Rate of decline in Canadian wholesale market slows to crawl

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The decline of Canadian wholesale used-vehicle values has slowed to a crawl.

Canadian Black Book’s weekly Market Insights report for the week ending Jan. 25 showed the overall market down just 0.10%, following the previous week’s 0.17% decrease.

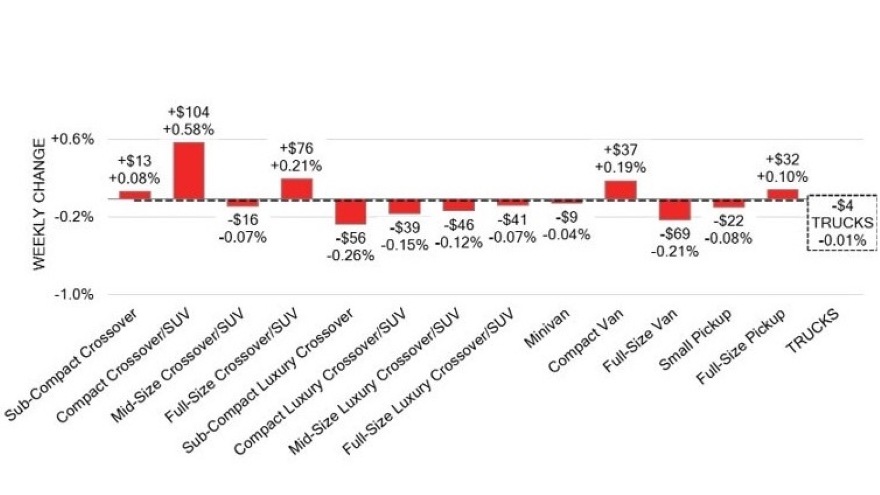

Truck/SUV values nearly broke even for the week, finishing down a mere 0.01%, with five of the 13 truck/SUV segments posting gains. At the top of that list were compact crossover/SUVs, which gained $104 (0.58%), Full-size crossover/SUVs (0.21%, $76), compact vans (0.19%, $37), full-size pickups (0.10%, $32) and sub-compact crossovers (0.08%, $13) were also on the plus side.

No truck/SUV segment lost more than the 0.26% of sub-compact luxury crossovers or the $69 dropped by full-size vans.

No car segments gained value, but the losses were mostly minimal as cars overall were down 0.19%. Six of the nine segments dropped less than 0.25%, and four of them: midsize cars (0.08%, $14), near-luxury cars (0.08%, $20), sporty cars (0.10%, $26) and premium sporty cars (0.10%, $80) declined by 0.10% or less.

The largest fall came from prestige luxury cars at $223 (0.38%), the only segment to lose more than $80.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average auction conversion rate rose to 49.2%, ranging from 19% to 74.6% averaging at 49.2%. CBB analysts said the rate of increase in supply entering the wholesale market has slowed, with upstream channels continuing to gain early access.

Like wholesale prices, retail prices also fell during the week, with the 14-day moving average retail listing price down $450 to $34,500.

CBB cited a report from TD Economics that explored the potential repercussions of U.S. President Trump’s proposed 25% tariff on vehicle imports. The study said Canada exports roughly 1.5 million vehicles to the U.S. per year, and for the U.S. to replace that capacity — around 10% — six new production facilities would need to be built. It also noted many of the best-selling models in the U.S., including the Toyota RAV4, Honda CR-V and Chrysler Pacifica, are massively supported by production plants in Canada.

CBB analysts characterized the U.S. wholesale market as “stable,” with depreciation slowing to 0.37%, aligning with pre-pandemic trends. After an inventory increase in early January, the impact of the anticipated low used supply for this year began to appear in a decline in total available inventory at auctions.