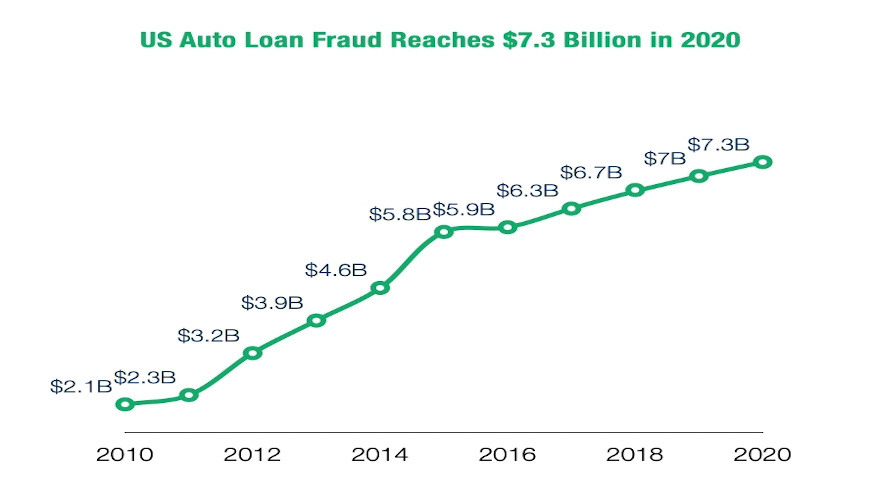

Point Predictive: Auto-finance fraud tops $7B in 2020

Chart courtesy of Point Predictive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

SAN DIEGO –

Point Predictive pinpointed a number in connection with one of the important topics being discussed this week during the Auto Intel Summit.

According to the company’s Auto Fraud Report, Point Predictive said fraud reaching $7.3 billion of originations last year, with chief fraud strategist Frank McKenna calling 2020 “a pivotal year for fraud risk.”

The San Diego-based artificial intelligence and data science company that helps finance companies and other lenders predict the trustworthiness of application information highlighted that its 2020 fraud report includes unique insights about income and employment misrepresentation, identity fraud, and collateral fraud for U.S. auto finance companies, as well as the impacts of the pandemic on this important sector of the economy.

“The pandemic heightened fear and anxiety and likely made consumers more vulnerable to scams and frauds,” said McKenna, who will be one of the experts appearing on Wednesday during the Auto Intel Summit.

“The ensuing economic turmoil caused an immediate and dramatic rise in unemployment, increasing some people’s willingness to engage in loan fraud,” McKenna continued in a news release. “Furthermore, a flood of stimulus money and generous lender forbearance programs simultaneously increased the level of fraud while delaying lenders’ ability to recognize it.”

The latest analysis came from the Point Predictive Anti-Fraud Consortium dataset, a secure and private data science collaboration among dozens of U.S. finance companies.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The consortium now includes more than 94 million applications, containing 85 individual fields of data on each application.

Every month, activity from 45,000 dealerships contributes to a view of vehicle financing that spans nearly all 157,000 U.S. dealers. This data set tracks more than $2.7 billion in known early payment default and the company’s machine learning techniques have generated more than 10 billion risk attributes.

“Consortium data is deeper and more predictive of risk than any credit bureau or public records source,” McKenna said. “This vast and deeply specific data on each loan application gave us incredible clarity into fraud risk that lenders are exposed to.

“And one thing is for sure: The risk of fraud to auto lenders rose dramatically as the pandemic unfolded,” he went on to say.

One of the most significant trends addressed by the analysis was the marked uptick in income and employment misrepresentation.

As the lockdowns began, Consortium members were suddenly impacted by a 100% year-over-year increase of falsified income and employment claims on auto-finance applications, a level of risk which continued throughout the year.

Detected among the trend was the use of more than 300 new, but bogus employers each month, used by applicants to fraudulently convince lenders of steady sources of income.

Completing a complex risk picture for fraud managers, the report noted that scams like synthetic identity creation, credit washing, and even lawful impacts of credit repair efforts complicate efforts by lenders to guard against fraud in order to more quickly serve trustworthy borrowers.

“As a lender, you have to keep your guard up at all times. No assumptions can be made about any loan application until every single one clears a satisfactory fraud review,” Elite Acceptance Corp. executive vice president Steve Christensen said in the news release. “The analysis and outlook from Point Predictive is essential reading in order to be prepared.

For Elite Acceptance, the crucial trends to get ahead of are the dealer implications, such as a sale price inflation of over 10% on the top 10 models,” Christensen continued. “I credit Point Predictive for exposing the truth behind what is presented to lenders by dealers and borrowers.”

Additionally, the analysis of auto-finance fraud in 2020 covers other concerning trends, including clusters of fraud in certain states and metropolitan statistical areas (MSAs), new tactics used by self-employed borrowers, patterns of suspicious and ambiguous naming conventions for fake employers, synthetic identity centers, Social Security number manipulation tactics, vehicles subjected to inflated pricing, and the systematic disputing of multiple negative tradelines on a credit report in order to make the borrower appear to be more creditworthy.

Point Predictive added that power booking is also on the rise, wherein dealers inflate sale prices and falsify down payments to increase the chances of loan approval.

The Auto Fraud Report concludes with recommendations from Point Predictive’s fraud experts for staying ahead of fraud in 2021.

Point Predictive chairman and chief executive officer Tim Grace encouraged finance companies to bolster fraud defenses and staff.

“In times of crisis, there is often a need to reduce costs to stay profitable amidst decreasing volumes. But this is a mistake,” Grace said. “The rate of fraud and risk will increase over the next 18 months, making fraud prevention and staffing one of the most important investments you can make in maintaining the health of your portfolio.

“Resist the urge to cut costs where it matters most,” he added.

Auto, mortgage and student lenders who are interested in receiving a copy of Point Predictive’s annual Auto Fraud Report can send a message to [email protected].