Ally tops J.D. Power’s dealer financing rankings in subprime for fourth straight year

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

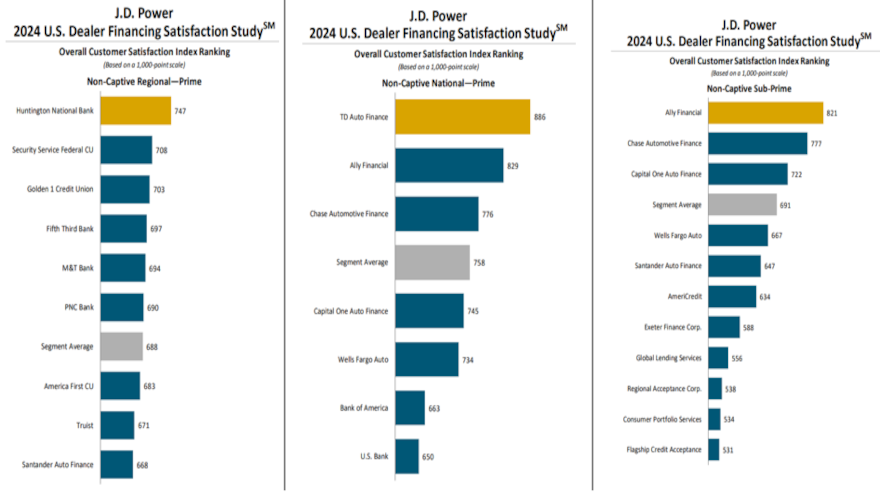

Ally Financial, Chase Automotive Finance and Capital One Auto Finance finished in the top three and above the average segment score among non-captive subprime auto finance companies ranked in the J.D. Power 2024 U.S. Dealer Financing Satisfaction Study released on Thursday.

Ally Financial ranked highest in overall dealer satisfaction in the subprime category for the fourth consecutive year, coming in with a score of 821.

Chase Automotive Finance (777) and Capital One Auto Finance (722) each earned scores above the segment average, which was 691.

Rounding out the top five finance companies in the subprime segment were Wells Fargo Auto (667) and Santander Auto Finance (647).

J.D. Power highlighted study rankings in four other finance categories, including:

Captive premium, prime

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Jaguar Land Rover Financial Group ranked highest in overall dealer satisfaction with a score of 855, followed by Maserati Capital USA (844) and Mercedes-Benz Financial Services (839). This is the first year this segment is award eligible since 2018.

Captive mass market, prime

Southeast Toyota Finance ranked highest in overall dealer satisfaction for a second consecutive year with a score of 889, followed by Subaru Motors Finance (810) and Ford Credit (785).

Non-captive national, prime

TD Auto Finance ranked highest in overall dealer satisfaction for a fifth consecutive year, with a score of 886. Ally Financial (829) ranked second and Chase Automotive Finance (776) came in third.

Non-captive regional, prime

Huntington National Bank ranked highest in overall dealer satisfaction for a second consecutive year, with a score of 747. Security Service Federal Credit Union (708) ranked second and Golden 1 Credit Union (703) placed third.

The 2024 U.S. Dealer Financing Satisfaction Study is based on responses from 4,472 dealer financial professionals. The study was fielded in from March through May.