Informed.IQ unveils new digital tool to verify info for underwriting

Image courtesy of Informed.IQ.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

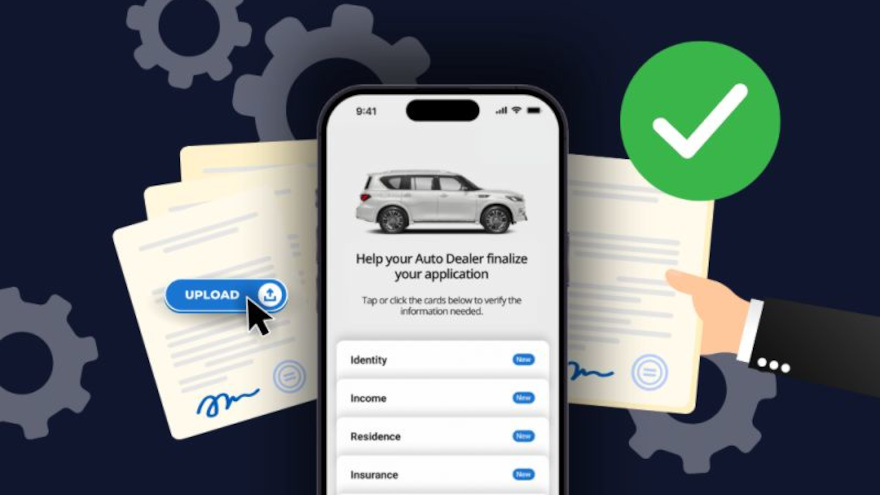

Informed.IQ, a technology company providing artificial intelligence powered software to streamline verifications and underwriting, announced the launch of CollectIQ.

The company said this AI-powered tool can enable auto finance companies to obtain consumer documents digitally to verify financing requirements.

Through accurate income calculations and validation of applicant data, Informed.IQ expects that contracts can be processed faster and more accurately with reduced fraud and improved dealer and consumer experiences.

CollectIQ also can enable dealers to verify consumer data and calculate income instantly, providing a transparent and accurate financing experience.

It also can enable car buyers to provide documents and data electronically easily and securely, giving dealers visibility into what the customer can afford.

Informed.IQ said the tool works with dealers’ current systems.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Through a news release, Informed.IQ shared the assessment of an anonymous user who is the vice president of credit at one of the country’s largest pre-owned auto retailers.

“As a user of CollectIQ, we are thrilled to embrace the latest enhancements including seamless integration with third-party service providers. This new connectivity is a game-changer for us. These enhancements will amplify our capabilities, streamline our processes, and deliver an unparalleled user and dealer experience,” the company said in a news release

In addition to a quick link option, Informed.IQ can provide a QR code and phone number that dealers share with car buyers.

The buyers can finalize the verification process by uploading their documents or linking to bank accounts and payroll providers.

Informed.IQ’s AI technology can analyze this data so the finance company can offer a better deal structure, reducing contracts in transit and potential errors, while increasing transaction efficiency and dealer satisfaction.

“In an industry where customer experience is everything, dealerships that prioritize digital transformation of their F&I departments will come out on top,” Informed.IQ CEO Justin Wickett said in the news release. “We are thrilled to be first to offer this type of technology to our lending partners. CollectIQ enables our lenders to board more loans, fund dealers faster and reduce fraud.”