TransUnion spots another quarterly decline in subprime auto

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auto finance originations are down, personal loan balances sit at a record high, and consumers of all credit tiers are antsy for an interest-rate reprieve from the Federal Reserve.

Those findings are the primary highlights of Q2 2024 Quarterly Credit Industry Insights Report (CIIR) from TransUnion.

Beginning with the auto portion of the report that showed continued drops in subprime activity, TransUnion determined originations for Q1 2024 — viewed one quarter in arrears to account for reporting lag — came in at 6 million, which was down 0.4% year-over-year.

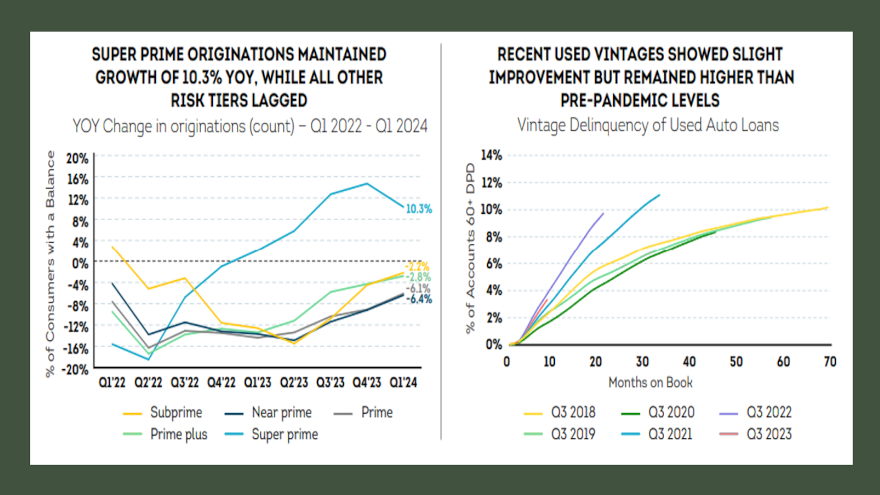

Analysts found that originations were down across all risk tiers with the exception of super prime, which was up 10.3% year-over-year.

TransUnion explained the new-used vehicle origination distribution continues to trend toward pre-pandemic ratios, with 40% of vehicles financed new as opposed to 60% used in Q1. This compares to 41% new and 59% used in pre-pandemic Q1 2019.

Analysts reported total auto-finance balances stood at $1.6 trillion in Q2 2024, up 2.7% year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion said the average amount financed in Q2 2024 softened 3.7% for used vehicles, although the amount remained flat for new.

As a result, analysts computed average monthly payments dipped slightly year-over-year for both new-car financing (down 0.5%) and used-car financing (down 1.5%). TransUnion cited vehicle price stabilization as the primary driver for that movement.

In the collections department, TransUnion reported the 60-day delinquency rate ticked up slightly in Q2 to 1.4%.

Satyan Merchant, senior vice president and automotive and mortgage business leader at TransUnion, explained that new vintages from 2023 continued to show consistent performance when compared to the pre-pandemic periods of 2018 and 2019 while 2023 used vintages were slightly improved compared to the 2022 cohort, but remained worse than 2018 and 2019 vintages.

“While originations remained down YoY, the fact that they were up significantly among super prime is a sign that increased inventories and price declines have gotten lower-risk borrowers off the sidelines and into the market,” Merchant said in a news release.

“Subprime continued to see the most significant challenges, likely due to affordability concerns, with originations down 27.4% from Q1 2019 levels,” he continued. “Price stabilization has led to monthly payments remaining relatively flat year-over-year.

“Higher delinquencies are worth watching, and they are impacting loan availability at this time,” Merchant went on to say. “Potential for rate declines, coupled with more normal inventory levels and reduced prices could provide relief to consumers in this market.”

Q2 2024 Auto Loan Trends

|

Auto Lending Metric |

Q2 2024 | Q2 2023 | Q2 2022 | Q2 2021 |

| Total Auto Loan Accounts | 80.2 million | 80.2 million | 80.4 million | 82.1 million |

| Prior Quarter Originations1 | 6.0 million | 6.0 million | 6.7 million | 7.3 million |

| Average Monthly Payment NEW2 | $740 | $743 | $680 | $597 |

| Average Monthly Payment USED2 | $527 | $535 | $521 | $448 |

| Average Balance per Consumer | $24,199 | $23,501 | $22,178 | $20,548 |

| Average Amount Financed on New Auto Loans2 | $41,324 | $41,290 | $41,094 | $36,634 |

| Average Amount Financed on Used Auto Loans2 | $25,995 | $26,983 | $28,481 | $24,272 |

| Consumer-Level Delinquency Rate (60+ DPD) | 1.4% | 1.3% | 1.1% | 0.7% |

1Note: Originations are viewed one quarter in arrears to account for reporting lag.

2Data from S&P Global MobilityAutoCreditInsight, Q2 2024 data only for months of April & May.

Source: TransUnion

Rise in originations push unsecured personal loans to new record balance

After five consecutive quarters of year-over-year origination declines, TransUnion reported unsecured personal loan originations increased 7% year-over-year in Q1 2024 to 4.6 million.

Like auto financing, personal loan originations are tracked one quarter in arrears to account for reporting lag.

Almost all risk tiers, except for prime plus, contributed to the growth in originations, led by super prime and near prime, according to TransUnion tracking.

Analysts pointed out Q2 2024 represented the 12th consecutive quarter of year-over-year growth in total balances.

However, for the seventh consecutive quarter, TransUnion acknowledged that year-over-year balance growth was at a slower rate than the quarter before, with growth of 6% to $246 billion. Total new account balance for Q1 2024 fell 10% YoY to $27 billion, while the average balance per consumer saw a small growth of 1.2% YoY in Q2 2024.

TransUnion said the total number of consumers with a balance grew year-over-year for the 11th consecutive quarter, reaching 23.9 million.

On the delinquency front, analysts determined the 60-day rate came in at 3.4% in Q2 2024, led by the subprime space.

“Super prime lending largely fueled the new record in balances and contributed to the first year-over-year quarter of origination growth in five quarters, although total new account balances were lower in aggregate,” TransUnion senior vice president of consumer lending Liz Pagel said in the news release

“Delinquency numbers continued to improve for the second consecutive quarter, driven by lower subprime borrower delinquencies,” Pagel continued. “We are seeing fintech activity in the unsecured personal loans market returning to levels seen in previous years.

“It will be worth watching to see if fintechs, and other lenders, are positioning themselves to take advantage of likely Federal Reserve rate cuts later in 2024,” she went on to say.

Q2 2024 Unsecured Personal Loan Trends

|

Personal Loan Metric |

Q2 2024 | Q2 2023 | Q2 2022 | Q2 2021 |

|

Total Balances |

$246 billion | $232 billion | $192 billion | $146 billion |

| Number of Unsecured Personal Loans |

28.8 million |

27.2 million |

24.9 million |

20.7 million |

| Number of Consumers with Unsecured Personal Loans |

23.9 million |

22.7 million |

21.0 million |

18.7 million |

| Borrower-Level Delinquency Rate (60+ DPD) |

3.38% |

3.62% |

3.37% |

2.28% |

|

Average Debt Per Borrower |

$11,687 | $11,548 | $10,344 | $9,079 |

|

Average Account Balance |

$8,557 | $8,558 | $7,705 | $7,072 |

|

Prior Quarter Originations* |

4.6 million | 4.3 million | 5.0 million | 3.2 million |

*Note: Originations are viewed one quarter in arrears to account for reporting lag.

Source: TransUnion

Anticipating future interest rate cuts, consumers continue to use existing credit

And speaking of interest rates, TransUnion said consumers continue to await interest rate relief in the form of rate cuts, and credit products continue to serve to bridge the financial gaps that may exist in many household budgets.

The report revealed that in this challenging current macroeconomic environment, consumers are continuing to engage in the credit market, taking on more balances and credit products.

And while prime and below consumers are seeing lower year-over-year new originations across many products, though not all, TransUnion said consumers continue to use their available credit to get by each month as evidenced by YoY growth in credit card balances and utilization.

“Consumers across the board continue to engage with a wide range of credit products, with continued balance growth across credit risk tiers. Lower risk super prime, in particular, originated more this quarter in areas such as credit cards and auto,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion.

“Of course, on the origination front, this doesn’t mean prime and below consumers don’t also have access to new credit in these areas. However, they are going to have to wait for lower interest rates and for their monthly payments to come down,” Raneri continued.

“It remains to be seen how these numbers will change if and when the Fed lowers interest rates later this year,” Raneri added. “For consumers, the best thing that they can do is ensure that their credit is in the best position possible when that time comes in hopes of being able to take advantage of those lower rates.”

TransUnion is hosting a free webinar to elaborate about report findings. Registration can be completed here.