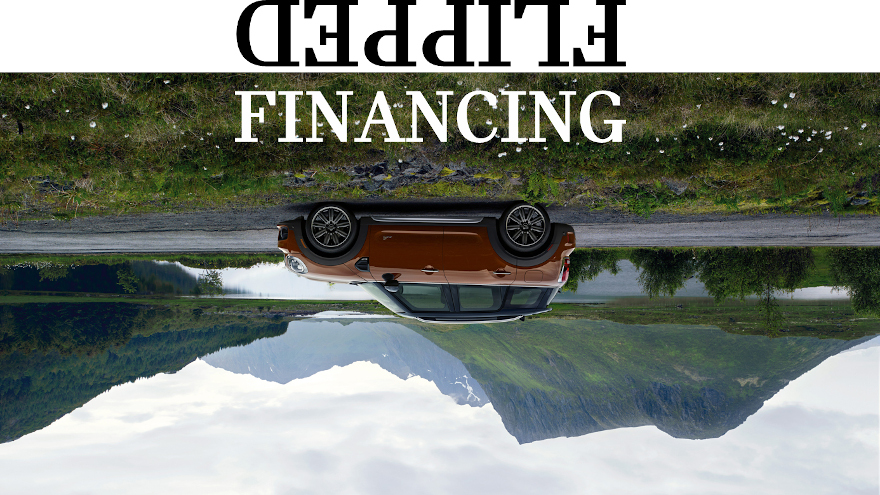

MINI describes what it means by Flipped Financing

Photo courtesy of MINI

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

WOODCLIFF LAKE, N.J. –

The image associated with this report provides a vivid glimpse of what a luxury automaker and its captive finance company are trying to do.

Last week, MINI USA and MINI Financial Services announced the introduction of Flipped Financing, a vehicle financing program that can help franchised dealers put consumers at the heart of what the companies say is an easier and simplified purchase experience.

With Flipped Financing, all approved credit applicants receive one interest rate as advertised, up-font and without any surprises. At the same time, the program can create a straightforward and clear-cut purchase process that eliminates the need for potentially lengthy negotiations or hassle for both the customer and the dealer.

“After a successful pilot program, during which we received direct feedback from dealers and customers alike, we’re incredibly excited to roll out Flipped Financing to all MINI dealers in the U.S.,” said Ian Smith, chief executive officer of BMW Group Financial Services Americas.

“We are confident that this is the start of a sustainable, long-term program that will not only help create a transparent and pleasurable purchase process for our customers, but will also allow them to get in and out of the showroom quicker so that they can spend more time having fun behind the wheel of their new MINI,” Smith continued in a news release.

In a rapidly changing retail environment, MINI aims to provide a simplified process for both dealers and customers with Flipped Financing.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For MINI dealers, this new program represents an opportunity to make it easier for dealer F&I offices to be more effective at satisfying customers with a faster, simpler and easier transaction. For customers, Flipped Financing offers one rate across the board to all whose credit applications are approved, along with a clean and simple process.

In addition, the company said MINI Flipped Financing removes added pressure for customers to purchase protection products at the time of sale. Customers now have up to 30 days after purchase of their new MINI to learn about and decide on purchasing additional products. This flexibility also offers dealers additional touchpoint opportunities to connect with their customers.

“As the name implies, MINI has flipped the typically complex auto financing process on its head,” the company said. “With a crystal-clear financing process and uniform rate for all, MINI Flipped Financing is the true definition of ‘what you see is what you get’ — one rate, zero pressure and no nonsense.

For customers interested in learning more about MINI Flipped Financing available exclusively through MINI Financial Services, visit www.MINIUSA.com/flipped-financing, or a MINI dealer.