Small decline in Canadian used-car wholesale market as tariffs take effect

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The U.S.’s long-awaited — and feared — 25% auto tariff is in effect, and at least for the moment, its effect on Canada’s used-car wholesale market has yet to be seen.

A week after posting its first increase in three years, was down again for the week ending April 8. But, again, just barely.

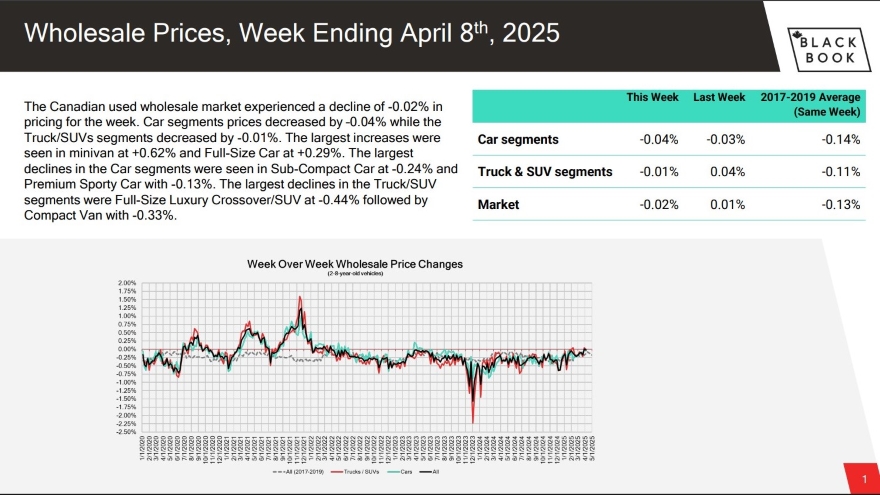

Wholesale values were down a mere 0.02% for week, according to Canadian Black Book’s weekly Market Insights report, a week after a 0.01% gain broke a downward trend that began in April of 2022.

Ten of the 22 vehicle segments showed gains, but only one — minivans ($141, 0.62%) — was up more than $100.

Full-size pickups (0.26%, $87) and compact crossover/SUVs (0/22%, $57) were the next biggest gainers among truck/SUV segments, which overall were down 0.01%. Full-size cars (0.29%, $56), compact cars (0.22%, $30) and sporty cars (0.12%, $30) had the largest increases among cars, which dropped 0.04% overall.

On the down side, full-size luxury crossover/SUVs ($265, 0.44%), full-size crossover/SUVs ($116, 0.32%) and premium sporty cars ($102, 0.13%) showed the largest decreases.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auction sale rates declined to an average of 45.5%, with a range from 15.3% to 67.6%.

While the wholesale market looked much the same for now, there was a marked difference in the retail market, with prices taking a turn upward. CBB reported the 14-day moving average rose to $35,500, up $750 from the previous week.

With the threat of tariffs looming in March, CBB noted auto sales boomed to 185,000 units for the month, up 11.4% year-over-year, citing data from Desrosiers Automotive Consultants.

In the U.S., the wholesale market was very active, with auction sales intensifying during the week. Several lanes reported 100% conversion rates late in the week, and prices climbed 0.25%, driven by competitive bidding.