Latest J.D. Power auto finance study emphasizes importance of online pre-approval

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TROY, Mich. –

J.D. Power pointed out that potential buyers’ ability to secure financing is even more crucial nowadays in an automotive market beset by supply shortages and record high prices.

Firm experts said more vehicle shoppers than ever have started to look for vehicle financing before ever setting foot in a dealership, reinforcing findings from the newly redesigned J.D. Power 2021 U.S. Consumer Financing Satisfaction Study.

The study showed auto financing pre-approval has become the top of the funnel for auto customer acquisition and brand loyalty, putting the focus on digital channels as the starting point for the consumer financing journey.

“Auto financing customer behavior has fundamentally shifted from an exercise that largely took place in a dealership finance department to one that takes place online upwards of 30 days prior to a vehicle purchase,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power.

“Nearly half — 45% —of all customers now do research prior to financing a vehicle and their experiences with lenders can have a tremendous influence on that process,” Roosenberg continued in a news release. “That really puts the onus on lenders to deliver a superior customer experience to existing customers and to position their websites and consumer marketing initiatives to maximize conversions.”

Other key findings from the 2021 study included:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

• Pre-approval becomes lynchpin to auto financing journey: Nearly half (45%) of all auto finance customers do some type of research on financing options prior to purchasing a new vehicle. The proportion jumps to 62% among members of Generation Z. Ultimately, 60% of customers who shop online for auto financing options end up applying for a pre-approval.

J.D. Power defines generational groups as pre-boomers (born before 1946); boomers (1946-1964); Gen X (1965-1976); and Gen Y (1977-1994); and Gen Z (1995-2004). Xennials (1978-1981) and millennials (1982-1994) are subsets of Gen Y.

• Auto financing research begins a month before a purchase: Among most auto loan customers who research financing options prior to a purchase, the research process begins more than 30 days prior to purchasing or leasing a vehicle. Effective use of both applied for and unsolicited pre-approvals can lead to a greater customer recapture rate and conquest opportunities, according to J.D. Power.

• The memory remains: Current and past experiences with auto finance companies matter now more than ever as many customers begin the shopping process because of marketing information or incentives they’ve received from their existing lender or auto manufacturer.

• Personalization is next frontier: Customers have different preferences for how they want to manage their accounts and be contacted by finance companies. As this interaction continues to shift to digital channels, J.D. Power said finance companies will need to tailor their outreach to the needs of individual customers.

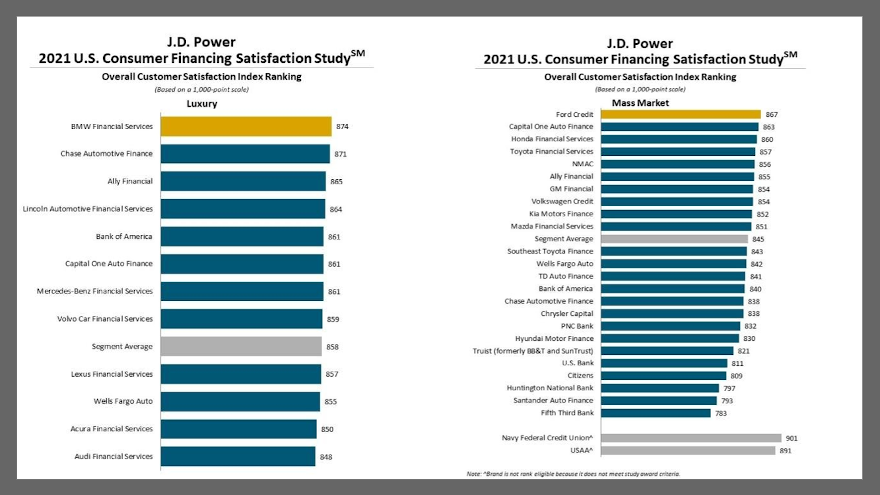

In terms of study rankings, J.D. Power said BMW Financial Services came in highest in customer satisfaction among luxury brands with a score of 874. Chase Automotive Finance (871) ranks second and Ally Financial (865) ranks third.

Ford Credit ranked highest among mass market brands, with a score of 867. Capital One Auto Finance (863) came in second and Honda Financial Services (860) took third.

The U.S. Consumer Financing Satisfaction Study measures overall customer satisfaction in five factors:

— Billing and payment process

— Mobile app experience

— Onboarding process

— Origination process

— Website experience.

The study was fielded in July and August and is based on responses from 10,462 customers who financed a new or used vehicle through a retail installment sales contract or lease within the past three years.