Used-car supply down, but ‘factory’ poised to fill the gap, CBB report finds

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Used-car supply is trending downward — but reinforcements are on the way.

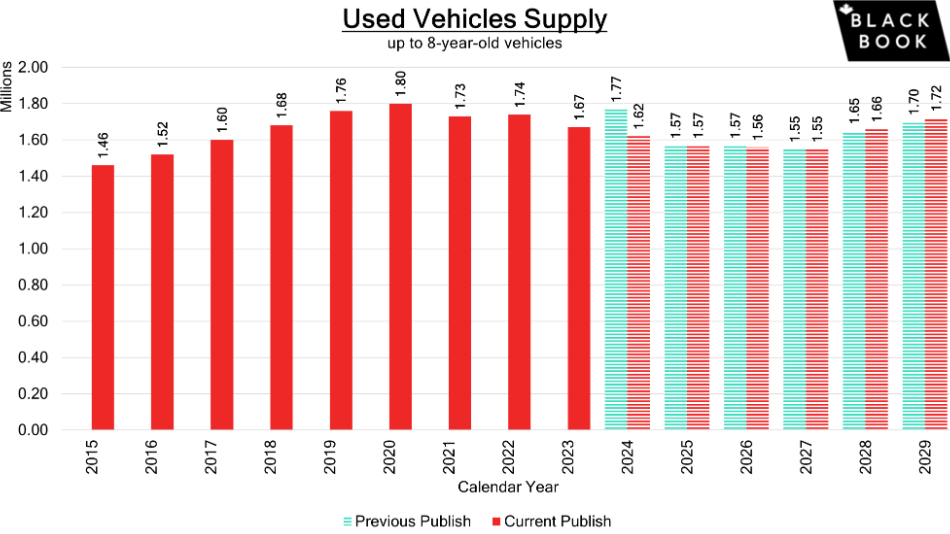

In its March Residual Value Newsletter, Canadian Black Book provided data and projections showing the supply of used vehicles dwindling over the past three years — and expected to fall even more through 2027.

The report showed used-car inventory for 2024 at 1.62 million units, far below the peak of 1.8 million in 2020 and down from the 1.67 million of 2023. By 2027, it’s projected to plummet to 1.55 million, an extended hangover from the depressed new-car market of the COVID pandemic.

The good news is found in the new-car sales numbers — otherwise known as the “used-car factory.”

The report showed new-vehicle sales up to 1.8 million units in 2024, up from 1.7 million the previous year and 1.5 million in 2022, which bodes well for used-car inventory down the road.

And even more encouraging, CBB projects new-car sales to rise to pre-COVID levels beginning this year, with 1.9 million units forecast for 2025 and ’26, followed by 2.0 million the next two years.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CBB’s data showed wholesale prices heading downward as the market continues to correct, with the monthly changes so far in 2025 looking very similar to those of 2012-2019.

And with prices continuing to fall back toward pre-pandemic norms, so is value retention. CBB found the average retention for four-year-old vehicles has dropped from a high of 72% of MSRP in 2022 to 64% this year, with greater decreases on the horizon. The projection drops to 62% next year, then to 54% in 2027 and ’28, and finally to 52% in 2029 — just above the 51% recorded in 2019.

The Residual Value Newsletter can be downloaded here.

Canadian wholesale values continue slow fall

Canada’s slow, steady decline in wholesale used-vehicle values continued in the week ending March 15, with the market declining 0.10% overall, according to Canadian Black Book’s weekly Market Insights report.

Five vehicle segments gained value for the week, one short of the most for a week this year. Four of them — full-size pickups (up 0.64%, $210), compact crossover/SUVs (0.44%, $80), compact luxury crossover/SUVs (0.26%, $67) and small pickups (0.12%, $33) — were in the truck/SUV category, which overall declined 0.12% for the week.

Three truck segments lost more than $100, topped by full-size vans at $301 (0.95%) and followed by full-size luxury crossover/SUVs ($144, 0.24%) and mid-size luxury crossover/SUVs ($121, 0.33%).

Car values fell just 0.09%, with premium sporty cars up 0.05% ($38) and no segments losing as much as $100 or 0.50%. Full-size cars (0.43%, $84) and mid-size cars (0.31%, $52) had the largest percentage declines.

Auction sale rates remained above 50%, averaging of 51.7% for the week, with a range from 33.3% to 69.7%. CBB analysts noted a slight increase in supply entering the wholesale market, but said upstream channels continue to gain early access, with demand strong on both sides of the border for more vehicles at auctions.

Retail used prices took a jump this week, with the 14-day moving average up $1,000 to $35,000.

CBB reported another key interest rate reduction of 25 basis points in March, dropping the rate to 2.75%. The Bank of Canada has cut the rate by a total of 225 basis points since the beginning of its easing cycle in June 2024. Analysts also noted Canada’s annual inflation rate rose to 2.6% in February, up from 1.9% the previous month and higher than market predictions of 2.2% and the Bank of Canada’s projection of 2.5%.

In the U.S., the wholesale market landed in positive territory, gaining 0.03% overall — the largest weekly increase since early April — and showing strong bidder activity at the auctions nationwide. CBB analysts said discussions about tariffs as the auto industry’s one-month reprieve nears an end, combined with the typical signs of a robust spring buying season, resulted in larger than usual increases.