CBB report shows slower decline for wholesale market last week

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

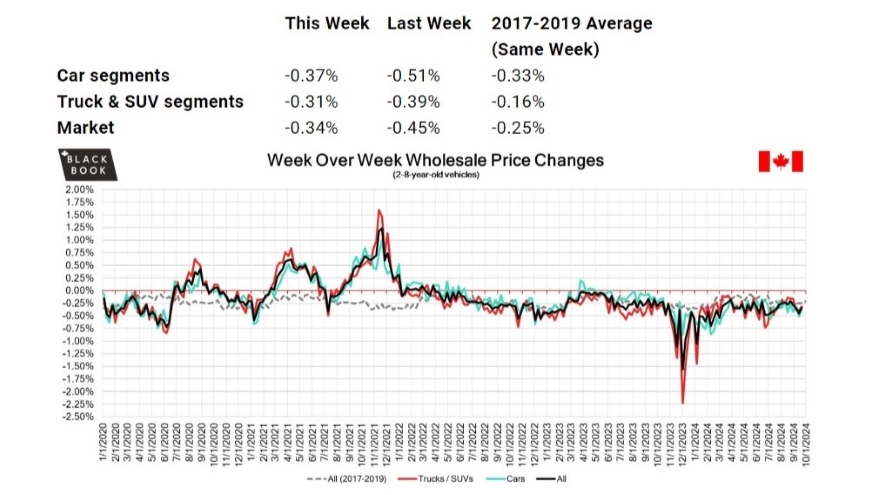

A week after the Canadian used wholesale market dropped by nearly half a percentage point, the decline for the week ending Sept. 21 was not quite so steep.

Canadian Black Book’s weekly Market Insights reported the market fell by 0.34% overall, following a 0.45% slide the previous week.

All but two of the 22 vehicle segments showed a loss of average value – compact crossover/SUVs broke even and compact vans gained $20 (0.1%)

On the flip side, 13 segments dropped by more than $100 and seven fell more than 0.50%, topped by sub-compact luxury crossover/SUVs, whose values plummeted by 1.11% ($258) during the week, full-size cars, down 0.97% ($205), sub-compact crossovers, down 0.81% ($134), and full-size luxury crossover/SUVs, which lost $405 (0.64%).

Car segments fell 0.37% a week after a 0.51% decline. Truck/SUV values were down 0.31% overall.

Monitored auction sale rates averaged 45.1% but fluctuated wildly during the week, ranging from 10% to 91%, which CBB analysts attributed to several factors, including the ongoing decline in floor prices.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The report also noted an increase in supply entering the wholesale market, despite upstream channels continuing to gain early access, and said demand for increased inventory and vehicles at auctions remains high on both sides of the border.

Retail prices continue to show stability, with the 14-day moving average at $34,400.

The U.S. market finally began to show the expected seasonal downward trend, falling 0.17% after four weeks of slight increases. Still, analysts said, the rate of decline was smaller than usual. Cars were down 0.12%, while trucks/SUVs dropped 0.20%.