BNY survey highlights community banks & digital transformations

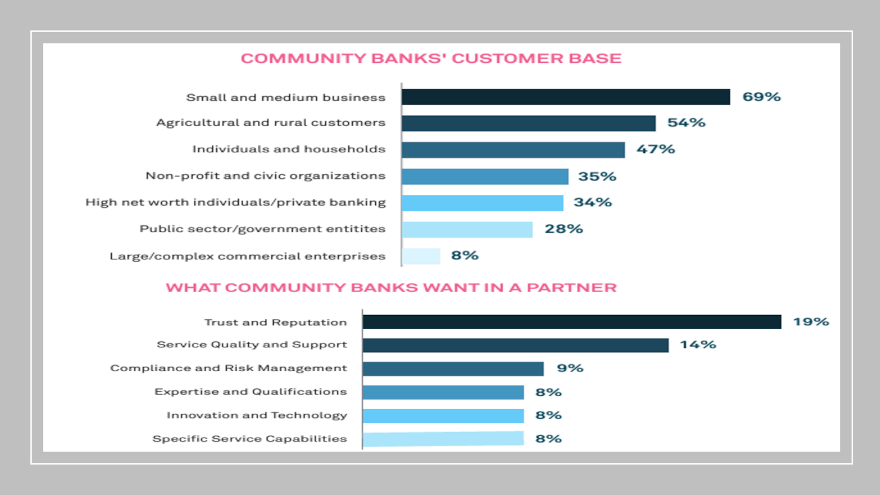

Charts courtesy of the Bank of New York Mellon Corp. (BNY).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

This week, the Bank of New York Mellon Corp. (BNY) released results of a survey of community banks that it conducted with the Harris Poll, a global market research firm.

The global financial services company found that more than 90% of community banks surveyed said they are looking to initiate digital transformations. However, less than 20% see themselves as experts in data analytics — underscoring a challenge they face in launching a digital transformation program successfully.

BNY also said that nearly 30% of those polled indicated that launching new technology services focused on efficiency and security, such as instant payments, are critical to maintaining a competitive edge. To be able to deliver these services effectively, 20% of banks surveyed are looking to collaborate with other companies over the next five years.

The firm said this survey showed community banks are eager to collaborate with large institutions and fintechs on solutions for both enhancing customer satisfaction and managing their operations. This includes such tech-forward solutions as automated loan services, e-signature technologies, and mobile wallets and payment apps.

The BNY Voice of Community Banks Survey polled key community bank decision makers, from CEOs and CFOs to executives responsible for adopting and implementing new technologies, across the United States on topics including digital banking solutions they want to offer to customers and fintech collaborations they’re pursuing that would help grow their businesses.

“The goal of this survey was to explore the current state of community banks in the U.S. — what they perceive as their greatest strengths, the challenges that keep them up at night, and ultimately, what solutions they are looking for to best serve their communities,” said Shofiur Razzaque, head of community banking and solutions at BNY.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The survey results reaffirm the crucial role community banks play in advancing our economy, and the important role BNY and other institutions have in helping community banks achieve their ambitions,” Razzaque continued in a news release.

BNY compiled a whitepaper about its findings, and Razzaque elaborated about the survey in an online Q&A that included his main takeaway.

“Nearly half of the respondents believe they are recognized within their communities for their innovative approaches to helping clients, but nearly a quarter believe they are also perceived as constrained,” Razzaque said.

“This reaffirms the crucial role community banks play in advancing our economy, and the important role BNY and other institutions have in helping equip them with the tools that can help them achieve their ambitions,” he went on to say.