CULA survey highlights credit unions’ concerns about terms & LTVs

Chart courtesy of Credit Union Leasing of America (CULA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Stretching terms concern credit unions when building their used-vehicle portfolios, but those auto finance providers don’t appear to be eliminating that practice any time soon.

Over-extension on used-vehicle installment contracts is the No. 1 concern for credit unions in the 2023, according to Credit Union Leasing of America’s (CULA) Q2 2023 Credit Union Used Vehicle Loan Snapshot.

But survey results showed credit unions continue to offer vehicle buyers a significant percentage of longer-term financing with low down payments on high mileage, older vehicles.

And the majority of credit unions are booking paper with LTVs above 125%, which might have alarmed CULA vice president of business development Mark Chandler most.

“It was no surprise to us that over-extension on used vehicle loans is generating significant worry for credit unions, as is overall used vehicle affordability, but the results also uncovered a troubling disconnect: credit unions continue to offer car buyers a significant percentage of longer-term loans, with low down payments, on high mileage older vehicles and increased LTV,” Chandler said in a news release about the results based on an online survey of 415 credit union professionals conducted on April 4 through May 5.

CULA found that 70% of credit union respondents said their longest-term contracts are 72 months or more, and the majority will book a contract for $75,000 or more on a used vehicle, with nearly one-third saying they would lend $100,000 or more.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, 76% of survey participants reported a mileage limit on their used-vehicle contracts of 75,000 miles or more, with 30% extending that limit to 100,000 miles or more.

The majority said they require a 10% or less down payment on used vehicle financing. Only 14% ask for more than 20%.

“As these survey results make clear, credit unions will continue to incur unnecessary risk if they don’t find an alternative to the long-term used auto loan, which they are continuing to offer in significant numbers — and on vehicles that present potential risk,” Chandler said.

The results also confirmed that the majority (52%) of credit unions’ used-vehicle auto finance customers are most interested in long term contracts of seven years or more.

But nearly half (48%) are most interested in short term loans — the usage of a newer vehicle for a low payment.

CULA explained this trend almost even split is probably due to high used vehicle prices: consumers are either looking for the lower payments of a long-term contract or the lower commitment of a short-term deal.

“The vast majority of credit unions in this survey agree that they would like a better alternative, such as short-term financing with affordable payments and higher yield. Vehicle leasing, which checks all of these boxes, might just be the answer credit unions are seeking,” Chandler said.

Other key survey takeaways included:

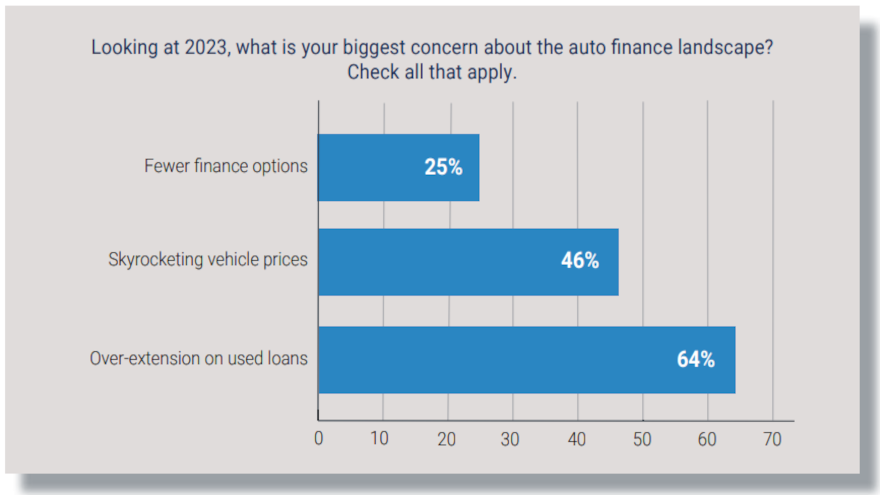

—64% of credit union respondents cited over-extension on used loans as their biggest concern about the 2023 auto finance landscape, followed by skyrocketing vehicle prices.

—Auto finance customers today, say respondents, are almost evenly split in interest between long-term (52%) and short term (48%) contracts.

—At least one-in-four used vehicle installment contracts are 72 to 84 months for the vast majority (78%) of credit union respondents.

—72% of credit union respondents say their longest-term loans are 72 months or more, with 28% saying that 84-month loans are their longest term.

—Of those credit unions reporting that 84 months are their longest-term contracts, 55% say those make up one in five or more of their deals, with nearly a third saying that they make up over 40% of originations.

—58% of credit union respondents require a 10% or less down payment on used-vehicle loans.

—55% of credit union respondents say they will extend LTV on used-vehicle financing by 125% or more.

—76% of credit union respondents have a mileage limit on their used vehicles of 75,000 miles or more, with 30% extending that limit to 100,000 miles or more.

—71% of credit union respondents will book a contract of $75,000 or more on a used vehicle, with nearly one-third (31%) saying they would take a deal of $100,000 or more.

To download the complete survey report, go to this website.