eLEND Solutions survey finds most dealers lack effective fraud protection

Chart courtesy of eLEND Solutions

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Most dealers who participated in a new survey from eLEND Solutions acknowledged they have a serious problem in connection with digital retailing and many do not have a proven strategy to solve it.

According to the fintech company’s new report titled, “Is Identity Fraud Jeopardizing Digital Retailing Profitability,” 60% of participating dealerships reported the loss of three or more vehicles to identity fraud during the past year.

Furthermore, the report based on a survey of more than 700 auto dealerships across the U.S. also revealed that while dealerships cite identity fraud as their top fraud challenge/concern, they almost unanimously agree that its increase is because of the increased digitization of the deal, since 67% lack adequate identity fraud protections.

“The pandemic changed a lot of things in the auto industry — and that is particularly true when it comes to fraud which, as this report underscores, is causing more and more losses for dealers — an estimated $619 million for franchise dealers alone,” eLEND Solutions CEO and founder Pete MacInnis said in a news release.

“Economic conditions and, especially, increasing digitization of the car buying process are driving more fraud but, unfortunately, this report reveals that most dealerships have not implemented ID verification technologies that can prevent it,” continued MacInnis, who is among the speakers set to appear during Used Car Week, which begins on Nov. 14 in San Diego.

According to the report, 84% of dealerships have directly experienced identity fraud at their dealership since the pandemic, with a third seeing an over 20% increase in identity fraud-related activities since the pandemic started.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And in just the past year, eLEND Solutions 79% of dealerships directly experienced an identity fraud-related vehicle loss at their store.

When asked to explain the increase in identity fraud, 95% of survey participants related it directly to the increase in the digitization of the deal and remote buying experiences, with 86% predicting that as more of the transaction moves online, identity fraud will increase and become harder to prevent.

The report also showed that losses are not limited to identity fraud, with most dealerships reporting an increase in credit application fraud in the past year.

According to the findings, 77% saw a 10-20% increase or more, with more than one-third reporting that one in every 100 applications at their dealership was fraudulent.

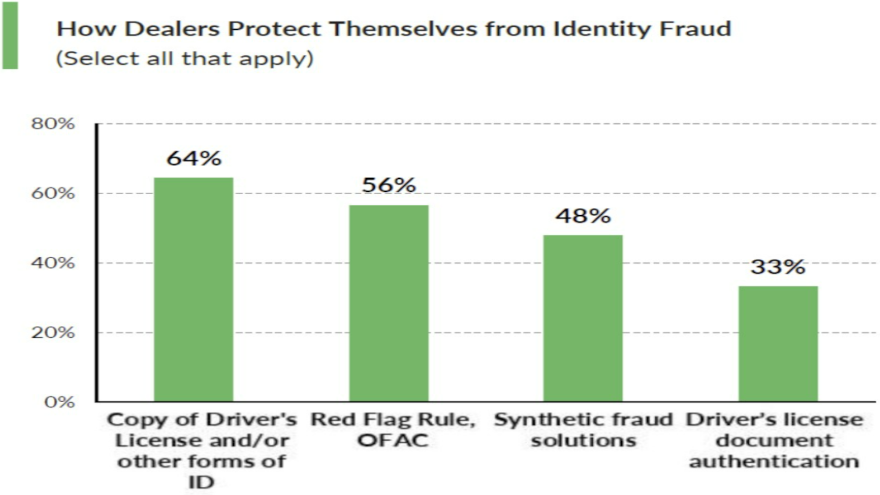

The report also investigated what dealerships have been doing to prevent fraud with photocopying the driver’s license / ID coming in No. 1 with 64% using this strategy, and the “Red Flags Rule” coming in second with 56% of stores doing this process.

Only 33% reported using critical document authentication as part of their process, a significant disconnect, according to eLEND Solutions.

“Without actually validating/authenticating ID documents and buyer identities, dealerships remain particularly vulnerable,” MacInnis said in the news release. “As more of the transaction becomes digital, embracing ID verification technologies that include forensic authentication of the driver’s license document, in conjunction with matching data extracted from the document against hundreds of databases, can easily help dealers minimize fraud risks before it becomes an expensive problem.”

Dealers were also asked about the timing of their credit pulls, a practice that rapidly evolved once the pandemic prompted more of the process to move online.

As compared to 2018, when only 8% of dealers said they pulled credit before the test drive, today 40% report doing so, with only 20% today waiting until right before the F&I handoff, versus 39% in 2018.

“This shift in credit pull timing is a dramatic and positive change in the way auto dealerships do business and, with the right technology in place, has positive implications for preventing fraud if dealerships take the opportunity to validate customer identity upfront with the simple swipe of a driver’s license — but only if document authentication is part of that process,” MacInnis said.

Other key data takeaways from the report included:

• 84%, say there has been a noticeable increase in identity fraud since the pandemic.

• 79% of dealers experienced an identity fraud-related vehicle loss at their dealership in the past year.

• 79% say that identity fraud has increased in their dealerships by over 10%, and nearly one-third say it has increased between 21% and 30%, or more.

• 60% reported a loss of three to five vehicles, or more, in the last twelve months.

• 89% of dealerships report an increase in loan application fraud in the past year.

• 34% report that one in every 100 applications at their dealership was fraudulent.

• 95% track identity fraud to the expansion of remote buying experiences and the digitization of the deal.

• 86% agree that as more of the transaction moves online, identity fraud will continue to grow and become even more challenging to prevent.

• 67% do not include driver’s license document authentication to protect themselves from identity fraud.

• 40% report pulling credit before the test drive, vs 8% in 2018.

• 93% say that if a driver’s license scan could be converted into a consumer consented pre-qualification it would be a meaningful benefit.

The complete report can be downloaded via this website.