CULA increases active dealer partners by 91% in 2024

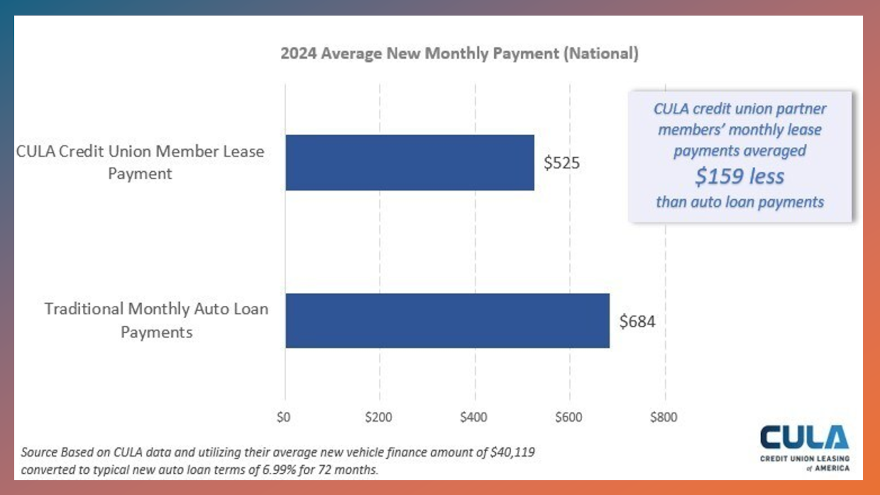

Chart courtesy of Credit Union Leasing of America (CULA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It was a good year for Credit Union Leasing of America (CULA).

The facilitator of indirect vehicle leasing for credit unions for more than 35 years highlighted its achievements reached in 2024, including the growth of its footprint to 27 states and increasing its number of active dealer partners by 91%.

CULA now also operates in Oregon, Maine, Idaho, and Vermont and has 2,554 dealer partners signed to its program that helped credit union members save more than $63 million on lease payments in 2024. That computed to an average of $159 per month versus traditional auto loan payments.

“Partnering with CULA for our leasing services has been a major benefit for both our credit union and our members,” Dort Financial Credit Union chief loan officer Sharon Lobo said in a news release. “With this partnership, we have diversified our portfolio and increased yields while providing our members with flexible and affordable auto finance options. CULA helps us to provide an even greater value to our members.”

In addition to enabling savings for its partner credit unions’ members, CULA data revealed that those credit unions using its program in 2024, compared to credit unions not partnered with CULA, realized higher loan yield (25 basis points higher), greater auto loan growth (2.21% versus a drop of 3.62%) and higher member growth (3.96% versus 3.36%).

“With financial pressures and inflation concerns continuing to impact auto shoppers, CULA’s credit union partners have been able to save their members significant amounts on transactions in 2024, compared to traditional auto loans; they do this by offering competitive rates through our leasing solution,” CULA president Ken Sopp said in the news release

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“It is also gratifying to see that loan yield, member growth and auto loan growth is higher for our partner credit unions than for those who are not offering our leasing program,” Sopp continued.

“Member savings, vehicle leasing’s continued growth, and positive impacts on our partner credit union’s businesses affirm that CULA’s data-driven and innovative program is well-positioned to continue driving credit union adoption and to deliver another strong year in 2025,” Sopp went on to say.

Sopp also said CULA is well-positioned to continue driving credit union adoption and to deliver another strong year in 2025, especially with affordability and other factors impacting consumer behavior.

“The recently announced tariffs will likely drive auto prices even higher, outpacing inflation and putting even more pressure on American consumers’ budgets,” Sopp said. “Even before these tariffs, our partners have observed the average auto transaction price climb from $36,755 in 2022 to $40,912 in 2024, reflecting the broader rise in vehicle costs.

“With this backdrop, credit unions have a clear opportunity to provide even more cost-effective solutions for their members through CULA,” he added.