J.D. Power examines consumer price sensitivity in EV market

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Amazing when a product’s price drops notably, it correlates into a swell in consumer demand.

J.D. Power spotted this phenomenon happening again with electric vehicles.

Four J.D. Power experts said that if ever there were a sign that EVs are rapidly transforming from high-priced playthings into mainstream consumer goods that are highly sensitive to economic trends, it was the complete about-face of consumer interest in Tesla following the brand’s January price cuts.

After dropping prices across its lineup by as much as 20% virtually overnight, J.D. Power reported consumer interest in Tesla spiked, reversing a recent trend of waning consumer interest.

Those assertions and more arrived on Monday when J.D. Power released its E-Vision Intelligence Report.

According to the J.D. Power EV Index — a new analytics tool developed by J.D. Power to track the progress to parity of EVs with internal combustion engine (ICE) vehicles in the United States — experts said the recent swing in Tesla brand consideration is part of a much larger trend toward consumer price sensitivity becoming an even more significant factor in the EV adoption curve.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

This E-Vision Intelligence Report delved into key data points trending in each monthly EV Index update, along with other data points gathered from J.D. Power studies and pulse surveys, to spotlight emerging trends and important shifts in EV consumer sentiment.

“Tesla can be credited with breaking down many of the barriers that once existed to widespread EV adoption, but affordability has not historically been one of them,” J.D. Power said in a news release.

J.D. Power determined the most affordable version of Tesla’s Model 3 sedan retailed for about $47,000 in December, while the brand’s average transaction price hovered near $73,000 throughout most of 2022.

During that same period, the J.D. Power EV Index identified a trend toward waning consumer interest in Tesla.

In fact, experts said that from November to December, the percentage of shoppers either “very likely” or “somewhat likely” to consider a Tesla for their next EV purchase fell to 39% from 44%, falling behind more mainstream offerings from Chevrolet.

Then, in mid-January, Tesla announced sweeping price cuts that brought the price of a base Model 3 down to $44,000 and cut the price of some models and trims by as much 20%. Immediately, J.D. Power discovered consumer interest suddenly roared back, putting Tesla back on top of the brand consideration ranks, with 44% of EV shoppers indicating interest in the brand.

“Suddenly, the brand that has been most closely associated with the premium market sentiment that has accompanied the growth of EVs, is starting to exhibit demand dynamics more in line with mainstream consumer goods,” J.D. Power said.

Experts added that it should come as little surprise that the other four brands at the top of the EV consideration list are all mainstream brands, including:

—Chevrolet 41%

—Ford 35%

—Toyota 26%

—Hyundai 20%

Leasing boost from Inflation Reduction Act

J.D. Power pointed out that another major shift in consumer behavior is percolating in connection with EV leasing activity.

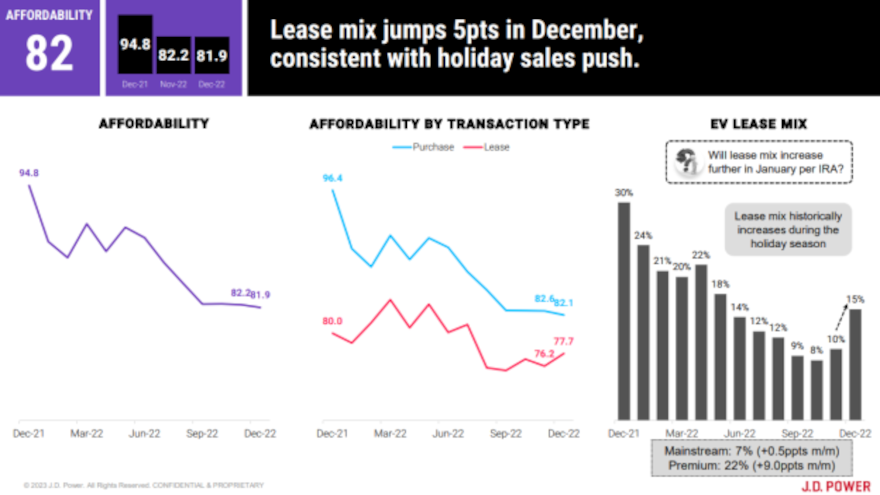

After consistently trending downward since April, J.D. Power reported EV lease mix increased to 15% in December, up 5 percentage points from the previous month.

“But that was just a harbinger of things to come,” said experts, who noted that based on an early look at January data, EV lease mix has spiked to 22% of total EV volume.

“That boost in month-over-month lease volume is, of course, driven by the Inflation Reduction Act and its provision designed to incentivize commercial fleets to go electric with a $7,500 federal tax credit for commercial EVs,” J.D. Power continued.

“The way the law is written, however, vehicles leased to consumers qualify as commercial. That means automakers can now opt to pass the $7,500 credit — or some portion of it — to customers who choose to lease rather than buy a new EV. Clearly, the policy has had an immediate and significant effect on lease mix,” J.D. Power went on to say.

Other notable trends & report basis

J.D. Power revisited what experts said is a commonly used strategy in the auto industry called “launching rich.” Experts elaborated about the term for someone who might not be familiar with it.

“It occurs when brands know they have a new vehicle launch that will garner lots of attention and consumer demand and use that momentum to drive sales of their highest priced trim packages at launch,” J.D. Power said.

“It’s the logic behind special launch edition and first edition models that come loaded with every option, and it has been used widely in the EV space,” J.D. Power added.

Experts cited the Ford F-150 Lightning as an example. When it launched in last spring, the pickup had an average transaction price of $85,600, according to the J.D. Power EV Index. By August, however, that average transaction price had decreased to $77,400 pulled down by increased sales volume in lower trim models priced slightly below $50,000.

Then in December, J.D. Power mentioned Ford announced a $4,000 price increase for 2023 models, bringing the average transaction price back up to $82,500.

This J.D. Power E-Vision Intelligence Report is based on data and insights from the J.D. Power EV Index and the J.D. Power EV Consideration pulse survey.

The J.D. Power EV Index is an analytics tool to benchmark the growing EV market in the United States. It tracks millions of data points aggregated into six categories — interest, availability, adoption, affordability, infrastructure and experience — to evaluate the progress to parity of EVs with ICE vehicles in the U.S.

Each month, J.D. Power’s electric vehicle practice will analyze these data points, and others to spotlight emerging trends and important shifts in consumer sentiment that are helping to define the fast-moving EV marketplace.

This report was authored by:

—Elizabeth Krear, vice president, electric vehicle practice

—Brent Gruber, executive director, electric vehicle practice

—Stewart Stropp, executive director, electric vehicle practice

—Kristen Richter, senior analyst, electric vehicle practice