Newest financing pushes Tekion valuation above $1 billion

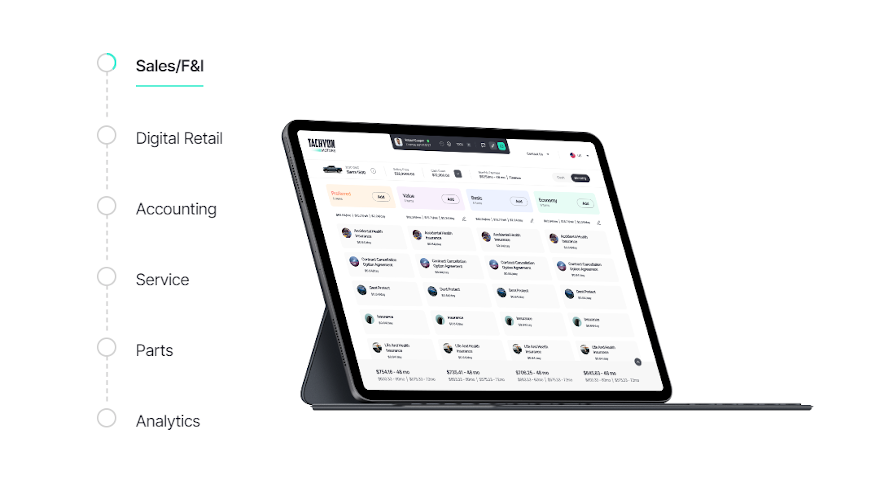

Screenshot courtesy of Tekion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

SAN RAMON, Calif. –

Fueled by its Series C financing round of $150 million, Tekion recently announced its valuation now stands at more than $1 billion.

And with an array of automakers and major dealership groups in the mix, the cloud technology company and provider of a Sofware as a Service retail operating platform have its eyes on making automotive retail similar to other popular places where consumers spend time and money nowadays.

“Today’s consumers receive outstanding personalized retail experiences from companies like Amazon, Apple, Google and Disney,” Tekion chief executive officer Jay Vijayan said in a news release. “Why shouldn’t they expect the same in their vehicle acquisition and service needs?

“We believe Tekion will be the trailblazer for enabling the modernization of the entire consumer journey and providing the best experiences and operational efficiencies, period. It’s time to even the playing field for the automotive retail industry,” Vijayan continued about its platform, Automotive Retail Cloud. “We are fortunate and proud to be supported by great investors from the world’s top OEM brands, top dealers in the country, venture and private equity firms.”

The latest funding round was led by Advent International, one of the largest and most experienced global private equity investors, with participation from Index Ventures, Exor (the holding company of Fiat Chrysler Automobiles and Ferrari), Airbus Ventures and FM Capital (a fund that includes a large number of top 100 dealers in the country as its limited partners).

Joe Serra is also an investor in Tekion’s series C round.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Tekion’s other key investors from the Automotive industry include General Motors, BMW iVentures and Nissan-Renault-Mitsubishi Alliance Ventures.

“We consider this as true validation of the value we are bringing to the industry,” Vijayan said about the $1 billion reading. “We are thrilled to welcome Advent as we scale our business, expand our products and transform what the auto retail experience should be.”

Tekion started on-boarding dealers on its Automotive Retail Cloud platform during the third quarter of last year and is growing rapidly nationwide by partnering with manufacturers and dealers of all sizes. Thus far, Tekion said dealers in 28 states use the Automotive Retail Cloud that’s already integrated with 17 OEM brands.

The company is targeting to complete the remaining OEM integrations early next year.

“Tekion is the true disrupter the industry has been waiting on for decades,” said Joe Serra, president Serra Automotive, who owns 50 dealerships representing 62 franchises spread across the country.

“I’m very impressed with their modern DMS platform and their awesome team,” Serra continued in the news release. “I’m so convinced that their technology and vision will transform automotive retail for consumers, dealers and manufacturers that I wanted to be a part of the change by investing in the company.”

More details about new funding

The company said Advent’s investment will provide Tekion with fresh capital to support additional investment in its platform and scaling the company.

“The automotive retail and dealer technology ecosystem are ripe for disruption. It has operated for too long with outdated technology and patchwork systems that fail to meet the needs of modern dealers and their customers,” said Eric Wei, a managing director on Advent’s technology investment team in Palo Alto, Calif.

“From the moment we started talking to Tekion’s dealers, we were blown away by the ease and speed of the migration process, especially from the multiple dealers who transitioned in one month’s time, entirely remotely during the COVID-19 pandemic,” continued Wei, who is joining Tekion’s board of directors along with Jon McNeill, an Advent advisory partner and former chief operating officer of Lyft and former president of global sales, marketing, delivery and service at Tesla.

“(Tekion’s) dealer-friendly approach to contract terms and data ownership will be a breath of fresh air for dealers. We are incredibly excited about the platform and the size of the opportunity,” Wei added.

Prior to Advent’s investment, Tekion had raised $65 million in equity financing from investors including Index Ventures, Storm Ventures, General Motors (GM), Alliance Ventures (Nissan-Renault-Mitsubishi), BMW iVentures, Exor, AME Cloud Ventures, alongside many dealer groups.

“We believe Tekion’s cloud-native technology, which simplifies sales and service for both consumers and dealership employees, has the potential to transform the automobile ownership experience,” FM Capital managing partner Mark Norman said.

Tekion explained that its Automotive Retail Cloud is designed to address the top pain points OEMs and dealers have been experiencing. The company said it has the first end-to-end cloud-native platform that brings every part of the retail journey in one seamless application.

In addition to advanced analytics, Tekion said it can provide open APIs and give dealers access to their data to glean valuable insights to help improve processes and experiences for their customers.

Tekion added that it also can provide enterprise scale capability for larger dealer groups with features such as centralized accounting and a highly secure data repository with the ability to access data from anywhere.

Dealer testimonials can be viewed at https://www.tekion.com/testimonials.