Canadian wholesale market trends up for first time in 2.5 years

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

One month is a data point. Two months is … a trend?

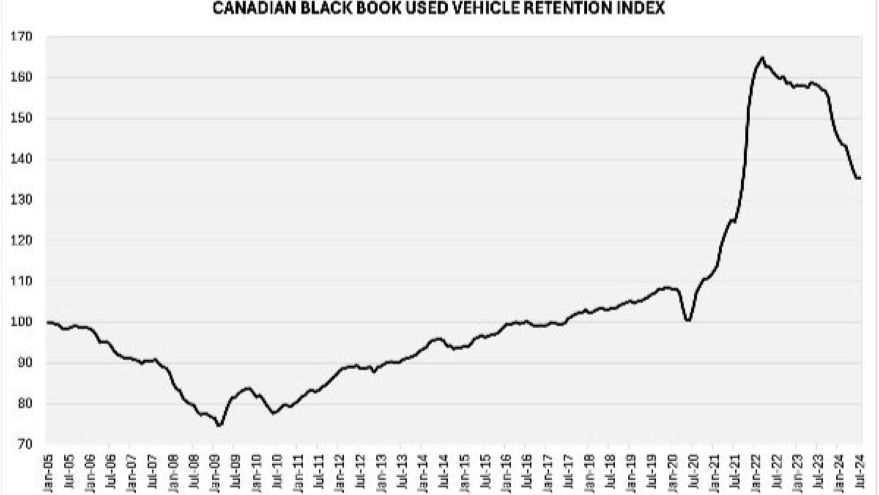

For the second month in a row, Canadian Black Book’s Used Vehicle Retention Index was up from the previous month, registering at 136.0 for August. That’s an increase of 0.6 points from July’s index of 135.4, which was up 0.1 from June.

That marks the first time the index has risen for two consecutive months since February and March 2022, when it peaked at 165.0.

“Decreasing used-car supply as well as a strengthening export market has continued to stabilize the Canadian wholesale market as we head into the fall market,” CBB senior manager and head of Canadian vehicle valuations David Robins said in a news release.

The current upward trend has made only a small dent in the market’s long downward slide since its high point two-and-a-half years ago — August’s index is still down 13.5-over-year.

The index is calculated using CBB’s published wholesale average value on 2-6-year-old used vehicles as a percent of original typically equipped MSRP.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The full index can be downloaded here.

Weekly Market Insights

Canadian used wholesale values took a steeper dive in the week ending Sept. 7 than they had in recent weeks, with values falling 0.35%, according to Canadian Black Book’s weekly Market Insights report.

Trucks led the slide with a decline of 0.39% following two weeks of 0.16% losses, while car segments were down 0.31%. Half of the 22 segments overall lost more than $100 in value during the week, while only two (subcompact cars and full-size crossover/SUVs) had gains, and those only totaled $20 between the two.

Mid-size luxury crossover/SUVs (0.75%), sporty cars (0.69%) and full-size luxury crossover/SUVs (0.63%) had the largest percentage declines, while full-size luxury crossover/SUVs ($398), mid-size luxury crossover/SUVs ($308), premium sporty cars ($263) and sporty cars ($201) lost the most dollar values.

Retail prices also fell during the week, though only slightly. The 14-day moving average based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots was $34,100, down $100 from the previous week. Monitored auction sale rates varied from 14% to 81%, with an average of 53.4%.

In the U.S., the wholesale market is trending upward, which CBB analysts said deviates from seasonal norms. Ten of the 22 segments in that market gained value, with car segments up 0.04% and trucks rising 0.06%.