12 findings from CULA’s latest Future of Auto Finance snapshot survey of credit unions

Chart courtesy of Credit Union Leasing of America (CULA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Orchestrated just before the Federal Reserve trimmed interest rates in September, Credit Union Leasing of America (CULA) released a dozen findings from its Future of Auto Finance – the Next Six Months snapshot survey of credit union professionals.

Not knowing at the time policymakers would roll out a cut of 50 basis points, credit unions told CULA that they are generally optimistic about the auto finance landscape through the end of 2024. But CULA found that most executives surveyed do not expect improvements in the liquidity and delinquency crises, or significant impact from lowered interest rates until mid-2025.

Fulfilling credit union projections recorded in CULA’s last survey in January — when 40% of respondents said they expected to see growth in their auto finance portfolio in 2024 — the new survey showed 42% of credit union respondents reported year-over-year origination volume increases.

CULA found that 50% of those credit unions reported volume growth of more than 6%, and 21% experienced growth of 11% or more.

CULA explained that arrived as a result of positive impacts from this year’s slight decline in vehicle prices, interest rates and inflation.

Of the 58% with no positive impact, CULA found that 21% reported origination volumes have been flat, while 79% have experienced declines.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Overall, CULA said the majority of credit unions are looking to mid-2025, and beyond, for significant improvements in the auto finance market.

For example, the survey showed nearly 60% don’t expect to see the auto finance delinquency rate stabilize until 2025. While 34% said they already see signs that the liquidity crisis is abating, the majority (more than 60%) see it lasting well into the next year and beyond.

Likewise, CULA indicated the majority don’t anticipate changes in interest rates significant enough to impact their business until 2025.

“The overall sentiment of credit unions today is one of cautious optimism, with the vast majority expecting no declines in their auto finance portfolios across the next six months, and nearly half expecting further growth, a slight uptick from our January 2024 survey,” CULA president Ken Sopp said.

“That being said, continued uncertainties around the current auto finance market, as well as the presidential election, are pushing credit unions’ projections for improvements in liquidity and delinquency well into 2025,” Sopp continued.

Sopp noted that 69% of those surveyed agreed that most consumers are waiting until after the election to make big ticket purchases, such as a vehicle.

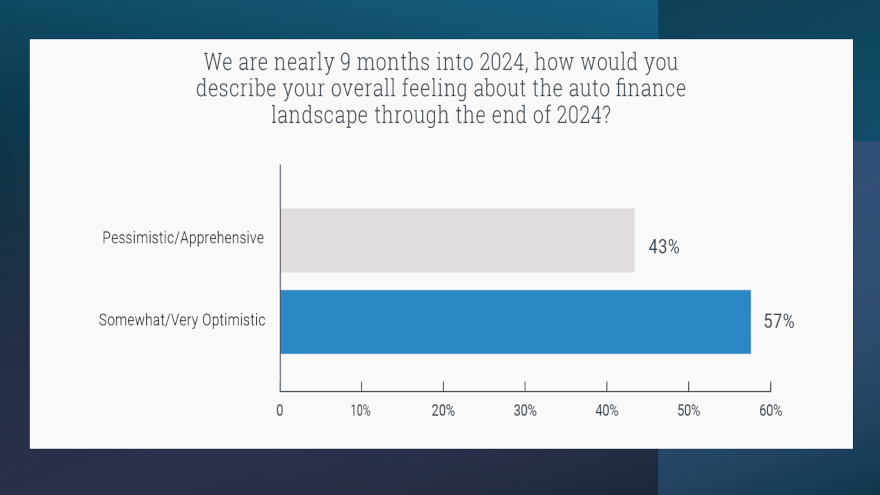

And, while the survey confirmed that 57% of respondents are feeling optimistic about the auto finance landscape through the end of 2024, 43% are apprehensive or pessimistic.

Rising delinquencies, continuing inflation, high interest rates, and financial uncertainty are contributing to their apprehension or pessimism, with delinquencies and overall financial uncertainty the biggest factors, according to CULA.

Vehicle leasing continues to be a strong auto finance option for credit unions, with 76% of survey participants saying that consumers are as likely to consider leasing today as they were when vehicle prices were higher because of leasing’s flexibility and affordability compared to long term installment contracts.

Interestingly, as electric vehicle sales reach record heights (albeit with a slower growth rate), CULA said credit unions expect that leasing will continue to increase as a percent of total EV purchases.

In fact, EV leasing tripled year-over-year to a 35.2% share of all EV purchases in Q1 2024, according to CULA tracking.

“The continued popularity of vehicle leasing with credit unions, even as vehicle prices soften, was a striking finding of the survey, although it makes perfect sense given the significant increase in car buyers opting for leasing in 2024,” CULA vice president of business development Mark Chandler said in the news release.

CULA conducted the snapshot survey online from Aug. 28 through Sept. 18 among more than 120 credit union professionals. Here again are the major findings:

—57% are optimistic about the auto finance landscape through the end of 2024.

—42% report that their auto finance portfolios are seeing a positive impact in originations from the slight YoY decline in vehicle prices, interest rates and inflation.

—50% of those seeing a positive impact say loan volumes grew up to 5% year-over-year, 29% say origination volumes grew 6-10%, 17% say volumes grew 11-35%, and 4% say volumes grew more than 36%.

—21% of those not seeing a positive impact say origination volume has been flat, with 79% saying origination volumes have decreased.

—87% say their auto finance portfolio will grow (45%) or remain flat (42%) in the next six months compared to the previous six months.

—59% expect the auto delinquency rate to begin to stabilize in 2025 (28% first half, 31% second half).

—28% don’t expect the auto delinquency rate to begin to stabilize until 2026.

—34% say they are already seeing signs of the liquidity crisis abating.

—57% say the liquidity crisis will last from six months to two years.

—76% say consumers are as likely to consider leasing as they were when prices were higher because consumers are still very price conscious and even in the best of times, vehicle leasing offers flexibility and affordability compared to long term installment contract.

—60% think vehicle leasing as a percent of total EV purchases will continue to grow.

—69% believe consumers are waiting to make big ticket purchases, such as vehicles, until after the presidential election.