Cars take the fall in Canadian wholesale market

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The wholesale used-vehicle market in Canada continued what Canadian Black Book analysts last week called a “steady gradual decline” — only with a bit more volatility among the car segments.

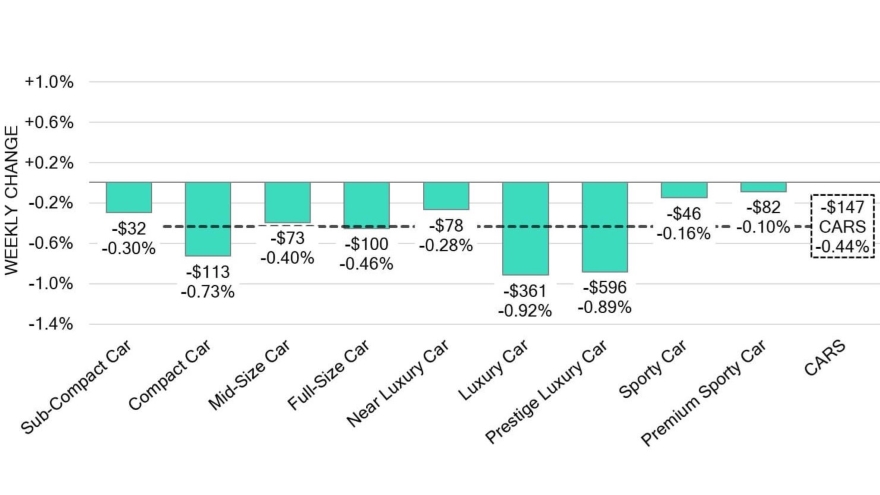

CBB’s Market Insights report for the week ending Aug. 17 showed a 0.28% decrease in overall values, slightly larger than the previous week’s 0.23% drop. But cars sank 0.44%, a large jump from the 0.20% rate of the week before, and four segments lost $100 or more in value during the week.

That fall was led by prestige luxury cars, which dropped $596 (0.89%) and luxury cars, down $361 (0.92%). Compact cars, which had actually gained value the previous week, fell by $113 (0.73%) and full-size cars were down $100 (0.46%).

Trucks/SUVs, meanwhile, fell just 0.14%, though only two segments gained value – full-size pickups ($171, 0.51%) and full-size luxury crossover/SUVs ($7, 0.01%). Minivans, down $135 (0.54%), full-size vans ($112, 0.33%) and compact luxury crossover/SUVs ($104, 0/25%) all lost more than $100.

In all 36% segments had an average value change of $100 or more.

Retail prices again held steady at $34,400.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Monitored auction sale rates stabilized, ranging from 25% to 59%, which CBB said is a result of a continued drop in floor prices, and analysts noted “less supply entering the wholesale market … as upstream channels continue to secure early access.” Even so, they said, demand remains high for more inventory in both Canada and the U.S.

The U.S. wholesale market was down 0.17% overall, with car segments dropping 0.29% and trucks down 0.12%. CBB analysts saw “a mix of adjustments” in a wholesale market three years out from the COVID-induced gap in new vehicle production that is also dealing with high interest rates, significant negative equity and rising new-vehicle incentives.

Last week, the compact car, crossover, minivan and small pickup segments performed well, while full-size luxury crossover/SUVs and other high-dollar segments declined significantly.