Dissecting Experian’s newest data on delinquency

Charts courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

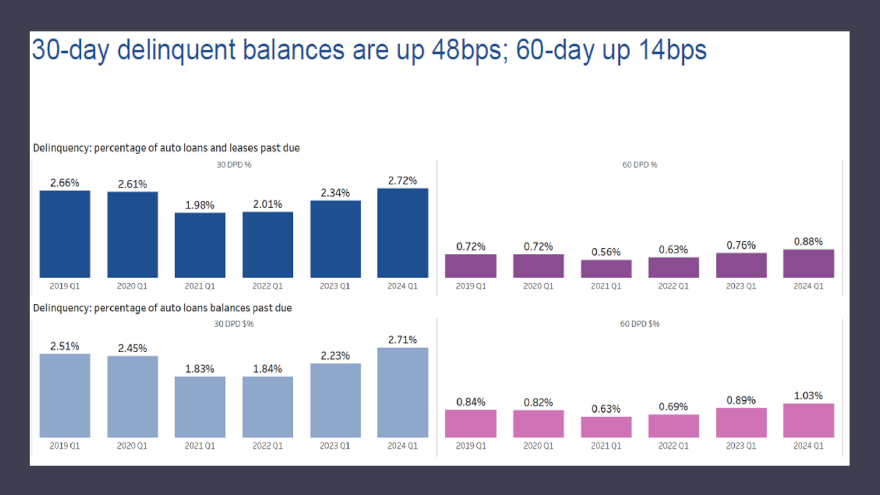

Experian’s State of the Automotive Finance Market Report: Q1 2024 showed year-over-year increases in both 30- and 60-day delinquency rates.

Perhaps what might be a more useful assessment is how those rates are both lower compared to the first quarter of 2019. Of course, that’s a full year before the pandemic arrived and triggered unprecedented impact on those metrics.

Analysts reported on Thursday that 30-day delinquencies increased from 2.34% in Q1 2023 to 2.72% in Q1 2024, and 60-day delinquencies reached 0.88% this past quarter, up from 0.76% last year.

And back in the first quarter of 2019, Experian indicated the 30-day delinquency rate stood at 2.66%, while the 60-day delinquency rate came in at 0.72%.

Here’s another way of looking at the Experian delinquency data that likely shows how the rising cost of vehicles has impacted portfolios.

Experian determined the percentage of outstanding balances sitting 30 days delinquent at the close of the first quarter stood at 2.71%. That’s 20 basis points higher than the same quarter in 2019 and 48 basis points above the prior-year reading.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts also noted that outstanding balances at 60 days delinquent created a rate at 1.03% at the end of Q1. That’s 14 basis points above the reading a year earlier and 19 basis points higher than Q1 of 2019.

New-car financing & leasing rebound

With new-vehicle inventory rebounding and some manufacturers continuing to offer incentives, Experian said consumers are shifting back into the new vehicle market — resulting in a notable impact on market share.

According to report, captives’ market share for new vehicle financing jumped to 61.75%, its highest level since 2010.

Meanwhile, Experian found that banks’ share declined from 23.36% to 20.65% year-over-year, and credit unions’ portion went from 17.02% to 9.69% over the same period.

“The return of new-vehicle inventory has had a ripple effect across the automotive finance market,” Experian head of automotive financial insights Melinda Zabritski said in a news release. “Not only are we seeing in-market shoppers transition away from the used-vehicle market but we’re starting to see the resurgence of leasing.”

Largely driven by the availability of new-vehicle inventory in Q1 2024, Experian indicated new-car leasing experienced a significant increase, reaching 24.12%, up from 19.33% in Q1 2023.

In addition, the average monthly payment for a new lease dropped $7 compared to the previous year, reaching $595 in Q1 2024, according to the report.

Experian also noticed SUVs comprised the majority of the top leased vehicles in Q1 2024, with the Honda CR-V at 3.12% and Tesla Model Y at 2.69%.

Rounding out the top five models in Experian’s database were the Nissan Rogue (2.35%), Chevrolet Equinox (2.21%), and Honda Civic (2.02%).

Looking at average monthly payments

Experian highlighted that what finance companies are collecting monthly from contract holders remains stable.

The company reported the average amount financed for a new vehicle was $40,634 in Q1 2024, down $481 from the previous year.

Meanwhile, the average amount financed for a used vehicle decreased $498 over the same period to settle at $26,073.

Despite the average amount financed for new and used vehicles declining, analysts explained elevated interest rates caused slight increases to average monthly payments.

Experian determined the average interest rate for a new vehicle was 6.73% in Q1 2024, up from 6.61% the previous year, while the average interest rate for a used vehicle was 11.91%, up from 11.40% over the same period.

As a result, analysts computed the average monthly payment for a new vehicle increased $3, reaching $735, and the average monthly payment for a used vehicle was up $2 at $523.

Interestingly, Experian data showed that 16.31% of all new-vehicle installment payments were above $1,000 in Q1 2024. Meanwhile, 33.6% of all used-car payments were below $400 this past quarter.

EV interest continues to grow

Experian indicated electric vehicles accounted for 8.56% of all new-vehicle financing in Q1 2024.

In addition, analysts noticed consumers are leasing EVs at a higher rate than previous years, with leasing making up 35.22% of EV financing in Q1 2024, an increase from 12.27% the previous year.

Of the top five leased EV models in Q1 2024, Experian determined the Tesla Model Y made up 39.26%, followed by the Tesla Model 3 (11.88%), Tesla Model X (3.72%), Rivian R1S (3.03%) and Volkswagen ID.4 (3.00%).

“With more manufacturers rolling out a diverse range of EV models and a wider availability of tax incentives, we’re seeing consumers lean into the EV market, particularly with leasing,” Zabritski said. “As technology evolves and infrastructure continues to develop, it’ll be interesting to see the buying preferences for these consumers once they come off lease.”

Three other findings for Q1

Experian wrapped up its latest update by mentioning a trio of other trends, including:

—Prime and super prime consumers accounted for nearly 69% of the total finance market in Q1 2024.

—Captives comprised 31.39% of total vehicle finance market share this past quarter, up from 25.93% last year. Banks went from 25.98% to 25.07% year-over-year and credit unions declined from 25.17% to 20.14% in the same time frame.

—New SUV registrations continue to grow at 64.29% in Q1 2024, up from 61.70% last year, while sedans declined from 16.53% to 15.46% over the same period.

For more details, watch Experian’s on-demand webinar available via this website.