Rise in CBB index hints at tariff-driven ‘instability’ ahead for wholesale market

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There could be trouble brewing in the Canadian wholesale used-vehicle market.

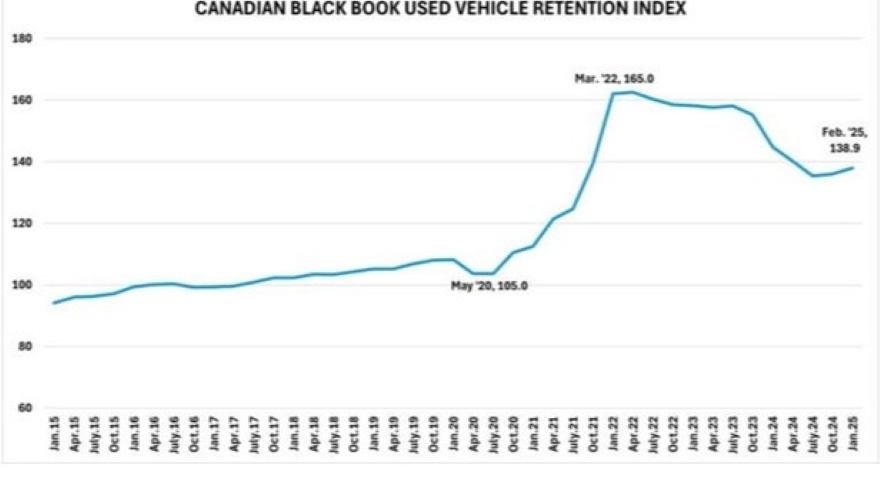

Canadian Black Book’s Used Vehicle Retention Index rose 0.9 points to 138.9 in February. It wasn’t the eye-opening 2.3-point jump of the previous month, and was still down 3.3% year-over-year, but CBB senior manager and head of Canadian vehicle valuations David Robins said it’s part of an upward trend that will continue to be fueled by the U.S. government’s 25% tariff on Canadian imports and Canada’s reprisal.

“Wholesale vehicles values in Canada are under upward price pressure in February with volumes decreasing and demand staying strong,” Robins said. “As U.S. tariffs have been implemented on March 4 and a Canadian retaliatory response is being phased in over the following 21 days, we expect increased instability while markets adjust to these major changes.”

President Trump’s announcement Wednesday of a one-month tariff exemption for autos complicates that assessment as the market reacts to the new circumstances. Trump’s “reciprocal tariffs” are scheduled to take effect April 2.

Until January’s sudden rise, the CBB index had been steady through the second half of 2024, gaining or losing less than 0.6 points during any month in that period. Prior to that, the index spent 27 months dropping as the market corrected from a COVID-induced peak of 165 in March 2022.

The index is calculated using CBB’s published wholesale average value on 2-6-year-old used vehicles as a percentage of original typically equipped MSRP and weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The full index can be downloaded here.

Big week for auction sales

CBB’s weekly Market Insights report said the biggest change in the wholesale landscape for the week ending March 1 showed up in the auctions, where sale rates rose to an average of 54.3%, up five percentage points from the previous week, with a range from 52.6% to 76.1%.

Overall values fell 0.19% for the week, slightly less than week before, with three segments gaining — compact vans (up 0.02%, $3), full-size pickups (0.29%, $96) and sub-compact cars (0.25%. $29) — gaining and sporty cars breaking even.

On the downside, six segments lost more than $100 in value, topped by full-size crossover/SUVs ($402, 0.66%) and prestige luxury cars ($272, 0.46%).

Used retail prices held steady week over week, with the 14-day moving average listing price remaining at $34,000.

CBB analysts noted a record 18.9% market share for zero-emission vehicles in the fourth quarter of 2024 as consumers raced to buy in front of the pending end of ZEV decrease/end of various rebate programs from federal and provincial governments, leading to a record 15.4% share for the year. Both of those numbers were up 40% year-over-year.

Not surprisingly, ZEV market share fell in January to 13.3%, which was still a 2.9% increase from January 2024.

The U.S. market was a mirror of the previous week with values down 0.19% overall, cars down 0.25% and trucks dropping 0.16%. Analysts said early indications of rising prices in select segments could be the harbinger of a spring market, as the overall decline remained less severe than the typical seasonal declines.