Experian spots surge happening within EV financing

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps the electric-vehicle market simply is recharging — at least from a financing perspective.

According to Experian’s State of the Automotive Finance Market Report: Q3 2024, consumer interest in EVs found additional juice in the third quarter, even following several quarters of incremental growth.

Analysts indicated EVs accounted for 10.06% of new vehicle financing during the quarter — growing more than 30% compared to the previous year.

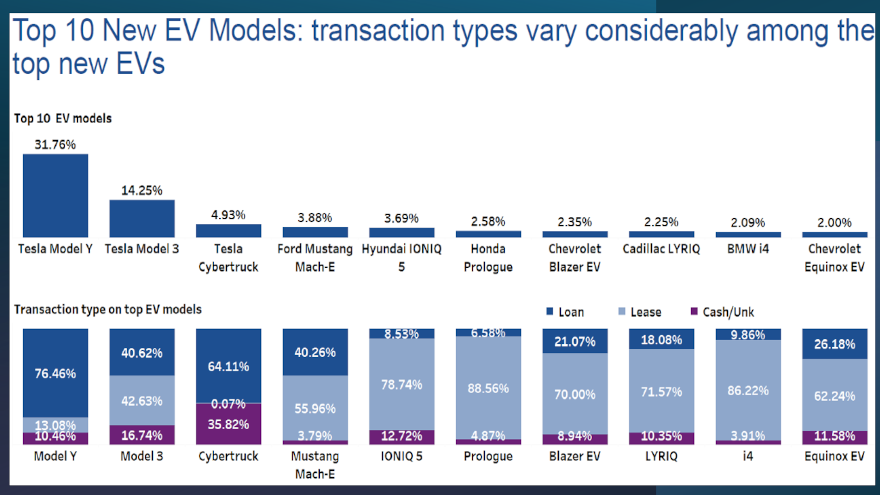

Experian said Tesla accounted for the top three transacted EV models in Q3, led by the Tesla Model Y (31.76%), Tesla Model 3 (14.25%) and the Tesla Cybertruck (4.93%).

“The growth in EV financing can be attributed to two factors: the EV tax credit and more affordable models hitting the market,” said Melinda Zabritski, Experian’s head of automotive financial insights.

“While vehicle pricing, particularly with EVs, continues to be a driving factor in consumers’ purchasing decisions, we’re seeing consumers lean on some of the lease incentive and rebate programs to make the overall cost and monthly payment of EVs more palatable for their specific situations,” Zabritski continued in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian also noticed leasing accounted for nearly 45% of all new electric vehicle transactions in Q3, up from 24.97% the previous year and 9.53% in Q3 2022.

Analysts explained that part of the appeal could be attributed to significantly lower monthly payments. The average monthly payment for a new EV lease was $198 lower than the average monthly payment for a new EV retail installment contract in Q3, according to Experian tracking.

Among the most leased EV models, the Tesla Model 3 (13.60%) held the top spot, followed by the Tesla Model Y (9.30%), Hyundai IONIQ 5 (6.51%), Honda Prologue (5.11%) and Ford Mustang Mach-E (4.86%).

To learn more, watch the entire State of the Automotive Finance Market Report: Q3 2024 presentation on demand.