Lease End reviews over-mileage levels & equity gains

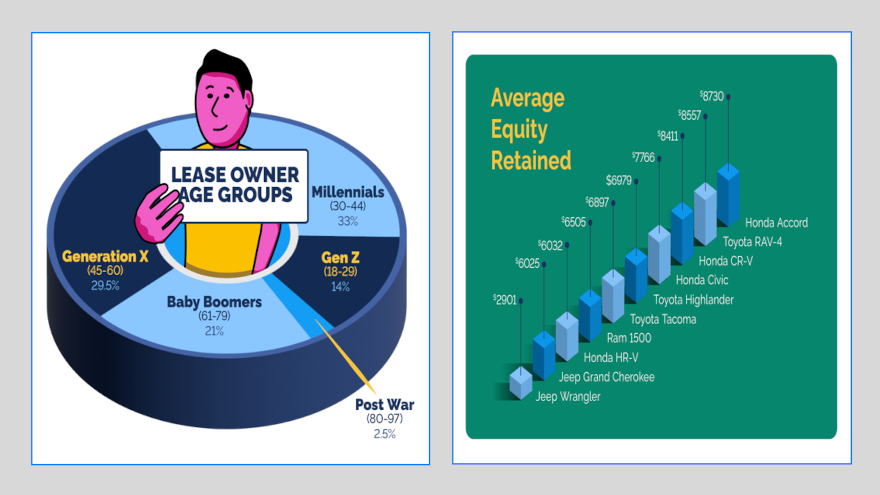

Charts courtesy of Lease End.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

That vehicle might have higher mileage than often seen with a leased unit, but it might also still be in a positive equity position.

That’s one of the themes highlighted in From Leased to Loved, the annual report generated by Lease End, a company that helps lessees navigate the lease buyout process with personalized support and data-driven insights

After analyzing the latest trends in consumer automotive lease buyout behavior, Lease End found that many leases are surpassing mileage limits by an average of 3,000 miles on a year-over-year comparison.

The company also noticed younger generations are increasingly opting to buy rather than lease or purchase a new vehicle, stemming from how rising costs and evolving driving habits are reshaping the lease buyout landscape.

“The data confirms what we’ve been seeing firsthand — drivers, especially millennials and Gen Z — are taking a more strategic approach to leasing,” Lease End co-founder and CRO Zander Cook said in a news release.

“With rising new-car prices and monthly lease payments over $700, consumers are recognizing that buying out their lease isn’t just a fallback option — it’s often the smartest financial move,” Cook continued. “Beyond that, it’s also about keeping a car they know and trust, avoiding the hassle of starting over, and securing a vehicle they’re already comfortable with at a price that makes sense.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“This shift reflects a changing mindset around vehicle ownership, where drivers are prioritizing long-term value and financial strategy over simply upgrading to something shiny and new,” Cook added.

Key findings from the report included:

—Millennials and Gen Z are leading the shift toward lease buyouts: 53% of lease buyouts were made by drivers aged 45 and older, while nearly 47% of lease buyouts were from younger drivers, signaling a shift toward leveraging lease equity to offset rising car prices and payments.

—Consumers are driving more and paying for it: Lease-end mileage averages reached 37,000 miles, up 3,000 miles from 2023, with Range Rover Velar drivers exceeding limits by 8,000 (which would equate to $800 to $2,400 in fees if not for lease buyouts).

Analysts said this point is “a clear sign that driving has rebounded post-pandemic, with further increases expected as return-to-office mandates rise.”

—SUVs and trucks dominate lease buyouts: SUVs accounted for 60% of all buyouts, with the Honda CR-V, Ram 1500, and Jeep Grand Cherokee among the most commonly purchased vehicles.

Analysts noted this finding is “further proof that when it comes to comfort, space, and capability, Americans continue to favor larger vehicles built for both daily life and adventure.”

—Average finance terms lengthening: Year-over-year, the report showed consumers have opted to spread their payments over a longer loan term with a year-to-date average loan term of 72.2 months, which helps with the cost of living with a lower monthly payment.

The report also highlighted another growing trend: leasing over and over is no longer always the most cost-effective option.

As market conditions shift, Cook acknowledged drivers are looking for smarter ways to retain value and avoid unnecessary costs at lease-end.

“We’ve reached a turning point where lease buyouts are no longer just a niche financial decision,” Cook said. “More consumers are realizing that buying out their lease could save them thousands — and Lease End is here to help them navigate that process.”

The report is sourced from Lease End’s proprietary transaction data, analyzing 14,235 lease buyouts nationwide in 2024. The company said it provides a comprehensive snapshot of real-world leasing behaviors, offering insights into market trends, vehicle valuations, and consumer decision-making in response to economic conditions, financing rates, and industry shifts.

The complete report is available here.