CBB’s 2025 forecast tells industry ability to pivot is key in a ‘tumultuous’ year

Images courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In an already chaotic year filled with questions and uncertainty, Canadian Black Book has a word of advice for dealers and the automotive industry at large.

That word is “pivot.”

In its 2025 Market Preview, CBB called it the “one recurring theme [that] echoed across the sector.”

“With shifting consumer preferences, regulatory developments and economic fluctuations, the ability to pivot remains critical,” the report said. “Over the next 10 months, market players must once again demonstrate adaptability and strategic agility to navigate the evolving automotive landscape.”

That’s because what that evolution is going to look like is anybody’s guess and is likely to change at any moment, given the unpredictability of various political and economic factors — notably tariffs and their effects.

Indeed, even as CBB delivered its forecasts for the year ahead, the company’s analysts acknowledged the impossibility of that task.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The year ahead will undoubtedly be tumultuous as variables we lean on for market certainty are continuously in flux,” they said in the report, adding that CBB looks at the industry “as the crow flies” to “guide the level of volatility” expected in the market.

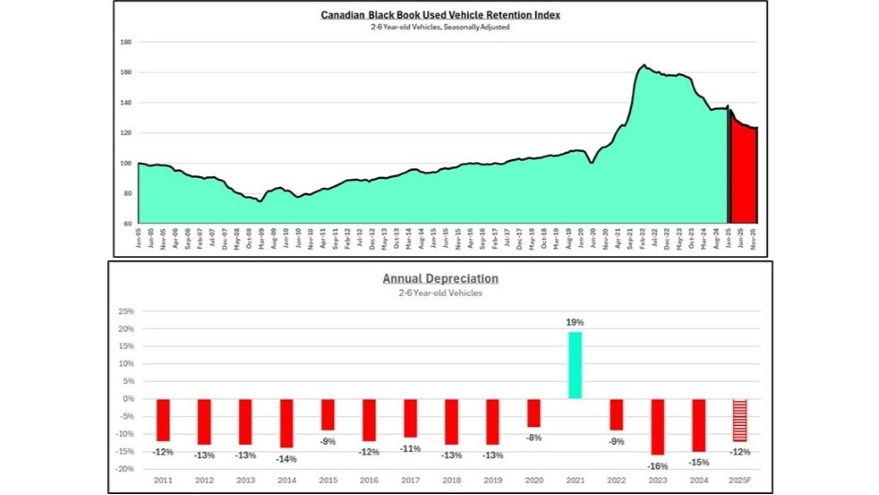

That said, CBB expects used-vehicle wholesale prices and depreciation to continue the downward correction they’ve followed over the past two-plus years, projecting a Used Vehicle Retention Index score of 123.1 by year’s end, down 9.3% from 2024’s year-end score of 135.7.

That’s still more than 13% above the pre-pandemic 2019 year-end level, as the shrinking supply of late model used vehicles — a hangover from the COVID era — will prop up values before further declines in 2026 and 2027 bring used values down closer to long-term historical norms. Canadian Black Book predicts that will translate to 12% depreciation for 2-to-6-year-old vehicles this year, less than that of the previous 24 months.

But again, the report notes the inherent uncertainty involved in such predictions in the current political climate.

“With anticipated volatility over the next six months in wholesale values due to proposed U.S. tariffs of 25%, the market could respond in a couple of different ways,” CBB said. “The Canadian market will realize decreasing used-car pricing, but with current pressure from the U.S. on used-vehicle demand, this has the capacity to soften price decreases with those buyers keeping their U.S. dollars stateside.”

The report projects the average four-year retained value for 2025 model-year vehicles to drop to 63% of original equipped retail price, with the expectation values continue decreasing throughout the second half of the decade as manufacturer and consumer behavior gradually move toward pre-pandemic levels.

But while percentage retention decreases, CBB said, the average dollar value each year will stay relatively flat due to significant pricing increases from 2022-2025.

As noted, supply of used vehicles up to 8 years old is expected to fall by 3.2% to 1.57 million units in 2025, the result of new-vehicle sales of roughly 1.2 million units between 2020 and 2023, and lease originations reaching a low of 18%.

On the new-car side, Canadian Black Book expects 2025 sales volume to remain relatively flat at 1.85 million units, with a long-term forecast for continued improvement and an eventual return to pre-pandemic market size. Lease penetration is projected to rise to 29%, just below the pre-COVID rate.

CBB said the Bank of Canada’s forecast of interest rates decreasing to 2% by the year’s end should help offset inflation caused by any tariffs imposed. Even so, with MSRPs rising 20-30% over the past few years, sticker shock is still common for customers returning to the showroom.

That has led to the rise of incentives, which averaged 6.8% in 2024, up 4.3% year-over-year. In 2025, CBB predicts incentives to reach 9%.

Affordability issues are particularly noticeable in the electric and plug-in hybrid vehicles sectors as a result of the removal of provincial and federal iZEV rebates. Still, CBB sees the ZEV share of the market to increase to 16% this year, up from 15.4% in 2024, noting EV adoption is expected to “maintain course,” but hybrids and plug-in hybrids outpacing the slowing growth of battery electric vehicles.

The complete report is available here.