Experian notices contract terms continue to shorten

Chart courtesy of Experian Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian’s newest State of the Automotive Finance Market Report showed average contract terms continued to decrease.

Amid rising interest rates, Experian reported on Thursday consumers are continuing to opt for shorter terms based on findings from the second quarter.

However, analysts pointed out that much of the growth in shorter-term contracts is for new vehicles. Experian said the 1- to 48-month segment of new-vehicle financing increased from 9.53% in Q2 2022 to 14.58% in Q2 2023.

While not quite as robust, Experian acknowledged a similar trend happening within used-vehicle financing.

Contracts for used cars with 1- to 48-month terms made up 11.31% of the paper in Q2 compared to 10.06% the previous year.

As a result of shorter-term contracts, Experian indicated the average monthly payment of new and used vehicles increased.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average monthly payment for a new vehicle increased to $729 in Q2 2023, from $672 in Q2 2022 and the average monthly payment for a used vehicle saw a slight uptick from $519 last year to $528 this quarter.

Experian also mentioned the average interest rate for a new vehicle increased to 6.63% in Q2 2023, from 4.60% in Q2 2022, marking a more significant year-over-year growth compared to 4.17% in Q2 2021.

Similarly, the average interest rate for a used vehicle increased to 11.38% this quarter, from 8.84% last year and 8.59% in Q2 2021.

Captives rebound

In the second quarter, Experian reported captives regained “the lion’s share” of total vehicle financing, outpacing banks and credit unions.

According to the report, captives made up 29.05% of the total vehicle financing market in the U.S., up from 22.15% the previous year.

Captives were followed by banks (24.84%), credit unions (22.49%), finance companies (13.09%) and BHPH/others (10.52%).

Experian indicated the trend was more pronounced with new vehicles, where captives made up 58.47% of new vehicle financing (up from 46.80% in Q2 2022), followed by banks (22.25%), credit unions (13.70%), finance companies (4.45%) and BHPH/others (1.13%).

“With more incentives in the market and consumers leaning back into new vehicles, naturally we’d expect captive lenders to take back market share,” Experian’s senior director of automotive financial solutions Melinda Zabritski said in a news release.

“Based on current market conditions, maintaining a close eye on consumers’ buying preferences, such as loan terms and preferred makes and models, lenders and dealers can help consumers find vehicles that fit within their budgets,” Zabritski continued.

Leasing activity picks up slightly

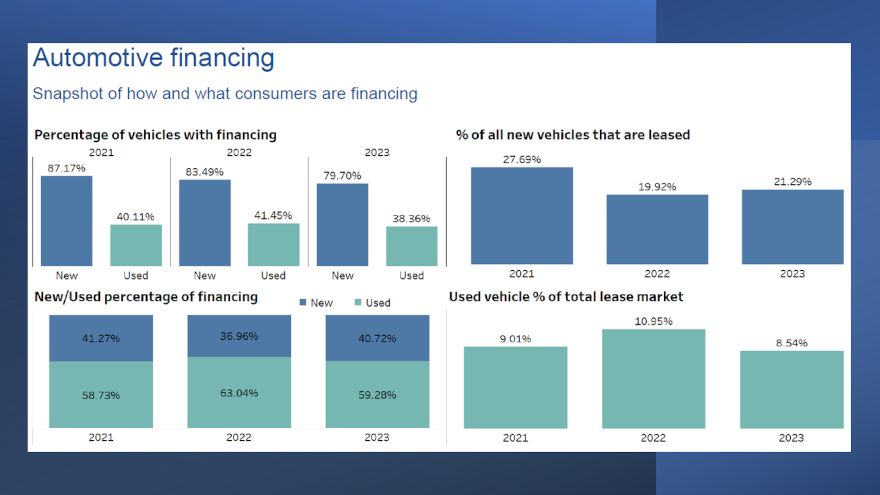

While leasing decreased significantly beginning in 2020, Experian data showed leasing experienced a slight uptick to 21.29% of Q2 financing, up from 19.92% generated a year earlier.

Digging a bit deeper, Experian noted the Telsa Model 3 marked the first time an electric vehicle appeared in the top 10 leased models, representing 1.79% of the market.

“While the industry continues to shift, it’s important for automotive professionals to watch the consumer purchase trends as they make informed decisions,” Zabritski said. “With shorter loan terms and the average price difference from loan to lease, it’s not uncommon to see consumers lean towards more budget-friendly options.”

4 other findings

Experian mentioned four other notable trends from its Q2 data, including:

— The total outstanding U.S. vehicle balance grew 6.5% year-over-year, reaching $1.45 trillion in Q2 2023.

— The market continues to grow in prime (45.58%) and super prime (21.77%), making up over 67% of total financing in Q2 2023.

— The average amount financed for a new vehicle only increased $70 year-over-year, reaching $40,657. The average amount financed for a used vehicle dropped $1,744 year-over-year to $26,863.

— 30-day delinquencies reached 2.28% in Q2 2023, while 60-day delinquencies reached 0.82%.