How pandemic eroded finance company loyalty

Charts courtesy of S&P Global Mobility and TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The pandemic apparently created another health impact; this time on auto financing.

Analysis by S&P Global Mobility and TransUnion revealed loyalty to automotive finance institutions eroded significantly during the pandemic whether customers were leasing or buying vehicles.

Across new-vehicle leasing and installment contracting, researchers found more than half of all customers defected to a new finance source when returning to market, with the numbers trending steadily downward from the onset of the pandemic in early 2020 through the end of 2022.

Finance companies saw declines in return-to-market loyalty and many have yet to recover, according to S&P Global Mobility.

Experts noticed captive finance companies in particular felt the upheaval in a turbulent marketplace, as inventory shortages made loyalty to specific vehicle brands also plummet.

“Nearly two-thirds of consumers have been switching banks,” said Thomas Libby, associate director of loyalty solutions and industry analysis for S&P Global Mobility. “There’s a nomadic element to this with households moving from one bank to another. That’s less loyalty than the banks would like.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

At a macro level, S&P Global Mobility explained the microchip shortage from 2020 through 2022 tilted the supply and demand balance in the direction of sellers. Experts pointed out that Leasing took a particularly hard hit as the incentives that had driven low monthly payments largely evaporated – there was no need for distressed merchandise tactics, as dealers marked up rare sheet metal as they saw fit.

As a result, S&P Global Mobility and TransUnion found that consumer loyalties overall plummeted, as whichever dealers had inventory on site saw gains, prior brand preferences be damned. This carried over into the financing world as well.

“There was no need for any discounting,” Libby said in a news release. “The dynamics of the market completely changed.”

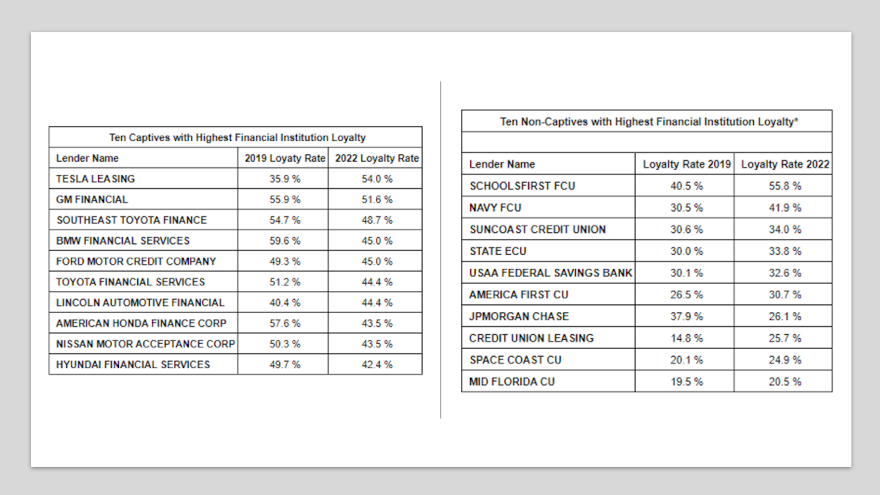

At the end of 2019, S&P Global Mobility determined four of the top 10 captives — BMW Financial Services, Mercedes-Benz Financial, GM Financial, and World Omni Financial (Southeast Toyota Distributors’ main provider) — successfully retained more than half their customers returning to market.

But three years later, those numbers had dropped dramatically, with only GM Financial managing to keep even half of its customers, according to analysis from S&P Global Mobility Auto Credit Insight and TransUnion.

Even the captive that topped the 2019 chart — BMW Financial Services — managed to retain just 45.0% of returning customers, when new-vehicle lease and installment contract numbers were combined, according to S&P Global Mobility Auto Credit Insight and TransUnion.

Following GM Financial were Southeast Toyota Finance, then BMW Financial and Ford Motor Credit.

Although Tesla Leasing had a 54% loyalty to technically lead the pack, researchers said that in 2022 its return-to-market volume vastly trailed that of more-established captives. (S&P Global Mobility’s methodology for loyalty to the financial institution measures households that returned to market and whether they returned to the same lending institution.)

Meanwhile, Mercedes-Benz Financial, which was second to BMW Financial in the 2019 loyalty scores at 57.5%, dropped out of the top 10 in 2022 at 39.4%.

When asked for an explanation for their decline, a Mercedes-Benz Financial spokesperson told S&P Global Mobility, “Leasing has decreased since the pandemic throughout the premium auto segment. Increases in lease customers’ equity in their vehicles led to a large number of lease buyouts in 2022, and increased interest rates led to a high number of cash purchases. Both factors contributed to lower lease levels than in previous years.

“On the financing side, higher interest rates have also led to increased competition from traditional lenders, in particular credit unions and regional banks,” the OEM representative added.

While all the major captives saw loyalty levels drop between calendar 2019 and 2022, S&P Global Mobility noted that some non-captives achieved gains — albeit with a far smaller return-to-market basis.

Some of the big gainers were Navy FCU and USAA Federal Savings Bank. But the largest of the Top 10 non-captive finance companies, JPMorgan Chase, saw its 2019 loyalty rate fall from 37.9% to 26.1% in 2022.

Libby mentioned the leader in loyalty, the SchoolsFirst FCU representing California teachers, is a smaller player, which could have seen its dramatic swing having little to do with macro conditions.

“Captive finance companies command the leasing market because they are able to more accurately forecast residual values,” Libby said.

Pre-pandemic, S&P Global Mobility explained captives were able to artificially inflate residuals, making leasing a more attractive option for discount-conscious consumers, particularly among luxury brands. But as inventories shrank, that advantage faded.

Indeed, the rate of leasing dropped sharply downward – from 30% penetration in 2019 to just 18% in 2022, as more customers resorted to borrowing or paying cash for new vehicles, according to S&P Global Mobility Auto Credit Insight data with TransUnion.

“The whole leasing business cratered because there were no longer any incentives,” Libby said. “Basically, the dealers have had a huge amount of leverage because of the imbalance between supply and demand. That affected the lease-loans ratio to a huge extent.”

While leasing penetration skidded, loyalty to finance institutions on the leasing side declined from 56.9% in 2019 to 52.6% in 2022, according to S&P Global Mobility AutoCreditInsight data.

Loyalty on the retail financing side dropped from 22.9% to 21.9%.

One caveat, Libby noted: “When a lease customer switches to a loan, that decreases loyalty since lessees in general are more loyal than owners.”

S&P Global Mobility went on to note there were bright spots on the lease loyalty side in 2022. Both GM Financial and Ford Motor Credit stood out, retaining 69.5% and 67.8% of returning lease customers, respectively.

But as leasing slipped, S&P Global Mobility acknowledged the market for retail installment contracts grew hypercompetitive.

Libby said, “Only one out of every five customers who return with a loan will go back to the same financial institution. That points out how incredibly competitive the loan market is. The independent banks are doing whatever it takes to get the business.”

The research showed World Omni Financial Corp. was best at retaining its retail installment customers with 44.0% loyalty in 2022, while the Navy FCU and Toyota Financial Services were the only other two institutions that kept better than one-in-three customers loyal.

S&P Global Mobility insisted that finance institutions are fully aware of the comparative lack of loyalty on the installment contract side with Libby saying, “It’s a self-fulfilling prophecy. Because they realize the customer is so likely to switch, they’ll be exceptionally aggressive to get the business.”

As pandemic disruptions have diminished, S&P Global Mobility said there are signs the market is shifting back toward some semblance of balance.

Experts said leasing penetration has crept back up to 20% for the first four months of 2023, “but it’s still a far cry from where it was before the bottom dropped out of the market.”