BlackSwan Cyber offering free analysis during M&A Cybersecurity Awareness Month

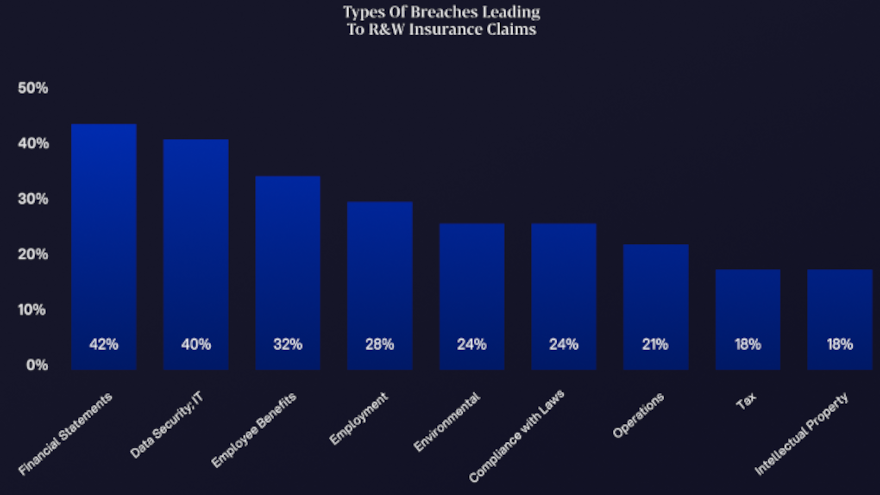

Chart courtesy of BlackSwan Cyber.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

To support M&A Cybersecurity Awareness Month, BlackSwan Cyber is offering complimentary cyber screening throughout March, providing lower middle-market deal teams with a fast and efficient way to assess cyber risks before closing.

The boutique M&A advisor, exclusively focused on helping private equity firms, M&A advisors, and deal teams assess cyber risk in transactions, said cyber risk has become a material concern in M&A, with 40% of representation and warranty claims now tied to cybersecurity issues — just behind financial misstatements.

Despite this situation, BlackSwan Cyber pointed out many deals move forward without evaluating cyber risk, potentially leaving buyers exposed to hidden financial and legal liabilities.

“Investors don’t skip cyber due diligence because they’re unaware of the risk. They skip traditional cyber due diligence because it was never designed for middle market deals — it’s slow, invasive, and priced for billion-dollar transactions. M&A moves fast and most deal teams don’t have time for security audits that add friction,” said Paul Theobald, partner at BlackSwan Cyber.

“We built our cyber screening process from the ground up to be fast, practical, and aligned with how M&A actually works. Buyers shouldn’t have to close a deal blind to cyber risks, so we’re making cyber screening accessible to the lower middle-market,” Theobald continued in a news release.

BlackSwan Cyber’s complimentary cyber screening for deals under $100 million can give M&A professionals a practical way to evaluate cyber risk before closing — without delays, extra costs, or seller friction.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The potential benefits include:

—Spot red flags early: Avoid costly post-close surprises by identifying critical cyber risks before they impact the deal.

—Quantify cyber exposures: Assess the financial impact of cyber risks on deal value and remediation costs.

—Benchmark against market standards: Strengthen negotiations by comparing the target’s cybersecurity posture to similar transactions.

—Frictionless assessments: Keep deals moving with minimal seller cooperation, no complex audits, and no disruption to diligence timelines.

To maximize the impact of M&A Cybersecurity Awareness Month, BlackSwan Cyber is partnering with M&A advisors, law firms, and insurers to raise awareness about cyber risk’s financial impact on deals.

Through co-branded thought leadership, joint educational initiatives, and industry discussions, we are working with key industry stakeholders to help teams better assess and manage cyber risk in transactions.

Organizations interested in collaborating on deals, insights, events, or industry initiatives are encouraged to contact [email protected].