Canadian wholesale values close in on break-even point

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Having slowed to a crawl in January, the fall of Canadian wholesale used-vehicle values has reached a virtual standstill.

According to Canadian Black Book’s weekly Market Insights report, the market was down a mere 0.05% for the week ending Feb. 1, following declines of 0.10% and 0.17% the previous two weeks.

The overall market has dropped less than 0.20% every week but one since the beginning of the new year.

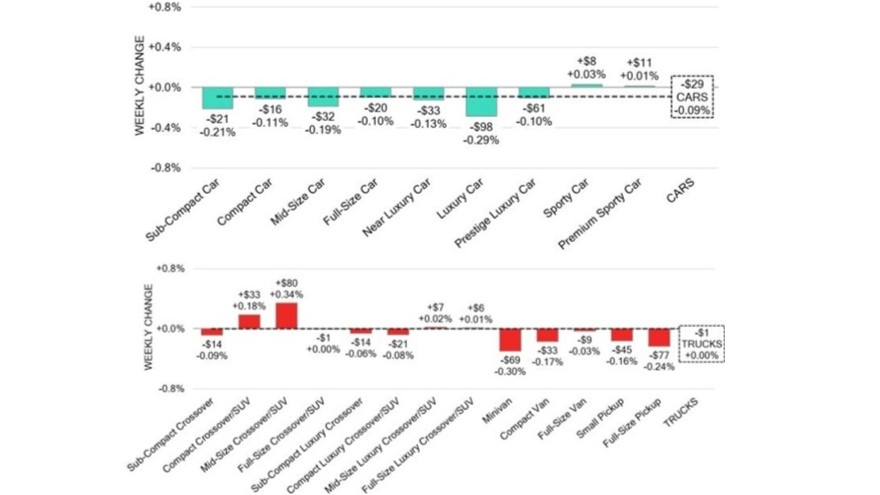

After a 0.01% drop a week earlier, truck/SUV values broke even for the week, while cars declined 0.09% compared to 0.19% previously.

Six segments — four of them in the truck/SUV category — gained value, led by midsize crossover/SUVs (0.34%, $80) and compact crossover/SUVs (0.18%, $33). No segments lost $100 or more, with luxury cars ($98, 0.29%) taking the largest dollar loss and minivans’ 0.30% ($69) as the top percentage decline.

The average auction sale rates dropped almost six percentage points week-over-week to 43.3%, with the range widening to 8.1%-84.6% for the week. CBB analysts attributed the fluctuation in sale rates to, among other factors, recent adjustments to interest rates, noting the Bank of Canada reduced its key interest rate by 25 basis points to 3% in January. That brings the total drop in that rate to 200 basis points since the beginning of the cycle in June.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Following a $450 drop the previous week, the 14-day moving average retail listing price held steady at $34,500.

The U.S. wholesale market continued to show stability, with depreciation at 0.34%, following a normal seasonal pattern.