Auto credit tightens again with banks expecting it to remain that way

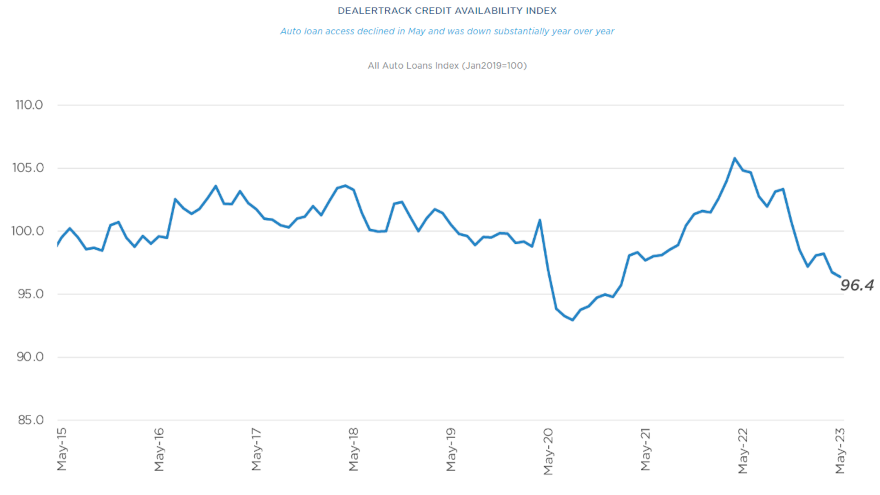

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive reported that credit availability for auto finance recently dropped to a two-year low.

And the April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices orchestrated by the Federal Reserve showed that level might stay there for the foreseeable future.

Access to auto credit tightened again in May, according to the Dealertrack Credit Availability Index for all types of auto financing. Cox Automotive indicated the index fell 0.4% to 96.4 in May, the lowest reading since February 2021.

Cox Automotive explained that the movement reflected that auto credit was harder to get in May than every month since the second stanza of 2021.

With the decline in May, experts said access was tighter by 8.0% year-over-year. And compared to February 2020, access was tighter by 2.8%, according to Cox Automotive.

“Movement in credit availability factors was mixed in May. Yield spreads narrowed, average terms lengthened and down payments declined, and those moves improved credit access for consumers. However, the subprime share declined, and the negative equity share declined, and those moves hurt credit access for consumers,” Cox Automotive said in its analysis that accompanied the latest index reading.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, the Fed survey of banking executives included the question, “Compared to my bank’s current lending standards, over the remainder of 2023, my bank expects its lending standards for approving applications for auto loans to,” of which 28 of the 46 participants responded with “remain basically unchanged.”

However, 17 other executives chose “tighten somewhat.”

In analysis that was included with the survey, the Fed wrote: “In addition, banks reported having tightened all queried terms on auto loans and other consumer loans on net. In particular, a significant net share of banks reported wider interest rate spreads on auto loans, while moderate net shares reported raising minimum repayments, raising minimum credit scores, decreasing the extent to which loans are granted to some customers that do not meet credit scoring thresholds, and decreasing maximum maturity.”

Turning back to Cox Automotive’s information, experts there said the average yield spread on auto financing in May narrowed by 10 basis points, “so rates consumers saw were more attractive in May relative to bond yields.”

Cox Automotive determined the average auto finance rate declined by 4 basis points in May compared to April, while the five-year U.S. Treasury increased by 6 basis points, resulting in a narrower average observed yield spread.

Analysts went on to mention the approval rate was unchanged in May but softened 2.4 percentage points year-over-year. Cox Automotive said the subprime share declined to 11.0% from 11.7% in April and dipped 1.2 percentage points year-over-year.

Cox Automotive also noted the share of contracts with terms longer than 72 months increased 0.6 percentage points in May but was ticked 0.2 percentage points lower year-over-year.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

The Fed will conduct its next survey of banking executives in July.