More positives from Wolters Kluwer Auto Finance Digital Transformation Index

Chart courtesy of Wolters Kluwer Compliance Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

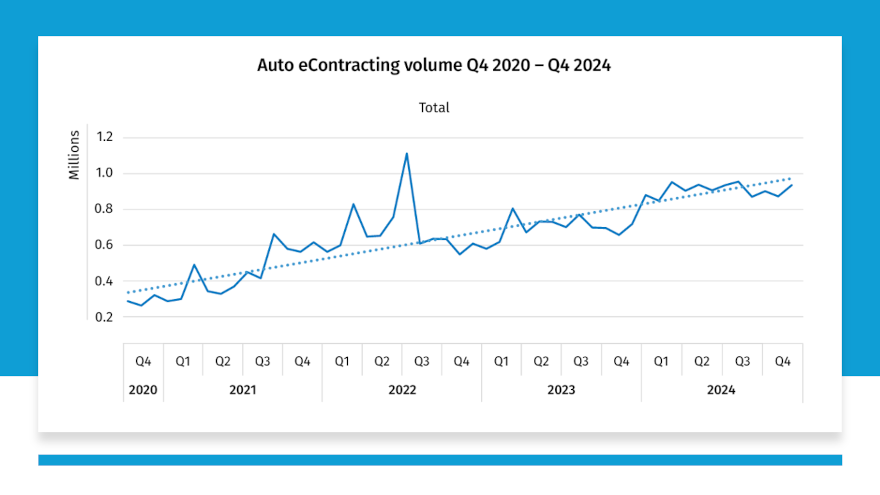

Analysis by Wolters Kluwer Compliance Solutions from its Q4 Auto Finance Digital Transformation Index showed adoption of digitized contracting and documentation workflows by auto retailers and their financing partners that foster back-office efficiencies saw a noticeable jump to close last year.

While adoption in the fourth quarter compared to third quarter was down slightly — 2% to be precise — Wolters Kluwer explained the year-over-year trend comparing 2024 Q4 with 2023 Q4 was up 32%.

Further, Wolters Kluwer highlighted the four-year trend continues to show digital adoption growth of 106% dating from Q4 2020.

Wolters Kluwer recapped that this index tracks the rate at which dealers, service providers and finance companies are seeing growth in the evolution from paper-based finance back-office processes to digital.

“The robust adoption of digital documentation processes over the last four years underscores the unwavering commitment of auto lenders and their dealer partners to modernize their operations,” said Matt Babcock, who oversees digital lending product strategy for Wolters Kluwer. “This rise in digital adoption compared to last year not only aligns with the strong finish we observed in auto sales toward the end of 2024 but also reflects the industry’s growing recognition of the critical role digital assets play in enhancing efficiency and customer experience.

“The continued emphasis on converting paper-based documentation to digital formats signals a mature understanding of the long-term benefits of digital transformation in the auto finance sector,” Babcock continued in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With the value in the deep subprime sector down noticeably toward the end of the year, the Wolters Kluwer Q4 Index reflected an 18% decrease in the digitization adoption rate for securitization markets compared with Q3.

Analysts noticed the year-over-year rate of adoption was also down 15%.

However, Wolters Kluwer said it is also noteworthy that the full year 2023 to full year 2024 securitization transactions increased 10.4%.

Furthermore, over the last four years, digital adoption for securitizations is up 55%, “signaling a continued increase in adoptions on a macro level,” according to Wolters Kluwer.

For more information about Wolters Kluwer, visit www.wolterskluwer.com.