New York Fed & LegalShield notice more strain on consumer finances

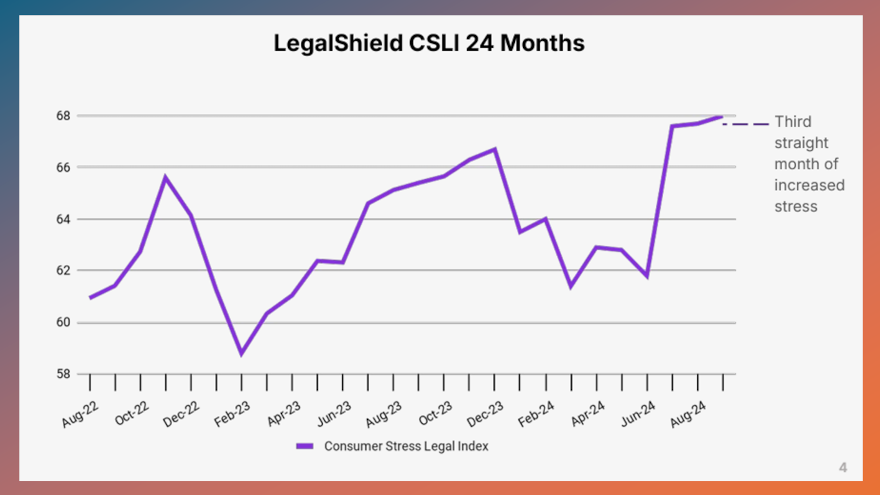

Chart courtesy of LegalShield.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The more researchers examine the current state of household finances, the more they’re uncovering plenty of negative trends.

The two newest developments surfaced this week from The Federal Reserve Bank of New York’s Center for Microeconomic Data and the LegalShield Consumer Stress Legal Index (CSLI).

The New York Fed released its September 2024 Survey of Consumer Expectations, which shows that inflation expectations remained unchanged at the short-term horizon while increasing slightly at the medium- and longer-term horizons.

Researchers found the average perceived likelihood of a voluntary job separation and the perceived likelihood of finding a job in the event of a job loss increased.

While year-ahead household income and spending growth expectations both slightly declined, perceptions and expectations about credit access improved, according to the New York Fed.

Researchers added delinquency expectations continued an upward trend and increased to the measure’s highest level since April 2020.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps what might be of most interest to auto finance companies is that delinquency reading.

The New York Fed said the average perceived probability of missing a minimum debt payment over the next three months increased for the fourth consecutive month to 14.2% from 13.6% in August. This is the highest reading of the series since April 2020.

Researchers added the increase was most pronounced for respondents between ages 40 and 60 and those with annual household incomes above $100,000.

The New York Fed pointed out median expected growth in household income declined by 0.1 percentage point to 3.0%. The series has been moving within a narrow range of 3.0% to 3.1% since September 2023 and remains above the February 2020 pre-pandemic level of 2.7%.

“Perceptions about households’ current financial situations deteriorated with fewer respondents reporting being better off and more respondents reporting being worse off than a year ago,” the New York Fed said. “Year-ahead expectations improved with a smaller share of respondents expecting to be worse off and a larger share expecting to be better off a year from now.”

Officials explained the Survey of Consumer Expectations is a nationally representative, internet-based survey of a rotating panel of approximately 1,300 household heads. Respondents participate in the panel for up to 12 months, with a roughly equal number rotating in and out of the panel each month.

“Unlike comparable surveys based on repeated cross-sections with a different set of respondents in each wave, this panel allows us to observe the changes in expectations and behavior of the same individuals over time,” the New York Fed said, adding that the entire survey report is available online.

Meanwhile, the LegalShield Consumer Stress Legal Index (CSLI) — a study that tracks about 150,000 calls per month from everyday Americans seeking legal help — rose in September, marking the third consecutive monthly increase on the heels of a 22-year record surge in July.

In September, the CSLI increased 0.3 points from August to 68.0.

“Consumer financial strain nationwide has continued to escalate following an unprecedented surge in July, indicating consumers are still facing pocketbook challenges,” said Matt Layton, LegalShield senior vice president of consumer analytics.

Layton’s overall outlook is that the Federal Reserveʼs interest rate cut in September still has not hit consumer payments and that may prolong increased stress.

“It’s important to remember that our data is based on actual calls by everyday Americans seeking legal help on a range of financial issues,” Layton said. “This is not a poll swayed by (political) debates or headlines.”

LegalShield’s CSLI is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. The index is built on three subindices tracking calls for legal assistance for issues related to bankruptcy, foreclosure and consumer finance.

The three subindices were mixed in September.

The bankruptcy subindex rose 0.8 points to 33.1, climbing by 17.1% year-over-year. It’s been on a gradual upward movement since November 2021.

The foreclosure subindex was down 3.0 points to 42.1.

The consumer finance subindex, which measures inquiries regarding a variety of consumer financial concerns such as billing disputes and loan modifications, was up 2.7 points to 108.7, the highest level since last June.

Kevin Almeroth is principal at Deming Parker, a LegalShield provider firm in Georgia

“Many homeowners and renters continue to struggle to make ends meet and are looking for help right now,” Almeroth said. “An increasing number of households are cost-burdened, paying more than 30% of their monthly income to meet housing costs. Hopefully, recent rate cuts and slowing inflation will help fuel homebuyer demand and bring more sellers to the market, leading to more steady home prices and rental rates.”