Credit relief gives AutoCanada added flexibility during financial restructuring

Image courtesy of AutoCanada.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In the midst of a financial restructuring, AutoCanada announced an amendment to its senior credit facility.

In a news release, the struggling dealership group said the move offers “additional covenant headroom” during the covenant relief period, which runs through Sept. 30, 2025, improving AutoCanada’s financial flexibility as it focuses on cost reduction, portfolio optimization and deleveraging for the next year.

AutoCanada said it is “committed to maintaining its liquidity and financial stability throughout this period.”

During the second quarter, in which the company reported a net loss of $33.1 million, AutoCanada began working with management consulting firm Bain & Company to help implement a series of operational improvements to reduce costs and enhance profitability.

The company is currently conducting a strategic review of its non-core and underperforming assets, which has already led to the sale of two “non-core” Chrysler Dodge Jeep Ram dealerships in Alberta, closing seven unprofitable RightRide locations and “repositioning” the six remaining RightRide stores to an “inventory-light” model focused on customers with challenged credit.

The strategic review and operational changes made in partnership with Bain, are designed to “enhance overall profitability, deleverage the balance sheet and refine the company’s focus on its core operations.” AutoCanada said the added financial space created by the covenant amendment gives it time to execute those initiatives “without near-term financial constraints.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

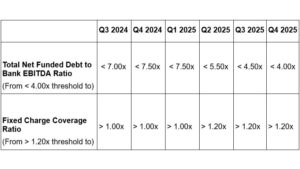

The amendment provides covenant relief of AutoCanada’s total net funded debt-to-bank EBITDA ratio and fixed charge coverage ratio during the covenant relief period. It also includes unspecified administrative changes to be in effect during the covenant relief period.

“We appreciate the support of our lenders as we take proactive steps to position AutoCanada for long-term success,” executive chairman Paul Antony said. “This amendment is an important milestone as we focus on driving operational efficiency, reducing expenses and deleveraging to create value for our shareholders.”

Source: AutoCanada