PODCAST: Wolters Kluwer sees digital adoption rise nearly 30% despite major ransomware attack

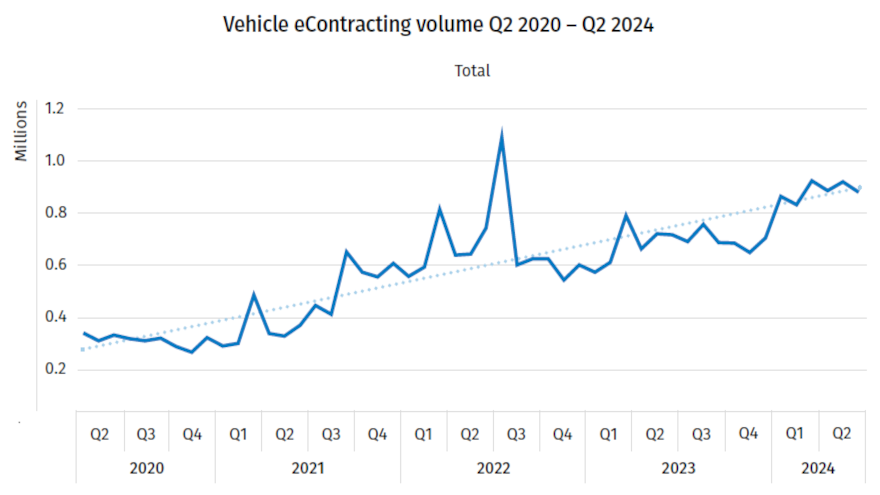

Chart courtesy of Wolters Kluwer.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Even with a notable ransomware attack happening during the span, the Q2 Auto Finance Digital Transformation Index highlighted how much digital activity is happening to get vehicles financed and retailed.

The year-over-year rate of digital adoption for contracting and transaction documentation in the U.S. auto market increased by 29% in the second quarter for finance companies and retailers, according to analysis by Wolters Kluwer Compliance Solutions, which generates the index.

The index tracks the rate at which dealers, service providers and auto finance companies are seeing growth in the evolution from paper-based finance back-office processes to digital.

“In having reached the midway point of 2024, we’re reminded of the true strength of digital adoption across an industry that is still operating on legacy philosophies,” said Tim Yalich, head of auto strategy for Wolters Kluwer. “A growing number of automotive businesses and professionals continue to adopt digital strategies for their back-office workflows and documentation.

“More impressively, despite a ransomware attack that threatened many businesses into a paper-based environment, many saw opportunities to pivot and remain digital, validating the importance of digitizing their entire workflow operations to meet customer needs,” Yalich continued in a news release

According to Wolters Kluwer data, auto retailers and their financing partners continue to seek opportunities to adopt digitized contracting and documentation workflows to increase back-office efficiency.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While the Q2 adoption rate compared to the prior quarter was only slightly up at 3% due to typical seasonal patterns in the auto industry, the four-year trend shows ongoing digital adoption growth of 165% dating back to the second quarter of 2020.

Wolters Kluwer’s Q2 Auto Finance Digital Transformation Index also showed that the digitization adoption rate for securitization markets continued to accelerate.

The digital auto volume in securitization markets decreased 41% on seasonality trends compared with the first quarter of 2024; however, volume was up 39% compared with the same time last year.

Over the last four years, the trend in digital adoption for securitization is up 70%, according to Wolters Kluwer, which offered an index report via this website.

Yalich also appeared on the Auto Remarketing Podcast to elaborate about the impact digital is having in automotive nowadays. Listen to the conversation in the window below.