June views of credit performance & defaults continue seasonal moves

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It might ease concerns from finance companies to see watchers of credit performance and defaults observe seasonal movements, according to the newest updates released this week.

The auto portion of the S&P/Experian Consumer Credit Default Indices generated just a 1 basis point uptick in June on a sequential basis, while Kroll Bond Rating Agency (KBRA) continued to notice a gradual but not startling softening in performance based on securitized paper.

The auto default reading came in at 0.80% in June, edging up from the level that remained steady in April and May. It’s 15 basis points lower than the February level and 35 basis points below the high point of the S&P/Experian database that goes back 10 years. That default plateau of 1.15% happened in September 2013.

Turning back to the newest data, S&P Indices and Experian noticed that the composite rate — which represents a comprehensive measure of changes in consumer credit defaults — also increased 1 basis point in June to 0.72%. The composite rate hasn’t been at or above 0.90% since April 2020, according to the database.

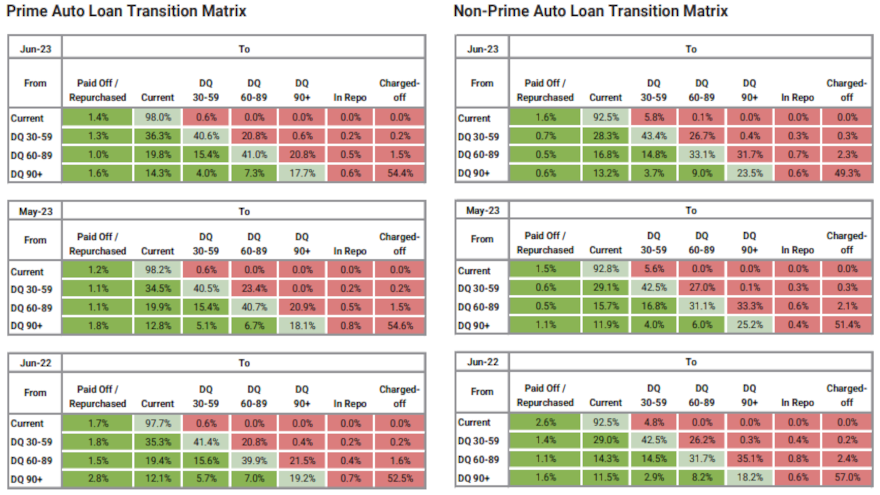

Reinforcing the findings from S&P Indices and Experian, KBRA reported this week that June remittance reports showed continued weaker year-over-year credit performance across securitized prime and non-prime auto pools during the May collection period. KBRA added that month-over-month performance largely followed seasonal trends.

KBRA’s prime auto loan index posted annualized net losses of 0.26%, down 6 basis points month-over-month but 14 basis higher year-over-year. Experts indicated the percentage of prime contact holders 60 days or more past due came in at 0.39%, rising 1 basis point month-over-month and 7 basis points year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Annualized net losses in KBRA’s non-prime index rose 2 basis points month-over-month and 197 basis points year-year-over, hitting 5.88%. Analysts added the non-prime 60-day delinquency rate moved up 46 basis points month-over-month and 61 basis points year-over-year to land at 5.17%.

Furthermore, KBRA noticed that recovery rates varied in both indices.

Analysts determined prime recoveries climbed 5.4 percentage points month-over-month but fell 5 percentage points year-over-year to 61.5%. Analysts added that non-prime recoveries decreased 0.4 percentage points month-over-month and 10 basis points year-over-year to 49.9%.

“Securitized prime and non-prime auto loan credit performance should continue to mimic seasonal trends and soften through the remainder of the year as summer spending weighs on consumer balance sheets,” KBRA said in its report.

“In addition to seasonal trends, we expect a more general deterioration through year-end, as consumers struggle with elevated inflation, the resumption of student loan payments in October, and softening consumer credit fundamentals,” analysts went on to say.