Pandemic repercussions affect Canadians’ approach to car buying

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

MARKHAM, Ontario –

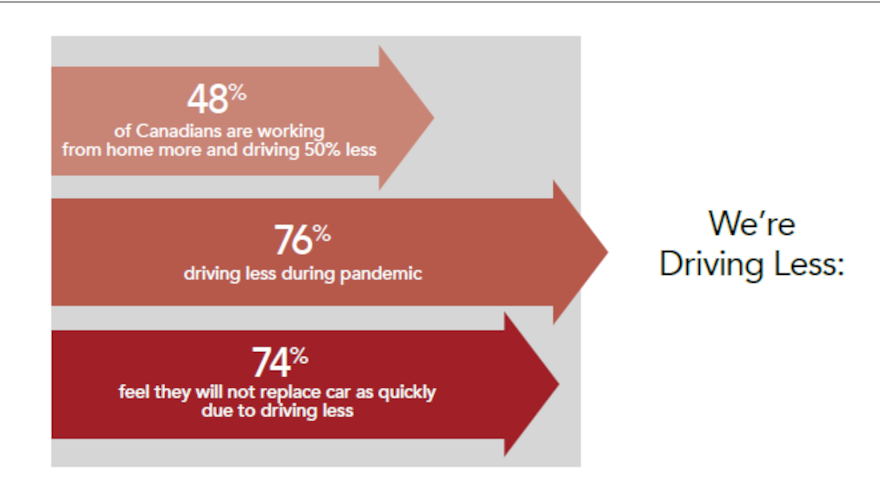

Canadians are driving less. As a result, they are buying less.

The result of less driving, says Canadian Black Book, is a reduced sense of urgency when it comes to buying a new vehicle.

That is according to a CBB study using Ipsos research on Canadians’ car-buying habits.

Other findings of the research: Intent to buy alternative energy vehicles in the near term has also decreased, and the federal government’s recent announcement of a carbon tax increase over the next decade could bring movement toward more fuel-efficient cars, less car ownership, and increased use of shared transit methods.

For the study, Ipsos, on behalf of CBB, interviewed a sample of 1,000 Canadians in January who own or lease a car or truck or who are looking to purchase in the next two years.

CBB said its 2021 study reveals some numbers that it described as stunning. The study also shows major contrasts compared to the 2020 edition. The company conducted that work before the pandemic became widespread in Canada.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“CBB’s 2021 study illustrates how the COVID-19 pandemic and its economic repercussions have had a significant impact on how Canadians drive, travel, and approach buying a car,” Canadian Black Book said in a news release.

Driving less; buying less

Seventy-six percent of Canadians are driving less since the beginning of the pandemic, and CBB said that that is the prominent catalyst and possibly the most significant change, directly connected to the effect of the pandemic.

Eighty-six percent of those 55 years of age or older say they are driving less. Eighty-two percent of those in Canadian households making more than $100,000 per year are driving less, as well.

EIghty-four percent of respondents from Alberta said they were driving less.

CBB research shows fewer total kilometers driven by Canadians because of the pandemic has had an impact on the auto industry, said David Robins, principal automotive analyst and head of Canadian vehicle valuations at Canadian Black Book.

“The resultant differences in automotive buying and shopping trends and attitudes over the past 12 months are considerable, which perhaps goes without saying,” Robins said. “However, they are very interesting to note and may help some industry people think differently about 2021 and beyond.”

People who are spending less time driving because they are working from home or learning remotely have decreased their driving by nearly 50% on average, compared to before the pandemic. According to the research, 48% are working from home more often. Seventy-four percent of those driving less often agree (20% strongly/54% somewhat) they will not need to replace their vehicle as quickly, because they are driving it less or shorter distances than usual.

Forty-four percent of respondents were likely to purchase a new vehicle in the next two years. That is a notable drop from 2020, when 52% suggested a vehicle purchase over the next two years.

“Over the last three or four years of this survey, the trend was that roughly 50% of Canadians, on average, intended to buy new vehicles within two years,” Robins said.

“The drop to 44% is well over the margin of error for this study and is a significant shift in intention to buy attitudes across Canada,” he adds.

Twenty percent of those surveyed have had to put off, delay or postpone their purchase as a result of the pandemic or recession. Eighty-eight percent of those who have delayed their decision to buy expect to postpone their purchase by a minimum of six months. Nineteen percent plan to delay their purchase by two years or more.

No rush to buy EVs, either

Intent to buy alternative energy vehicles in the near term has also decreased. Thirty percent of respondents say they would likely buy a battery-electric vehicle or a plug-in hybrid electric vehicle in the next five years.

That number is down significantly from last year, when 37% expressed intent to buy an EV. Quebec and Ontario residents are most likely to buy EVs in that time-frame, while the Prairie Provinces are less likely.

Those who are strongly considering purchasing a new vehicle in the next two years are also the most likely to say that in the next five years, they are going to be in the market for a BEV or PHEV.

People age 18 to 34 are most likely to buy EVs. Men are far more likely to consider an EV than females, and university graduates show strong interest in EVs.

Public transit, ridesharing sentiment unclear

Although use of ridesharing services instead of owning a vehicle remains popular, shifts in the market before and during the pandemic means near-term growth remains unclear. Eight percent of Canadians rely on ride sharing services instead of owning a vehicle, compared to 11% of respondents last year.

Seventeen percent rely on transit instead of owning a vehicle. Those aged 18 to 34 are most likely to use transit as their primary means of getting where they need to go.

Other insights

— Fifteen percent have bought a car to avoid the use of public transit or ride-sharing service or are considering it.

— When it comes to buying their next vehicle, 75% say that the current economic situation has no impact on whether they are more likely to buy new or used. Those who do feel an impact from the economic climate are more likely to say they would possibly buy a used vehicle rather than a new one.

— Twenty-six percent of Canadians agree that the pandemic has made them more willing to shop for and purchase a vehicle completely online. Seventy-four percent disagree, preferring to see in-person what they’re buying.