Carpay arrives as newest NIADA National Corporate Partner

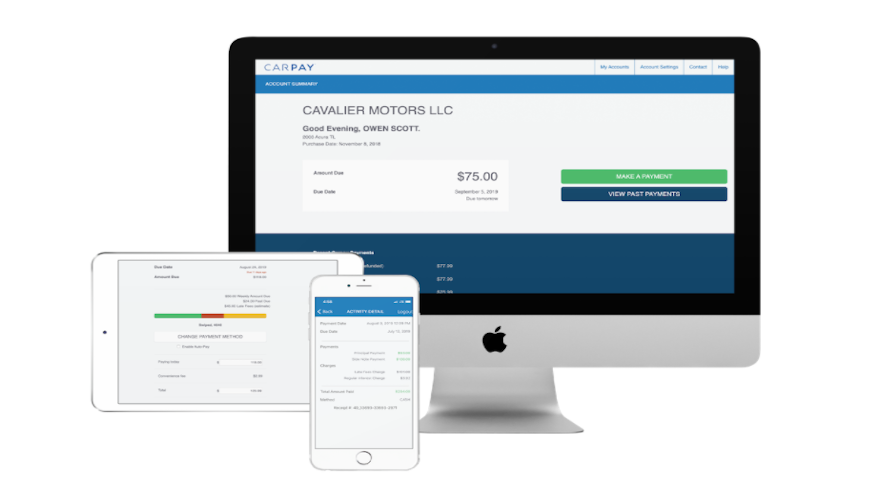

Screenshot courtesy of Carpay.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ARLINGTON, Texas –

It’s probably the unofficial mantra of buy-here, pay-here dealers when operators say, “We’re not in the car business. We’re in the collections business.”

Well, the newest Bronze-level National Corporate Partner of the National Independent Automobile Dealers Association aims to help operators keep payments coming into their accounts.

Carpay, a loan management software provider, recently joined with NIADA as a partner.

“Now more than ever, our BHPH members need access to results-oriented, revenue-focused products that elevate their ability to grow their business and provide services that create a meaningful experience for their customers,” NIADA vice president of member services James Gibson said in a news release.

“Having access to Carpay’s loan management software will go a long way toward helping BHPH dealers manage and grow their portfolio,” Gi

Carpay can helps catch late customers up and keep others from falling behind on their payments.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With more than $3 billion of BHPH contract data, Carpay highlighted that its platform is constantly being updated to reduce late payments and help BHPH dealers keep their portfolio on time.

The platform also offers:

• Unlimited text and email reminders (payment due, payment overdue, card failed, etc.).

• Mobile app for borrowers (iOS and Android).

• Web portal for borrowers (pay.carpay.com).

• “Make Payment” button on dealer websites.

• Automated phone number for borrowers to make payments 24/7 (English/Spanish).

• Text-to-pay.

• Work late accounts.

• Smart auto-pay.

• Dealer dashboard with portfolio analytics charts and detailed reporting.

“Most dealers come to Carpay after years of trying to piece together those services themselves,” Carpay chief executive officer Brandon Cavalier said in the news release. “But it’s just much easier and the data plays off of itself when dealers can consolidate all of the services under one vendor that only thinks about how to help BHPH dealers manage their borrowers.

“Carpay helps manage dealers' soft collections so their staff can spend their time on borrowers who need a little bit more attention,” Cavalier went on to say.

The National Corporate Partner program provides NIADA/NABD members with an extensive, highly vetted roster of partners they can rely on to help them grow their business, protect their assets and enhance their profitability.

“Dealers use NIADA to find vetted vendors to help them grow their dealerships and their bottom line,” Cavalier said. “So we’re honored to fill the spot for BHPH dealers looking for ways to keep their customers on time.”

As a Bronze NCP, Carpay is recognized as one of NIADA’s most trusted resources, “with a proven track record of quality and excellence,” according to the association.

For more information about Carpay, visit www.carpay.com.