KBRA: 4 elements likely to keep credit performance on seasonal softening trajectory

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

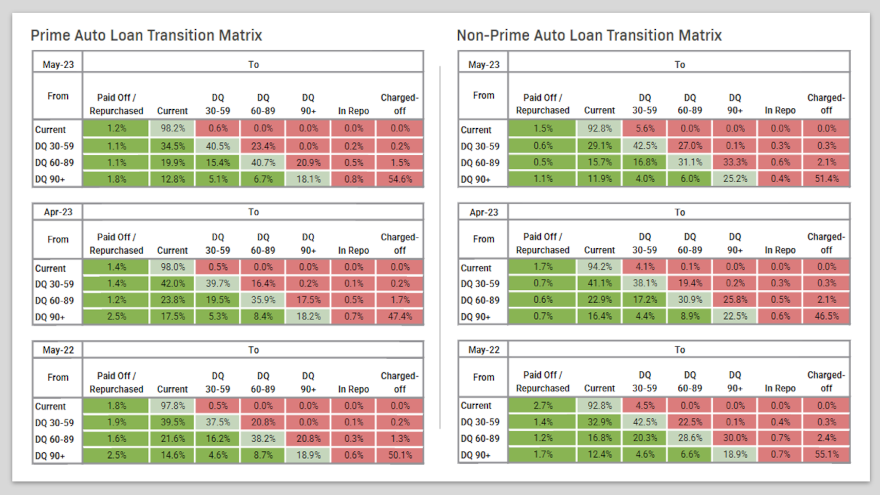

The newest report from Kroll Bond Rating Agency (KBRA) showed not only weaker credit performance based on securitized prime and non-prime auto finance pools, but experts also pinpointed four ingredients that might keep the trend going in that direction.

KBRA indicated May remittance reports showed weaker performance during the April collection period.

Annualized net losses in KBRA’s prime auto loan index increased 2 basis points month-over-month and 22 basis points year-over-year to 0.32%, while 60-day delinquencies climbed 4 basis points month-over-month and 7 basis points year-over-year to 0.38%.

Similarly, the firm indicated annualized net losses in KBRA’s non-prime index jumped 37 basis points month-over-month and 220 basis points year-over-year, coming in at 5.86%. Meanwhile, KBRA determined non-prime 60-day delinquencies climbed 30 basis points versus the previous month and 77 basis points compared to year-ago levels, hitting 4.71% in May.

With used vehicle prices down 3% month-over-month in April (as measured by the Manheim Used Vehicle Value Index), KBRA calculated recovery rates in its prime and non-prime indices landed at 56.2% and 50.3%, respectively. The computed to be a decline of 1.2 percentage points month-over-month in the prime index and 4.2 percentage points month-over-month in the non-prime index.

“We expect credit performance to continue to deteriorate in the coming months due to seasonal trends, high inflation, the resumption of student loan payments, and weaker consumer credit fundamentals,” KBRA analysts said in the report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.