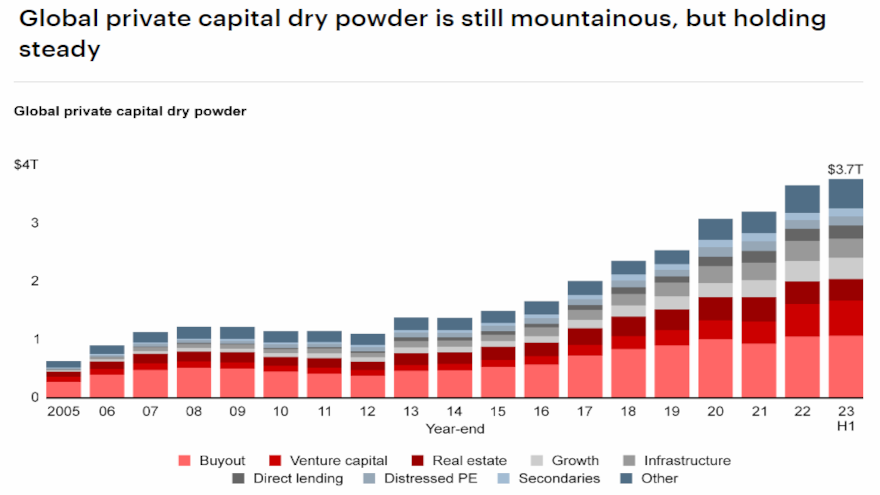

Bain examines potential investment implications of record $3.7T in ‘dry powder’

Chart courtesy of Bain & Co.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The investment world could generate quite an explosion with the amount of “dry powder” that’s available, according to Bain & Co.

On Monday, the firm released its Private Equity Midyear Report 2023. Bain said that after four quarters of relative inactivity, investors have ample incentive to get moving.

With the clock ticking on a record $3.7 trillion in dry powder and buyout funds sitting on $2.8 trillion of unexited assets, Bain indicated limited partners (LPs) are feeling a “liquidity crunch.”

Bain highlighted a recent survey revealed that most LPs are more inclined to choose liquidity today rather than hold out for incremental gains. Experts explained this finding suggests that the industry’s primary focus in the months ahead will be restarting the capital flywheel by increasing distributions to LPs — whether through exits, general partner (GP)-led secondaries, recaps, or other liquidity solutions.

“Sitting around because the market is down has never been a particularly effective strategy in private equity,” said Hugh MacArthur, chairman of the global private equity practice at Bain & Co.

“Past cycles have shown that for dealmaking to rebound and continue, buyers and sellers need a reasonably stable economic environment — not necessarily an attractive one. And while investors need confidence in the five-year outlook for an industry and a company, a clearer picture is finally emerging. The global private equity market is hopefully stabilizing,” MacArthur continued in a news release announcing the report’s availability online.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Bain’s study shows that concerns about “too much dry powder” appear unwarranted, as the volume is holding steady at $3.7 trillion across all private asset class strategies, with about 75% of that defined as “fresh,” meaning less than three years into the investment period.

While there are challenges to getting deals done, particularly large deals, Bain said private credit is stepping in as commercial bank lending becomes tighter.

Bain also mentioned buyout funds alone are sitting on a record $2.8 trillion in unexited assets — over four times the level held during the global financial crisis.

While investments were down, experts noticed exits fell more sharply during the first half of the year, with 2023 annualized global buyout-backed exits on pace to drop by 54% versus 2022, and exit count is tracking toward a 30% decline.

For cash-strapped LPs, Bain pointed out that distributed to paid-in capital (DPI) is becoming new the internal rate of return (IRR).

“The macro environment has shifted in the past 12 months, largely altering the assumptions behind many portfolio company deal theses,” said Brenda Rainey, executive vice president of Bain’s private equity practice.

“The decision to sell or hold an asset could come down to a pair of questions: Do you believe that exit conditions will be meaningfully different over the next several months? And does generating the return you were counting on require a value creation plan reset to account for all that’s changed on the macro front? Smart dealmakers won’t be betting on a wait and see approach, rather they know now is the time to make a move,” Rainey went on to say.

Bain’s midyear report explores how the first six months of 2023 played out in further detail on other fronts, including:

Investments

Buyout funds generated globally hit $202 billion in deal value during the first half of 2023, a 58% decline from the first half of 2022, according to Bain. Annualized, it netted out to be a 41% drop from 2022’s total.

Bain noted the 863 deals closed over the first half signal a 29% full-year decline from the pace in 2022, with add-ons continuing to represent a significant share of the global buyout market, accounting for 9% of total deal value in the first half of the year and 56% of deal count.

Exits

Bain acknowledged GPs are feeling significantly more pressure on the sell side. Experts said buyout managers have a backlog of unrealized assets that has slowed distributions to investors.

Over the year’s first half, Bain reported buyout-backed exits fell to $131 billion, a 65% decline from the same period a year ago. On an annualized basis, exit value is tracking down 54%, and exit count is off 30% compared to 2022.

With about 26,000 portfolio companies sitting in buyout funds for almost six years, Bain explained GPs need a schedule and a strategy to unlock the $2.8 trillion in unrealized value those companies represent.

“Most of those assets are coming up against, or have passed, the typical five-year timeframe for a private equity exit. Nearly one quarter have been held for longer than six years, and more than half have been held for more than four years,” experts said.

Fundraising

After a decade of growth in private capital fundraising, with nearly $12 trillion raised since 2012, Bain determined 2023 fundraising has been “unsurprisingly challenging.”

Experts added that LPs remain in a “cyclical squeeze,” with a large amount of existing unfunded commitments, cash flow in negative territory due to the sharp decline in exits, and a notable supply/demand imbalance as nearly 14,000 private capital funds compete for an aggregate $3.3 trillion in capital.

Bain calculated the value of global private capital raised in the first six months fell to $517 billion, a 35% decline from the same period a year ago. On an annualized basis, experts added global private capital fund-raising is on trend to drop 28% in terms of value and 43% in terms of funds closed compared to full-year 2022.

“Fund-raising data can be a lagging indicator that might make the current environment seem better than what GPs are experiencing,” Bain said in the news release. “This can be because some funds closing today were launched or committed to under better circumstances in 2021 or 2022.

“An even more forward-looking indicator is the current level of supply and demand. This current slowdown in available capital has come as a shock and increased competition is pressing funds to professionalize their capital-raising capabilities,” experts went on to say.