto finance companies are verifying income and employment at record levels and have seen a significant increase in usage year-over-year significantly since 2012. Graphic courtesy of Equifax.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

Reading headlines from major media outlets this past summer, it might seem as though auto finance companies didn’t understand the importance of verifying income and employment information provided by applicants. Everything was written from auto finance companies being fraudsters to the auto industry being the harbinger for the next recession. However, the headlines largely got it wrong.

It’s time for a fresh perspective based on the facts. Most auto finance companies are using sophisticated verifications tools to help them determine with confidence that an applicant will be able to repay a vehicle installment contract. In fact, according to a recent Equifax report, auto finance companies are verifying income and employment at record levels and have seen a significant increase in usage year-over-year significantly since 2012.

For example, in 2017 automakers sold 17.2 million vehicles. This is the first time the industry has cleared the 17 million mark for three consecutive years, according to IHS Market. Based on reporting from The Work Number database — one of the largest central source for employer-provided employment and income data — the number of auto verification requests for income and employment was nearly 29 million at the end of 2017. That’s nearly 30 million requests for income and employment information in a market that sold more than 17 million vehicles. Auto finance companies are, indeed, verifying information provided by consumers.

The amount of verification requests submitted to The Work Number by auto verifiers has grown from just over 7 million in 2012 to nearly 29 million in 2017.

Clearly auto finance companies understand that the risk of not verifying income and employment on potential borrowers is too high. Also, they know that time is incredibly important to today’s car buyers and dealer personnel. Both groups tend to avoid hassles at all costs. Most consumers are opting for a car buying experience similar to the one they use when shopping for new clothes online or browsing for world news and other social happenings — frictionless, consistent and user-friendly interactions with businesses when they want it. Knowing these habits, lenders have implemented a similar fast-paced and transparent environment into the car-buying process.

Auto finance companies’ use of verification tools has allowed them to understand a potential buyer’s propensity to repay a loan earlier on in the car-buying process. This, in turn, has also allowed them to give approvals back to their dealers without stipulations and potentially avoid auto finance defaults that can happen if a borrower can no longer afford the designated car payment.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And then there’s the need for finance companies to verify based on the reality of the auto industry. The legend of the fake pay stub and applicants who overstate and understate their income, further point to the importance of verifying information.

First, the fake paystub is real, and it doesn’t seem to show signs of slowing down. There are even websites dedicated to helping consumers re-create their fantasy paycheck to get the vehicle they desire. And the worst part is these fake paystubs are so well done that they are passing some finance companies’ sniff test.

Secondly, whether consumers intentionally or unintentionally overstate or understate their income should be a moot point to auto finance companies as they are not forensic experts and shouldn’t have to be.

Even when offsetting for credit score, the higher a person’s verified income, the likelihood of default decreases. Also, job tenure can help predict repayment risk as consumers with job tenure one year or less are almost twice as likely to go delinquent (again, even with FICO score accounted for) as those with 10-plus years of tenure. You can see the type of dilemma that can unfold if income is not verified at the beginning of the car-buying process.

Verifications tools largely eliminate the need for auto finance companies to operate like the local grocer 50 years ago who knows everyone in town and kept a ledger of who will repay their monthly grocery bill, based on their family history and if they attend church regularly. Verifications are based on factual data provided directly from employers. Very simply, is the borrower employed and how much do they make?

Of course, verifications can be strengthened by adding in other data assessments such as the aforementioned job tenure, but salary information as well as alternative and trended data are also available. The latter forms of data push beyond traditional credit data to reveal more details about consumers, their payment behaviors and financial priorities. As a result, it can help lenders offer more specialized, customer-focused service, while also helping to better protect their bottom line against bad debt, write-offs and more. When you put the add-ons aside, verification by itself is the foundation for mitigating the affordability issue caused when applicants produce fake paystubs or understate or overstate their earning information. It’s largely becoming a table stake for the industry.

Prime Lenders Are Entering the VOI and VOE Space with Great Results

However, there is an imbalance in the verifications process that auto lenders can and should work to stabilize. Prime lenders are not verifying income and employment on their applicants and borrowers in the same way as their subprime brethren. While independent, monoline auto and dealer finance companies may provide to higher risk customers, usually ones with subprime credit scores so that higher interest rates make up delinquencies, banks, credit unions and captive lenders want very little risk and they typically lend to customers with prime credit scores (620 and higher).

On the surface, it makes sense, and prime customers are often a safer bet with prime lenders making the argument that a prime borrower’s credit score offers enough information so the risks of approving a loan for them is fairly low. But even prime lenders have battle scars from fraudulent or unaffordable loan activities. All it should take is one $30,000 mistake for a prime lender to realize that verifying income and employment is the right thing to do for their business, the industry and their customers. Instead of viewing verifications as a tool for the subprime market, it should be viewed as a standard practice for all lenders to tell a more complete picture of the borrower.

Accurate income and employment verifications improve the entirety of the car-shopping process for the finance company, the customer and also the dealer. With the most exact information accessed early on, finance companies are able to offer the appropriate auto financing packages to consumers.

Lou Loquasto joined Equifax Automotive Services with 20 years of experience in the automotive industry. In his role, he is responsible for the team of auto industry veterans tasked with helping auto finance companies and dealers grow while minimizing expense and controlling risk. Prior to joining the company, he was a co-founder and served as chief marketing officer for Global Lending Services (GLS), a national non-prime auto finance company. Prior to GLS, Lou was the head of Lender Solutions at Black Book, responsible for developing products, data and analytics for auto lenders. Prior to that, he was VP- head of Marketing & Business Development and the Central Direct of the Consumer department while at Wells Fargo Auto Finance. Lou is active in the industry, speaking at conferences such as Used Car Week and serving on the boards of industry associations including as past president of the National Auto Finance Association.