Full-size pickups buck Canadian wholesale market’s downward trend

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

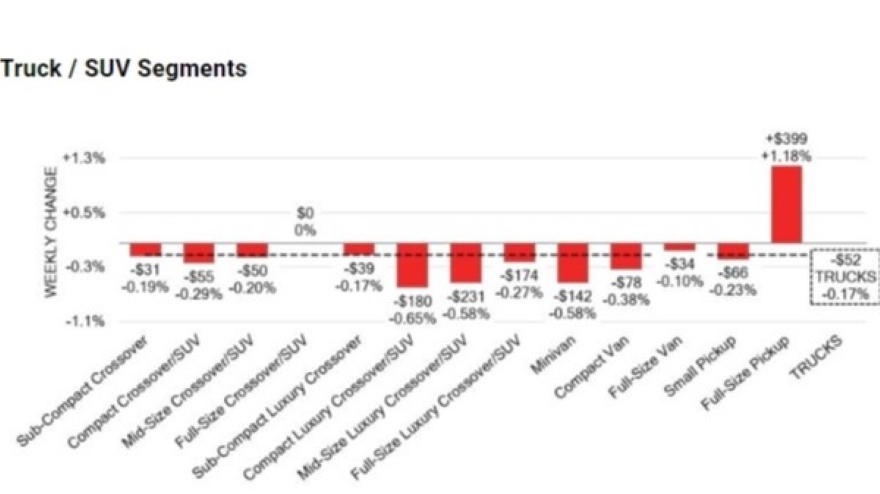

Every segment of the Canadian used wholesale vehicle market was down for the week ending Nov. 2.

Except one. And that one went through the roof.

Canadian Black Book’s weekly Market Insights showed the average wholesale price of full-size pickup trucks soared $399 — a massive 1.18% increase for the week. That was the largest dollar difference of any segment and by far the largest percentage change.

Full-size pickups were the anomaly in a market that fell by 0.31% overall, a significantly larger drop than the previous week’s 0.13% loss.

Car segment values were down 0.46%, just a week after recording a miniscule 0.09% loss. The downturn was led by near-luxury cars, which sank 0.63% ($172), prestige luxury cars (0.56%, $345), sporty cars (0.53%, $145) and premium sporty cars (0.48%, $393).

The big jump by full-size pickups helped shrink the overall average loss for truck segments to 0.17%. Compact luxury crossover/SUV values took the biggest hit, down 0.65% ($180), followed by midsize luxury crossover/SUVs (0.58%, $231) and minivans (0.58%, $142).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In all, nine of the 22 segments lost more than $100 in value for the week.

The average monitored auction sale rate was down to 28%, with the range varying from13.9% to 68.9%, which CBB analysts attributed to the ongoing gradual decline in floor prices, among other factors. Supply continues to increase and demand remains high both north and south of the border for increase in inventory and vehicles at auctions.

CBB said the 14-day moving average retail listing price was at $34,250 and trending slightly upward.

In the U.S., the fourth quarter is showing the expected seasonal depreciation — normally the highest depreciation of the year — for most segments. The exception is the small pickup segment, which surprisingly increased in value for units 8 years old or newer.