Credit availability finishes 2024 on a high note

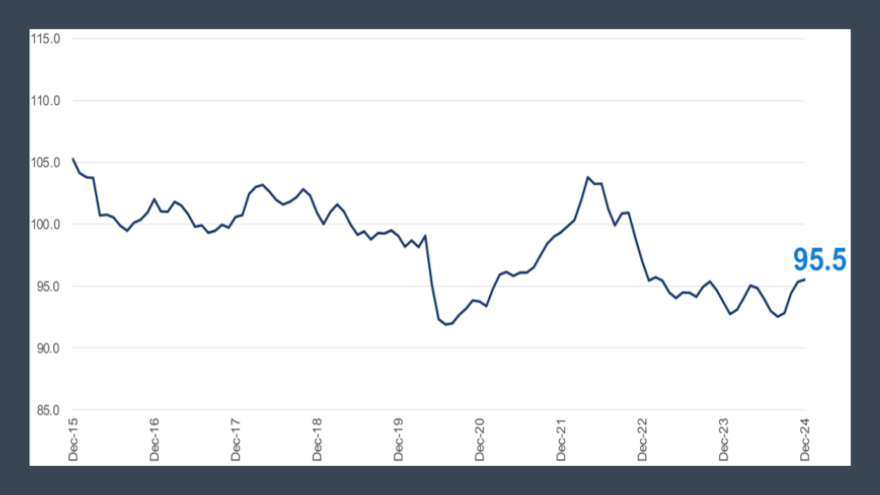

Dealertrack Credit Availability Index for December. Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As you might have noticed when booking paper and finalizing deliveries during the holiday season, it was a bit easier to get consumers into financing during the closing month of the year.

Cox Automotive reported earlier this week that the Dealertrack Credit Availability Index made a notable improvement in December, reaching 95.5. That represented a 0.2% increase from November and a 1.9% rise year-over-year to generate the highest level of auto credit access since March 2023.

While that might seem completely rosy for financing, Jonathan Gregory, a senior manager on Cox Automotive’s economic and industry insights team, poured a bit of cold water on the improvement in a commentary that accompanied the latest index update.

“The December Dealertrack Credit Availability Index illustrates mixed results in credit access for auto loans,” Gregory wrote. “Consumers benefited significantly from tightening yield spread, higher approval rates and more favorable loan rates, which played critical roles in pushing the index slightly upward. Meanwhile, the persistence of certain tightening factors — like shorter loan terms, higher down payments, and a reduced share of subprime loans — was not enough to reverse the loosening trend.

“For consumers, this means better borrowing conditions and easier access to auto financing, particularly when purchasing used vehicles from franchised dealers,” he continued. “Lenders are also navigating a mixed environment as credit demand intersects with loosening policies for credit unions and auto-focused finance companies but tightening at banks and captives.”

Gregory drilled deeper into the key drivers of credit access, adding some specific numbers to six specific trends:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Approval rates: Cox Automotive indicated the approval rate increased by 40 basis points in December, a key factor in driving improved credit access.

“The increase in approval rates and the narrowing of yield spreads mean that more consumers are getting approved for loans — and at better rates. This upward trend offsets some restrictive measures observed in other credit factors,” Gregory said.

—Yield spreads: Cox Automotive recapped the 5-year U.S. Treasury increased by 2 basis points in December, leading to a smaller yield spread. Yield spreads narrowed by 25 basis points, making auto finance rates more favorable compared to bond yields.

Cox Automotive also noted the average auto finance rate dropped by 23 basis points from November. Those rates also have decreased by 175 basis points since March, according to Cox Automotive tracking.

“The narrowing yield spreads and the drop in average loan rates make borrowing conditions more favorable for consumers, leading to lower monthly payments and decreased overall loan costs,” Gregory said.

—Subprime share: Cox Automotive determined the subprime share decreased by 50 basis in December, although it increased year-over-year.

“While a smaller presence of high-risk loans can tighten access for some borrowers, the impact was balanced by more favorable dynamics elsewhere,” Gregory said.

—Term length: Cox Automotive noticed the share of contracts with terms longer than 72 months declined by 20 basis points, continuing a four-month trend of decreases.

“While facing shorter loan terms could mean higher monthly payments, it also means consumers can pay off the loan faster and potentially save on interest over the life of the loan,” Gregory said.

—Negative equity: Cox Automotive pointed out contracts with negative equity decreased sharply in December, plummeting by 120 basis points. However, the metric remained higher compared to a year earlier.

“While fewer negative equity loans can signify healthier financial conditions overall, it may narrow access for some borrowers,” Gregory said.

Down payment percentage: Finally, Cox Automotive indicated the down payment percentage decreased by 20 basis points in December compared to previous month and remains up slightly compared to December 2023.

“Higher down payments can challenge consumers but can also lead to lower monthly payments and less interest over time,” said Gregory, who closed with a couple other observations.

“Credit access was mixed across all sales channels in December, with used-vehicle loans from franchised dealers experiencing the most loosening. Used-vehicle loans from independent dealers tightened the most,” he said.

“Lender types saw mixed results with access to credit availability. Credit unions showed the most loosening, while captives showed the most tightening,” Gregory added.