Edmunds: ‘Storm is brewing’ fueled by negative equity

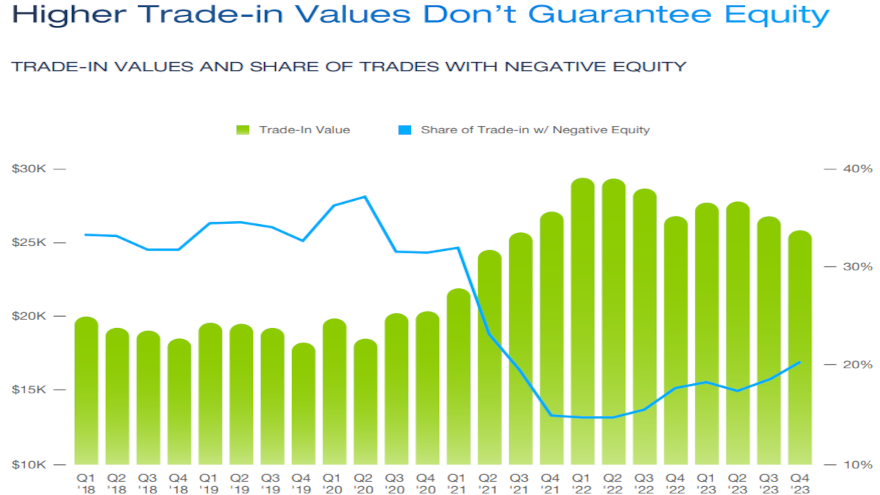

Chart courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cherokee Media Group asked Jessica Caldwell of Edmunds about negative equity during a conversation at NADA Show 2024 in February. Caldwell immediately replied, “Right now, that is a yikes.”

The latest Edmunds Used Vehicle Report released on Wednesday added more specifics as to why Caldwell offered such a reaction. Edmunds indicated 20.4% of new-vehicle sales with a trade-in had negative equity in the fourth quarter — the highest in two years — compared to 17.7% in Q4 2022 and 14.9% in Q4 2021.

“When people bought their vehicle last year or the year before when prices were high and inventory was low, or they just bought a car that they didn’t really want or wasn’t right for them, now that the market is a little bit easier and they’re coming back to it, they bought high and they’re selling low, and they’re not happy about that,” Caldwell said during that conversation that’s a part of this episode of the Auto Remarketing Podcast.

But wait, there’s more alarming details from that new Edmunds report.

Analysts discovered consumers who are upside down on their financing owe more than ever before. Edmunds reported the average amount owed on upside-down installment contracts climbed to a record high of $6,064 in Q4 2023, compared to $5,347 in Q4 2022 and $4,143 in Q4 2021.

Edmunds also mentioned the average transaction price (ATP) for all used vehicles in Q4 dipped to $28,371, a 4.4% decrease from $29,690 in Q4 2022.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Edmunds director of insights Ivan Drury put it this way through a news release promoting the entire report’s availability.

“A storm is brewing in the used market as incentives and inventory continue to trickle back into the new vehicle market,” Drury said. “With demand for near-new vehicles on the decline, used-car values are depreciating similarly to the way they did before the pandemic, and negative equity is rearing its ugly head.”

Edmunds analysts noted that the consumers who paid above MSRP for a new vehicle during the pandemic are the most vulnerable to falling underwater on their financing because their newer trade-ins are the most susceptible to dramatic decreases in value.

According to Edmunds data, 1- and 2-year-old vehicles are experiencing the most significant drops in value compared to older used vehicles.

Compared to Q3 2022 (when used-vehicle values were at their peak), Edmunds’ data revealed:

—The ATP for 1-year-old vehicles in Q4 2023 dropped to $38,720, a $6,763 decrease.

—The ATP for 2-year-old vehicles dropped to $32,583, a $3,294 decrease.

—The ATP for 10-year-old vehicles dropped to $12,447, a $1,304 decrease.

“During the last few years, consumers could jump into new car loans and their trade-ins were shielded from negative equity because some dealers, desperate for used inventory, were willing to pay near original purchase prices,” Drury said.

“These days, consumers need to be more careful — especially if they’re trading in newer vehicles — because near-new cars are being hit the hardest by depreciation,” he added.

Although a downturn in used values is negatively affecting a growing share of new car owners, Edmunds analysts pointed out that there’s a bright spot for shoppers with bigger budgets.

In an analysis of ATPs of 0- to 3-year-old vehicles compared to ATPs for new vehicles, Edmunds data showed that luxury large cars offered an average discount of $48,111 — the greatest dollar savings across all vehicle segments — with new vehicles going for $118,309 compared to $70,198 for used.

Large mainstream SUVs also offered a notable average discount of $19,966, with new vehicles going for $76,131 compared to $56,164 for used, according to Edmunds.

“If you want to save big on used versus new, you still have to be willing to spend big,” said Joseph Yoon, Edmunds’ consumer insights analyst. “Unfortunately, the most price-sensitive consumers seeking affordable transportation will have a much harder time finding discounts because the supply of older used vehicles is still pretty restricted.”

Looking forward, Edmunds analysts cautioned that a number of factors influencing used-vehicle prices will make trade-in values increasingly difficult to predict heading into 2024.

“As near-new vehicles sit on dealer lots for longer periods of time and automaker incentive programs continue to change dramatically month to month, dealers will likely be hedging their bets against value reductions as they manage their inventory,” Drury said.