Canadian wholesale market continues downward trend

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The Canadian used wholesale vehicle market continued to trend downward last week, and at the same rate as the week before, according to Canadian Black Book’s weekly Market Insights report.

Vehicle values fell 0.33% overall in the week ending Nov. 30, matching the decline from the previous week, and again trucks led the way, though by a wider margin this time around.

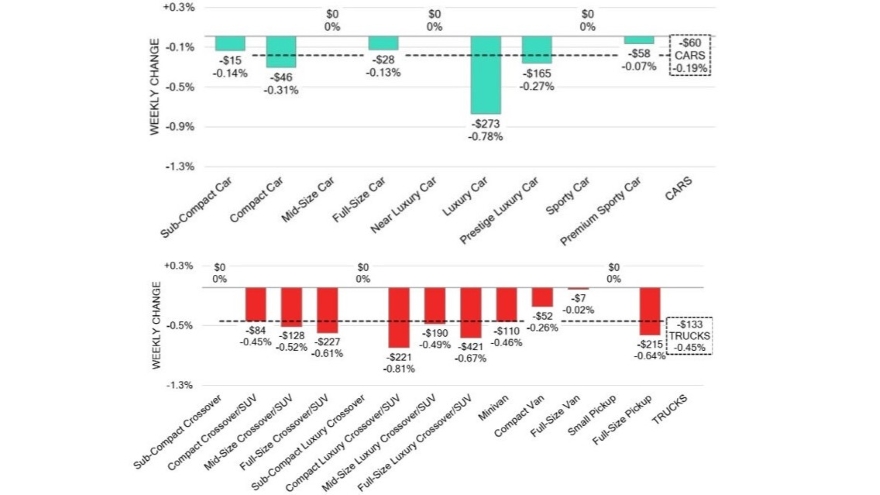

Truck segments were down 0.45% a week after sinking 0.39%, while cars declined 0.19%, up from the 0.26% drop a week earlier. None of the market’s 22 segments gained value for the week, though six — midsize cars, near-luxury cars, sporty cars, small pickups, subcompact crossovers and sub-compact luxury crossovers — managed to break even.

The losses in the truck segments were led by compact luxury crossover/SUVs at 0.81%, full-size luxury crossover/SUVs (0.67%), full-size pickups (0.64%) and full-size crossover/SUVs (0.61%). Seven truck categories lost more than $100 in value during the week and four sank by more than $200, with full-size crossover/SUVs at the top of that list with a massive $421 decline.

Luxury cars were down 0.78% ($273), by far the biggest drop among car segments. Only one other segment fell by more than 0.30% – compact cars at 0.31% – and more than $60 – prestige luxury cars at $165.

The average monitored auction sale rate was up to 45.8% for the week, with a relatively narrow range from 22.9% to 58.9%. CBB analysts attributed the “continuous fluctuation in sale rates across various lanes” to the ongoing gradual decline in floor prices and recent adjustments to interest rates, among their factors.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As has been the case in previous months, supply entering the wholesale market increased and demand for more inventory and vehicles at auctions remains high on both sides of the border.

CBB said retail listing prices are up slightly, with the 14-day moving average at $34,320.

Depreciation rates slowed in the U.S. last week as overall auction activity was affected by the Thanksgiving holiday. The market declined just 0.29% following a 0.46% drop the previous week.

That’s a significantly smaller decline than the pre-pandemic average of 0.82% for the same week and a marked improvement from the 1.86% plummet at this time last year.