J.D. Power: Customer retention more critical than ever in auto finance

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to the J.D. Power 2022 U.S. Consumer Financing Satisfaction Study, customer retention has become a key focal point for auto finance providers, putting the spotlight on specific actions credit providers can take to drive increased loyalty and brand advocacy.

That focal point surfaced against a backdrop of rising interest rates, slowing origination volumes and increased competition. As a result, J.D. Power explained that auto finance companies are finding that their most valuable future customers are the ones they already have.

“Consumers have more lending choices than ever before,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. “They’re doing more research and doing that research earlier in the vehicle-buying process. That’s why the customer experiences they are having with their existing lender is so important.

“For lenders that want to secure repeat business with existing customers, it is critical to consistently anticipate and meet their needs at key points in the customer journey,” Roosenberg continued in a news release.

Three key findings of the 2022 study included:

• Captives significantly outperform non-captives for customer advocacy: For a second consecutive year, automotive captive lenders significantly outperform non-captive lenders when it comes to brand advocacy with existing customers.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average Net Promoter Score (NPS) for captives is 56 and the average NPS for non-captives is 40.

Industry-wide, customers who are promoters (those who say their likelihood to recommend their current finance company as a 9 or 10 (on a 0-10 scale) are nearly twice as likely to say they “definitely will” consider their current lender for their next vehicle when compared to customers who are passive (those who say their likelihood to recommend their current lender as a 7 or 8).

• Most auto financing research begins a month before a purchase: Among auto loan customers who research financing options prior to a purchase, most begin the research process more than 30 days prior to purchasing or leasing a vehicle.

Effective use of both applied for and unsolicited pre-approvals can lead to a greater customer recapture rate and conquest opportunities.

• Key actions to drive brand advocacy: Specific actions taken by auto finance companies that have the most positive effect on customer advocacy include easy-to-use websites; useful account review information; and electronic statements that are easy to set up.

So which providers topped the latest study rankings?

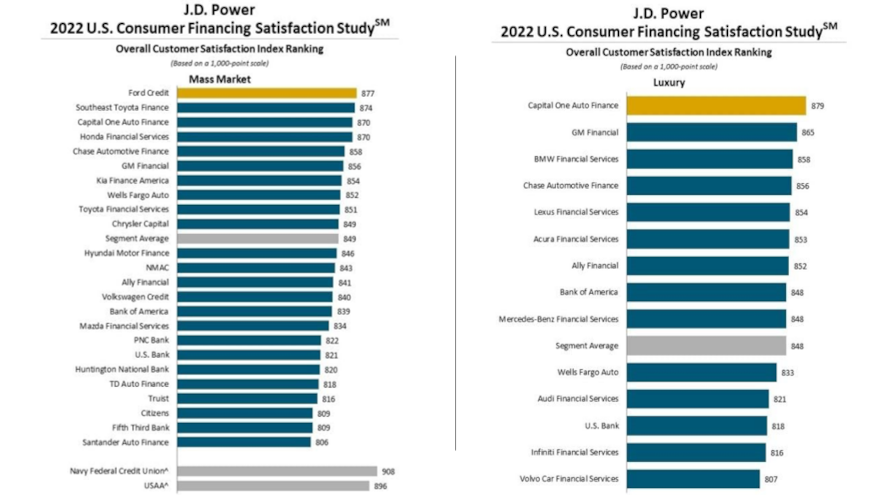

J.D. Power reported Capital One Auto Finance ranked highest in customer satisfaction among luxury brands with a score of 879. GM Financial (865) came in second and BMW Financial Services (858) placed third.

The study showed Ford Credit ranked highest among mass market brands for a second consecutive year with a score of 877. Southeast Toyota Finance (874) placed second, while Capital One Auto Finance (870) and Honda Financial Services (870) finished in a tie for third.

The U.S. Consumer Financing Satisfaction Study measures overall auto financing customer satisfaction in five factors:

—Account management

—Application/approval process

—Billing and payment process

—Customer orientation process

—Customer service experience

The study was fielded in July and August and is based on responses from 10,199 customers who financed a new or used vehicle through an installment contract or lease within the past three years.