RateGenius: Applications & savings via auto refinancing jump in 2020

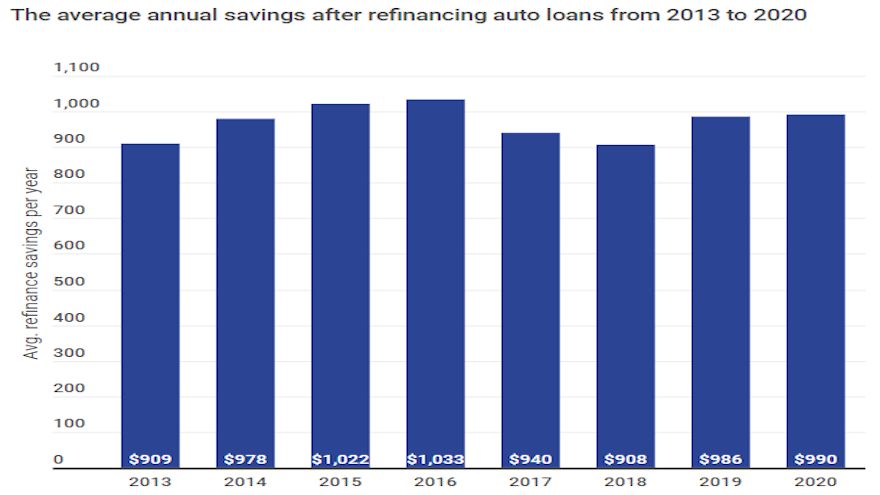

Chart courtesy of RateGenius.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

AUSTIN, Texas –

RateGenius shared how much consumers saved when refinancing their vehicle’s retail installment sales contract in 2020.

According to the firm’s report based on activities through its network of more than 150 finance companies nationwide, RateGenius said Americans saved an average of $989.72 percent year via refinancing their vehicle in 2020. That’s the largest amount in RateGenius’ database since 2016.

RateGenius highlighted in the report that 42% of successful refinancing applications generated annual savings of $1,000 or higher.

Furthermore, with an average interest rate of 10.5% on their existing contracts, RateGenius said the average rate on the refinanced contract came in at 5% — the greatest interest rate reduction in eight years.

Also of note, RateGenius said Americans who applied to refinance in 2020 did so only 14.5 months into their existing contract — the shortest time the firm’s database.

While RateGenius said the average credit score of a refinance applicant was 657 in 2020 — three points lower than in 2019 — the average credit score of an approved refinance application in 2020 was 720 — four points higher than in the prior year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Likely driven by the COVID-19 pandemic, RateGenius noted that 16% more Americans applied to modify their auto financing in 2020 than in 2019.

The firm indicated 38 out of 50 states contained more consumers getting refinancing approved in 2020 versus the prior year with Washington (up 56%), Arizona (up 47%) and Oregon (up 44%) leading the charge.

RateGenius pinpointed that consumers in Odessa, Texas, gained the most by refinancing, getting more than $1,700 in average annual savings.

The report pointed out that contract holders in that west Texas city also held the highest outstanding balance, averaging more than $31,000.

RateGenius went on to mention pickups such as the Ram 1500, Chevrolet Silverado 1500 and Ford F-150 were the most refinanced vehicles in 2020, accounting for nearly 10% of all refinanced contracts in 2020. In fact, the Chevrolet Silverado 1500 was the most common vehicle to refinance in 22 out of 50 states.

The firm added pickup trucks generated the highest savings among major vehicle classes at $1,138 a year.

As a class, RateGenius found that trucks had the best average loan-to-value ratio (LTV) at 104%. SUVs came in second with 116% LTV.

Maserati Ghibli held the most equity, with an average LTV of 80%, according to the report, which added that Mitsubishi Mirage owners found themselves with least equity in their vehicles, with a 141% LTV.

The entire report can be found via this website.