LegalShield: Consumers might be approaching ‘breaking point’

Chart courtesy of LegalShield.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Please excuse comparisons back to the pandemic, but it’s the reference point LegalShield used to explain its latest research findings about consumer finances and bankruptcy.

LegalShield reported on Wednesday that bankruptcy inquiries surged in the first quarter to their highest level since early 2020, signaling a potential summer spike of filings.

Researchers said the legal service provider’s data has historically been a leading indicator of bankruptcy and other consumer financial trends. LegalShield suggested record consumer debt and new tariffs could push financially strained households past their breaking point.

“Bankruptcy inquiries hit the highest we’ve seen since early 2020, just before Americans’ checkbooks were boosted by COVID checks from the government,” LegalShield senior vice president of consumer analytics Matt Layton said in a news release.

“When you combine record debt, rising delinquencies, and prolonged financial stress, topped by price pressures driven by tariff uncertainty, the risk of a summer surge in bankruptcy filings becomes very real,” Layton continued.

In another research endeavor, WalletHub took a closer look at delinquency in auto finance.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

To determine which states are experiencing the biggest increases in auto loan delinquency, WalletHub analyzed proprietary user data on consumer delinquency rates across all 50 states between Q3 2024 and Q4 2024.

WalletHub discovered that the top 10 states experiencing surges in auto delinquency during that time include:

1. Delaware

2. Kansas

3. New Hampshire

4. Montana

5. Oklahoma

6. Colorado

7. Washington

8. Alabama

9. Massachusetts

10. Arizona

Might those locations also be the places where bankruptcy filings surge, too? LegalShield didn’t offer any specifics on locations, but the company reiterated its Bankruptcy Index historically has been a leading indicator of actual bankruptcy filings by two quarters.

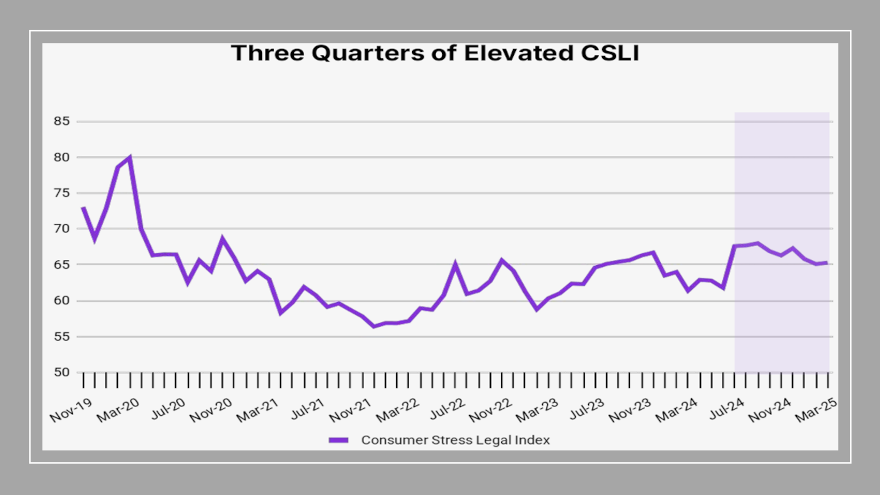

Researchers indicated the bankruptcy warning signs surfaced amid a third straight quarter of elevated consumer stress measured by LegalShield’s Consumer Stress Legal Index (CSLI), pointing to a heightened financial strain that has become a “new normal” for American households.

The CSLI has remained elevated since a spike in July of 2024, leveling off slightly to close Q1 2025 at 65.3, down from 67.3 at the end of 2024.

“The decline was driven by a significant drop in consumer finance inquiries amidst tax refund season and relatively strong employment numbers, which may be masking greater concerns as bankruptcy and foreclosure inquiries increased before tariff announcements sent the markets into turmoil,” LegalShield said in the news release.

“Many American households may be poised for a breaking point in the first half of 2025 as they deal with new tariffs, rising prices, increased debt and sustained elevated interest rates,” LegalShield continued, also noting that U.S. bankruptcy filings surged 14.2% year-over-year by the end of 2024, according to U.S. court records.

The CSLI tracks approximately 150,000 calls per month from everyday Americans seeking legal help, comprising a dataset of more than 35 million consumer requests since 2002. The index is built on three subindices tracking calls for legal assistance for issues related to bankruptcy, foreclosure and consumer finance, which measures inquiries regarding a variety of consumer financial concerns such as billing disputes, debt issues and loan modifications.