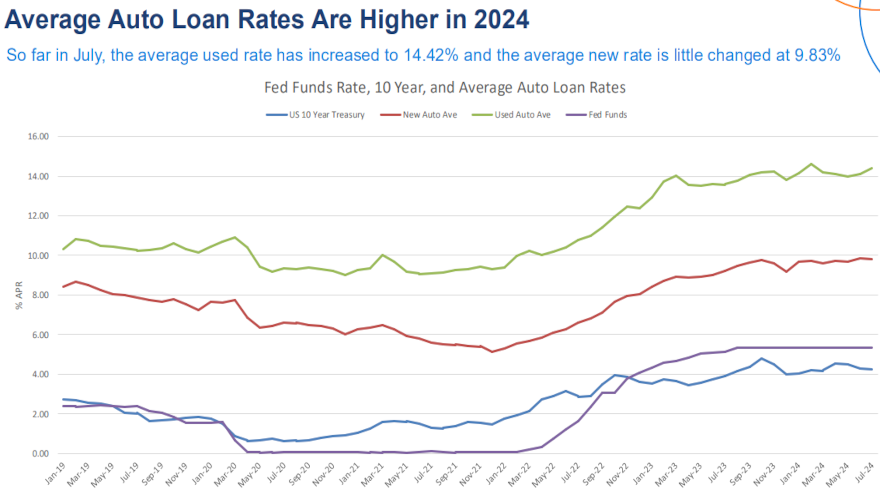

Cox Automotive: Average used APR up 80 basis points so far in July

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive chief economist Jonathan Smoke squeezed in an online video update about auto financing while also being a keynote presenter in San Antonio this week for the Texas Independent Automobile Dealers Association’s annual convention.

Citing data collected via Dealertrack, Smoke reported the average rate for used-car financing booked so far this month has increased 29 basis points to 14.42%. That’s up 80 basis points year-over-year.

For new vehicles financed so far in July, Smoke said the average interest rate declined 1 basis point to 9.83%, leaving it 63 basis points higher year-over-year. He pointed out the average new rate peaked at 10.01% during the middle of June.

“Manufacturers are not offering many low-rate loans but lucky consumers can find some financing deals ahead of expected market rate declines later this year against expectations auto loan rates have moved higher so far in 2024,” Smoke said. “And with market volatility last week, rates have moved higher for used.”

Smoke wrapped his commentary with these observations.

“We are seeing vehicle sales and supply data normalize, showing the vehicle market is holding up pretty well,” Smoke said. “While consumer spending overall is weak, retail vehicle demand remains resilient but clearly constrained by affordability. The main negative for demand is the level of interest rates.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“I’m optimistic that as long as the Fed doesn’t wait too long to start cutting rates. The consumer situation should improve with inflation coming down with rates soon to follow thereafter,” he continued.

“Can we make it until September is the key question,” Smoke added. “Growing credit defaults and repos suggest that consumers are struggling with historically high rates.”