6 features of RiskGauge Desktop from S&P Global Market Intelligence

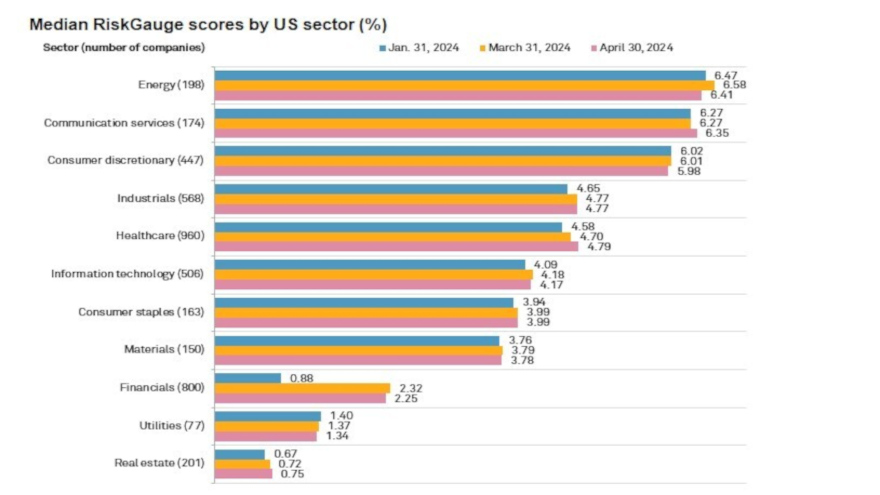

RiskGauge Desktop from S&P Global Market Intelligence can generate charts like this one. Image courtesy of the company.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

S&P Global Market Intelligence rolled out its newest tool to gauge risk.

On Monday, the provider of information services and solutions to global markets announced the launch of RiskGauge Desktop, a scalable solution designed to streamline the credit risk assessment workflows of corporations of all scopes and sizes.

The company said RiskGauge Desktop combines credit expertise, S&P Capital IQ’s data assets, analytics and an intuitive user workflow to provide credit professionals with a clear, tailored view of their credit risk exposures.

Key features of RiskGauge Desktop include:

—Proprietary scoring methodology combining market, financial and business risk inputs to offer a more accurate read on entity and portfolio risks.

—An innovative model combining financial, business and market risk for millions of companies with the option of macroeconomic scenario, qualitative adjustment and loss given default overlays, to provide a more comprehensive view of risk.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—At-a-glance view of critical entity and portfolio risk, enabling quicker action through early warning signals.

—Ability to view customer trends and stratify risk by country, industry and risk scores and analysis across key segments and peer groups, allowing for the identification of potential risk hot spots.

—RiskGauge reports for more than 50 million companies with detailed historical performance and key developments.

—Access to S&P Capital IQ extensive data assets, including financial statements for over 12 million public and private companies, news, key developments, ownership and transactions data.

“Bringing our vast credit data, advanced analytics and real-time portfolio surveillance into a single desktop application optimizes complex credit risk management for any organization,” said Whit McGraw, head of credit and risk solutions at S&P Global Market Intelligence.

“RiskGauge Desktop provides data-based insights that help credit leaders mitigate risk, identify new opportunities and enhance their overall credit risk management capabilities. Our goal was to build a product that forms the backbone for sustainable growth for organizations of all sizes and levels of sophistication, especially important in today’s dynamic market environment,” McGraw continued in a news release.

For more information about RiskGauge Desktop, go to this website.