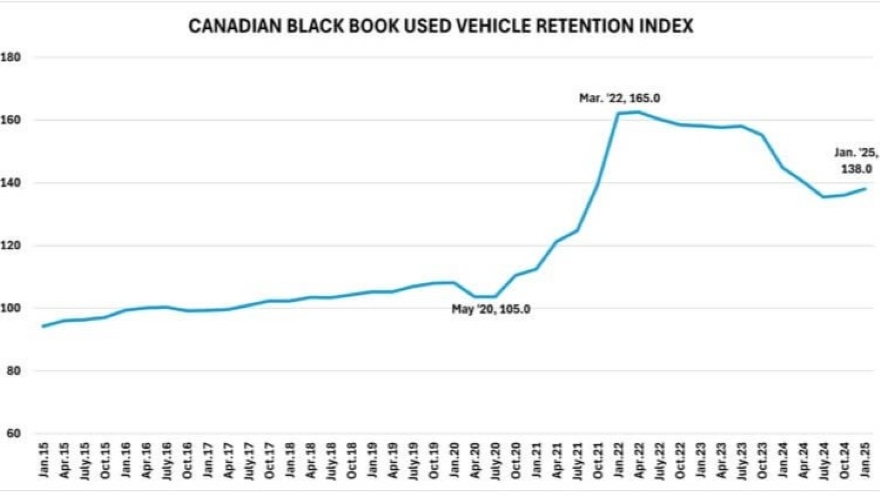

CBB monthly index makes its biggest jump in three years

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

After half a year of slowly creeping upward, the Canadian wholesale used-car market took a significant leap in January.

Canadian Black Book’s Used Vehicle Retention Index was up 2.3 points for the month, rising to 138.0 from December’s 135.7. That’s the biggest jump in the index since it rose 3.6 points, from 158.5 to 162.1, in January 2022.

CBB senior manager and head of Canadian vehicle valuations David Robins said political and economic factors, including U.S. President Trump’s talk of tariffs on Canadian imports, were the key drivers in the market bump.

“Threats of tariffs persisted through January,” he said. “The Canadian dollar declined while exporter demand increased, which pushed the used-vehicle retention index upward.”

Even with the 1.7% increase, the index was still down 4.7% year-over-year, as the market evens out after four volatile years that included a COVID-induced 21-month run of unprecedented rising values, reaching an all-time high index value of 165, followed by 27 consecutive months without an increase, as the index dropped back to 135.3 in June.

The index is calculated using CBB’s published wholesale average value on 2-6-year-old used vehicles as a percentage of original typically equipped MSRP and weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The full index can be downloaded here.

Truck values gain ground in another week of slow decline

Canadian wholesale used-vehicle values followed the trend it has shown since the beginning of 2025 — a gentle slide downward — with one exception.

The truck/SUV segments broke into positive territory.

While Canadian Black Book’s weekly Market Insights report showed the overall market sank 0.12% for the week ending Feb. 8 — the fifth time in the past six weeks the decline has been less than 0.20% — the truck/SUV category finished the week up 0.04%.

Six of the 13 truck/SUV segments gained value, led by compact vans (up $107, 0.55%), and full-size crossover/SUVs ($207, 0.33%), both up more than $100, and mid-size crossover/SUVs (0.36%, $85). On the down side, subcompact luxury crossovers (down 0.72%, $157) and small pickups (0.57%, $156) took the biggest falls.

After dropping just 0.09% the previous week, car segments were down 0.30%, though only one — prestige luxury cars (0.24%, $123) lost more than $100. Compact cars (0.57%, $60) had the largest percentage decrease.

The wildly fluctuating auction sale rates evened out a bit for the week, ranging from 31.6% to 72.6% and averaging 51.7%.

CBB said the 14-day moving average retail listing price for used vehicles continuing to fall, declining slightly for the week $34,490. A report from AutoTrader released this week also showed a downward trend, with prices in January down 5.7% year-over-year, but with a higher average of $36,899.

CBB analysts noted that after the Canadian government abruptly discontinued the federal iZEV rebate program last month, some dealers and automakers instituted their own $5,000 incentive for consumers purchasing fully electric or plug-in hybrid vehicles. Those businesses have now been told they are likely not be reimbursed for their contributions to prolong the program.

In the U.S., analysts said the wholesale market remained resilient despite uncertainty from President Trump’s negotiations with Canada and Mexico regarding a 25% tariff on imports, showing strong sales nationwide and values that continued to align with seasonal depreciation trends. The overall market was down 0.36% for the week.