PNC to acquire BBVA in $11.6B all-cash deal

Graphic courtesy of PNC Financial Services Group.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

PITTSBURGH –

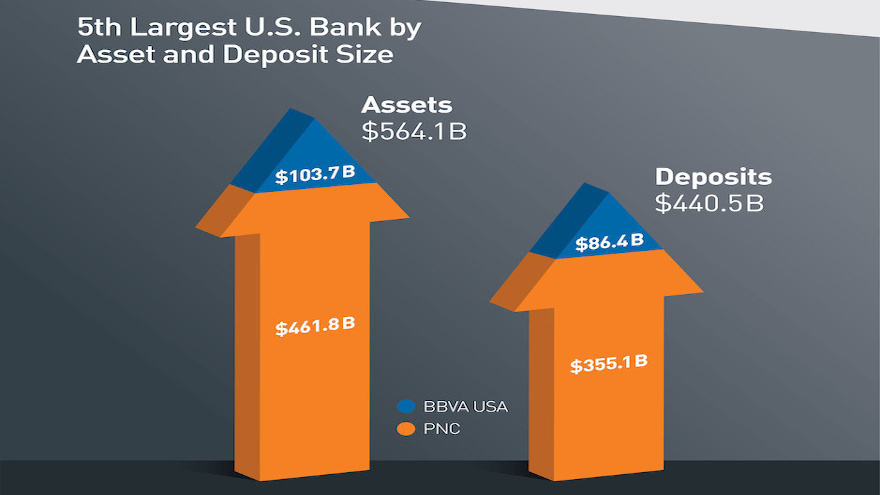

Should federal regulators give the same approvals both company boards already have, PNC Bank is set to become the fifth-largest bank in the U.S. based on assets and deposits.

On Monday morning, PNC Financial Services Group and the Spanish financial group, Banco Bilbao Vizcaya Argentaria (BBVA) announced that they have signed a definitive agreement for PNC to acquire BBVA USA Bancshares, including its U.S. banking subsidiary, BBVA USA, for a purchase price of $11.6 billion to be funded with cash on hand in a fixed price structure.

Executives said the all-cash deal by PNC values the business sold at 19.7 times its 2019 earnings, 1.34 times its tangible book value as of Sept. 30 and reflects a deposit premium of 3.7%.

They also said the transaction, which has been approved by both companies’ boards of directors, is expected to close during the middle of next year. It’s subject to customary closing conditions, including regulatory approvals.

BBVA USA Bancshares, with $104 billion in assets and headquartered in Houston, provides commercial and retail banking services through its banking subsidiary BBVA USA and operates 637 branches in Texas, Alabama, Arizona, California, Florida, Colorado and New Mexico. When combined with PNC’s existing footprint, the company will have a coast-to-coast franchise with a presence in 29 of the 30 largest markets in the U.S.

“Our acquisition of BBVA USA will accelerate our growth trajectory and drive long-term shareholder value through a strategic deployment of the proceeds from the sale of our BlackRock investment,”, PNC chairman, president and chief executive officer William Demchak said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“This transaction is an opportunity to navigate our future from a position of strength, accelerating PNC’s national expansion strategy while drawing on our experience as a disciplined acquirer,” Demchak continued.

“We are excited to bring our industry-leading technology and innovative products and services to new markets and clients, leveraging our mutual commitment to building diverse and high performing teams and supporting the communities we serve,” he went on to say.

PNC said it expects the transaction to be approximately 21% accretive to earnings in 2022 and to substantially replace the net income benefit from PNC’s passive equity investment in BlackRock that was divested in May.

The bank indicated the transaction has an estimated internal rate of return to PNC in excess of 19%.

PNC highlighted the acquisition adds approximately $86 billion of deposits and $66 billion of loans based on BBVA USA’s balance sheet as of the end of the third quarter.

Post-closing, PNC pointed out the estimated allowance for credit losses to total loans for the combined entity is 2.85%, including reserves for the acquired loans from BBVA USA of 3.85%.

PNC acknowledged that it expects to incur merger and integration costs of $980 million, inclusive of approximately $250 million in write-offs of capitalized items, and achieve cost savings in excess of $900 million, or 35% of BBVA USA’s 2022 estimated annual noninterest expense through operational and administrative efficiency improvements.

Upon closing, PNC intends to merge BBVA USA Bancshares into PNC with PNC continuing as the surviving entity. Post-closing, PNC also intends to merge BBVA USA into PNC Bank, N.A. and convert BBVA USA customers to the PNC platform with BBVA USA branches assuming the PNC Bank name.

PNC is not acquiring BBVA Securities, Inc., Propel Venture Partners Fund I, L.P. and BBVA Processing Services, according to the news release.

“This is a very positive transaction for all sides. PNC has recognized the great value of our unique client franchise and of our great team in the U.S., who will be part of a leading financial services group in the country,” BBVA Group executive chairman Carlos Torres Vila said.

“The deal enhances our already strong financial position,” Vila continued. “We will have ample flexibility to profitably deploy capital in our markets strengthening our long-term growth profile and supporting economies in the recovery phase, and to increase distributions to shareholders.”

Bank of America, Citi, Evercore and PNC Financial Institutions Advisory acted as financial advisers to PNC and Wachtell, Lipton, Rosen & Katz was legal counsel.

J.P. Morgan Securities plc represented BBVA as financial adviser and Sullivan & Cromwell LLP was legal counsel.